Intel wants to build ARM chips for Apple including 5G chips

Apple has been replacing Intel's chips with its own in-house silicon. Last November, Apple introduced its highly ambitious ARM based M1 chip with an outrageous 16 billion transistors in each chip. That compares to the 11.8 billion transistors inside the A14 Bionic SoC found inside the Apple iPhone 12 series. While Intel is losing the business it once had to supply Apple with processors for the Mac, the chip maker does have a plan to get back into Cupertino. It plans on seeking business from Apple for a new foundry business it is starting called Intel Foundry Services (IFS) which will be run by current Senior Vice President Randhir Thakur.

Intel wants to build chips for Apple

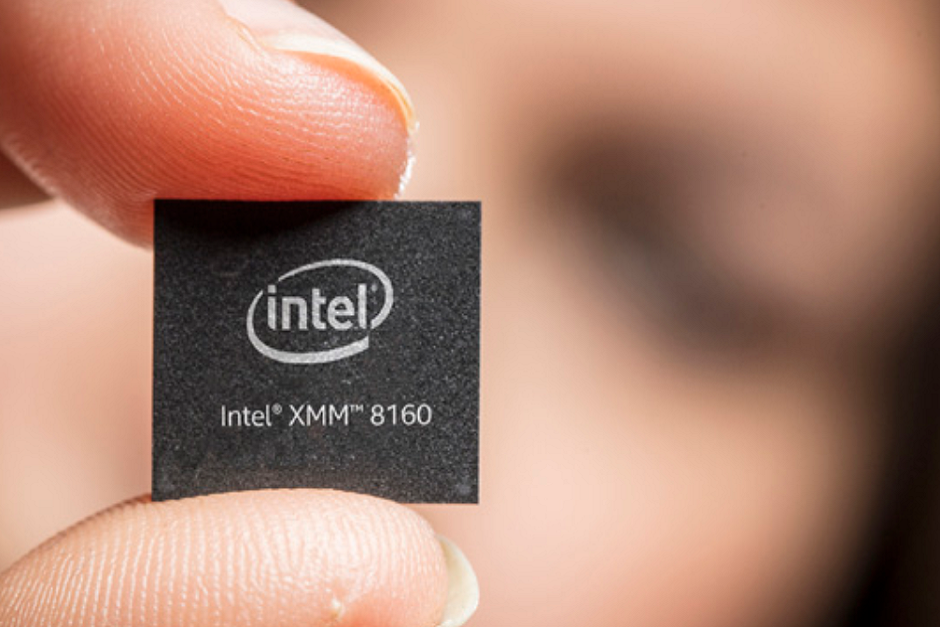

IFS would compete for business from Apple, Google, Microsoft, and Qualcomm. Those four firms design their own chips, but since they do not own the facilities to actually make them, they turn to third-party foundries like TSMC that actually produce the components. Intel will spend $20 billion to open two new fabs in Chandler, Arizona. The announcement comes during a global chip shortage that has affected companies that use plenty of chips from automobile firms to electronic companies.

Intel is opening a foundry business to manufacture chips for other companies based on non-Intel designs

According to CNBC, new Intel CEO Pat Gelsinger says that the foundry business will be involved in a market with a global valuation of $100 billion by 2025. Among the chips that Intel will manufacture are those based on ARM's architecture for mobile devices like phones and tablets. "Intel is and will remain a leading developer of process technology, a major manufacturer of semiconductors, and the leading provider of silicon globally," Gelsinger said. With its new foundry business in the U.S. and Europe, Intel will offer electronics manufacturers the ability to move part of their supply chain out of Asia. Intel's announcement appears to be a response to President Joe Biden's Executive Order to start a 100-day review that could result in new government policies and support to improve the U.S. chip industry. At the time, Biden said that the U.S. chip industry is a priority for his administration.

In response to the Executive Order, Intel said, "Today’s Executive Order, combined with full funding for the CHIPS Act, can help level the playing field in the global competition for semiconductor manufacturing leadership, enabling American companies to compete on equal footing with foreign companies heavily subsidized by their governments. But the U.S. has also shown a willingness to use its power to manipulate the chip market in order to be the judge and jury against certain Chinese firms. Last May, the U.S. changed export rules forcing any foundry using U.S. technology to manufacture chips to obtain a license in order to ship chips to Huawei. As a result, Huawei's inventory of the 5nm Kirin 9000 SoC that it designed and had manufactured by TSMC started running low. The U.S. considers Huawei to be a national security threat because of its alleged ties with the Communist Chinese government.

Apple has relied for years on TSMC to produce its chips and Apple is the foundry's largest customer. That means that it is going to be difficult for Intel to get Apple to use Intel Foundry Services to manufacture some of its chips.

Intel currently uses the 10nm-14nm process nodes for the chips it designs and manufactures itself. Intel CEO Gelsinger says that the company is on track for its 7nm chips to reach a milestone during the second quarter and while it produces most of its chips itself, it does plan on increasing the use of third-party foundries including TSMC, Samsung Foundries, and GlobalFoundries.

TSMC and Samsung are currently churning out 5nm chips with 3nm semiconductors expected to be delivered next year. Compared to Intel's Integrated Circuits, components produced by TSMC and Samsung contain more transistors in a dense chip making them more powerful and energy-efficient.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: