Honor’s overseas numbers tell a story many brands would love to copy

And mid-range phones are doing the heavy lifting.

Honor 500 series. | Image by Honor

Honor leads Chinese brands in overseas growth

With 2025 now wrapped up, multiple independent research firms have published their full-year smartphone market data. We already know that Apple finished 2025 as the top brand in China – and globally as well. Now, a new report takes a closer look at how Chinese smartphone brands performed outside their home market.

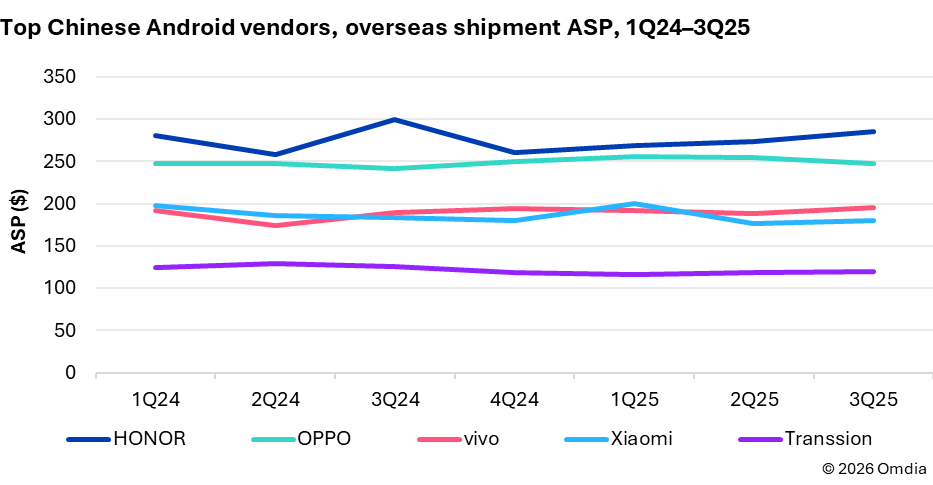

Moving on. While many Chinese smartphone makers still lean heavily on entry-level devices, Honor has clearly prioritized the $300–$499 price segment. In fact, this category accounted for around 23% of Honor’s international shipments during the first three quarters of 2025, the highest share among major Chinese vendors. Oppo followed in second place, with vivo and Xiaomi close behind.

Honor is among the top Chinese Android vendors overseas.

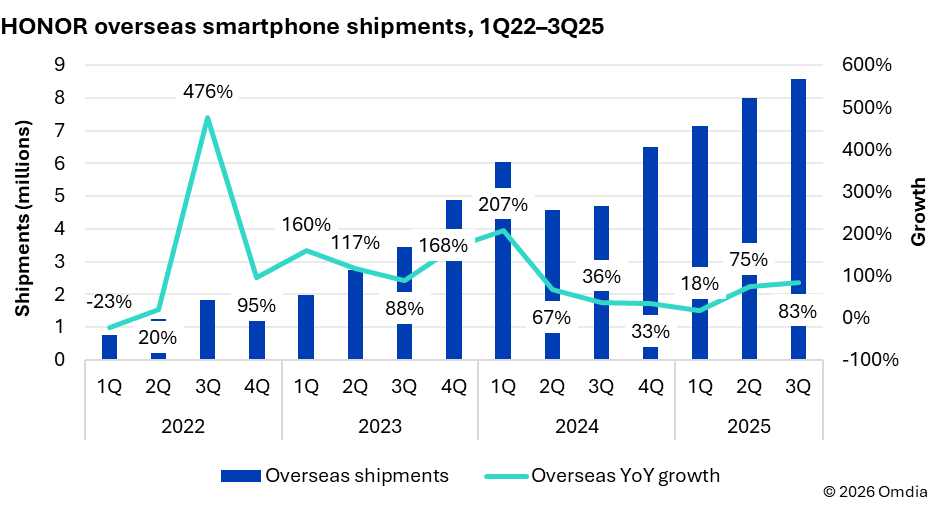

Honor’s international business has also gone through a major shift over the past five years. Back in early 2021, overseas shipments made up less than 10% of its global volume. By Q3 2025, that figure had climbed to nearly half, showing just how much the company’s footprint has expanded beyond China.

The company is starting to establish itself as a global player.

Europe played a key role in Honor’s international growth last year. Between Q1 and Q3 2025, the brand held a top-five position in major Western European markets such as the UK and France. The Magic V5 alone helped Honor secure second place in Western Europe’s book-style foldable segment.

At the same time, Honor continued investing in sales channels and brand building across Central and Eastern Europe. Shipments in the region rose by 15% during the same period, pointing to growing market traction.

Latin America remains the backbone of Honor’s overseas shipments, with the brand strengthening its presence in Mexico and Central America while expanding opportunities across the region. Honor has also been reinforcing its premium channel presence in the Middle East, while South Africa saw rapid growth driven by strong operator partnerships and localized product offerings.

Southeast Asia is shaping up as the next major growth frontier. Gradual investments in local manufacturing and channel development paid off in 2025, with Honor’s flagship models gaining noticeable traction across the region.

What the numbers say about Honor’s position

Stats like these matter when trying to understand where the smartphone industry is heading. Honor is still not a major global brand, but the data suggests it has real potential to capture more market share, especially in the budget and mid-range segments.

Growth comes with challenges ahead

Smaller and relatively newer brands like Honor often have more room for rapid growth, simply because they are starting from a lower base. That makes double- or even triple-digit growth more achievable early on, similar to what Nothing managed last year. Even so, leading overseas growth among Chinese brands is still an encouraging sign.

That said, I believe keeping this momentum going will not be easy. Rising NAND and DRAM prices introduce both cost and supply risks. While higher average selling prices overseas help offset some margin pressure, Honor’s smaller scale compared to global leaders limits its bargaining power.

This could impact supply flexibility, especially for mid-range phones with higher memory configurations. How Honor balances pricing and costs this year will likely play a big role in whether its overseas growth story continues.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: