Verizon is the loser that the Dow might shed next

The Dow Jones Industrial Average might drop Verizon and add T-Mobile.

The Dow Jones Industrial Average (DJIA) may soon drop Verizon, according to a prediction by The Motley Fool.

The DJIA tracks thirty prominent companies that generally lead their respective industries. As a price-weighted index, it grants greater influence to higher-priced stocks.

Verizon has the lowest share price of all 30 companies in the Dow

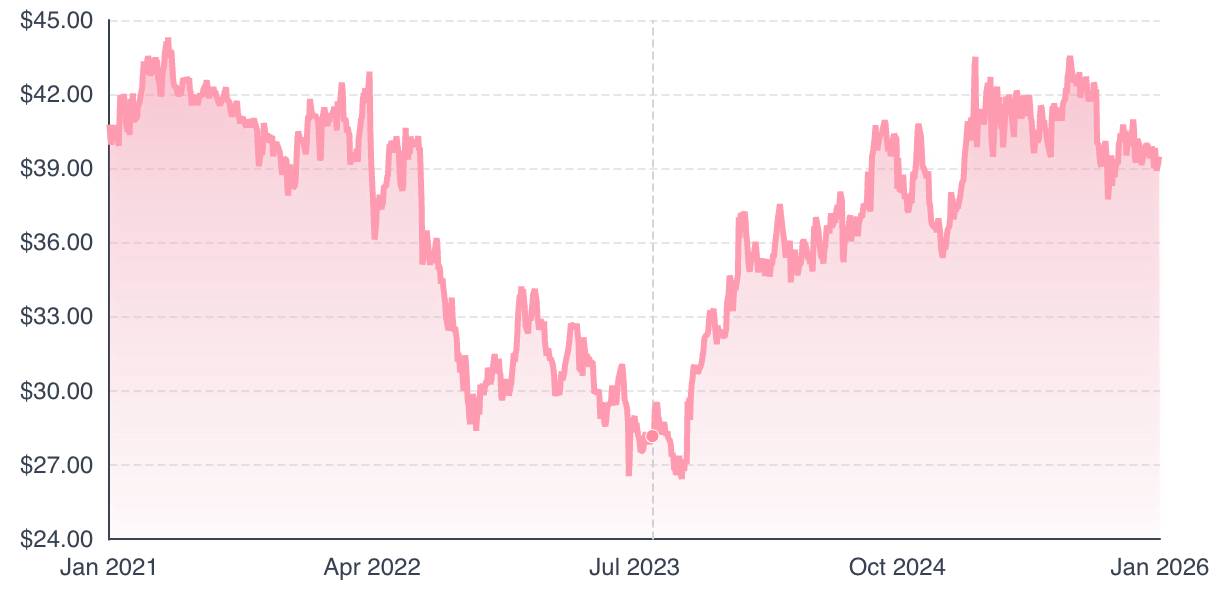

Verizon's stock price. | Image Credit - The Motley Fool

As a blue-chip index, the DJIA tracks the performance of reputable, financially stable companies known for providing consistent returns to investors. An unofficial hallmark of a blue-chip company is a competitive edge that allows it to maintain a dominant leadership position in its industry.

Lately, Verizon has struggled to meet that definition, following a trajectory similar to companies previously excluded from the benchmark.

Verizon replaced AT&T in 2004, but this may be its final year in the index.

Unlike the S&P 500 and Nasdaq Composite, the Dow doesn't prioritize market valuation. On January 21, Verizon's stock slid to $39.24 per share, making it one of the only four stocks to plunge below $111. Even the next-closest stock, Nike, was at $65.41 on January 21. Verizon contributes just 241 of the Dow's 49,077 points.

It's not about recent performance alone, as Verizon's stock has only grown 17 percent in nearly 22 years.

The future also looks bleak, given wireless and broadband saturation. Annual growth is unlikely to exceed 5 percent, which doesn't meet the Dow's standards.

Alphabet, Meta, or T-Mobile could be possible replacements. T-Mobile's similar operating model means that it might end up in the same place as Verizon in the future, while Meta's share price is considered too high for the Dow. Alphabet is seen as the best fit for now.

This doesn't doom Verizon

Verizon still pays high dividends to investors, its cash flow is reliable, and its churn rate is relatively low. The company's potential exclusion from the DJIA doesn't signal failure. It just means that it's no longer a good fit for the Dow, which typically favors companies that display growth and innovation.

Verizon should still view this potential exclusion with concern. The DJIA doesn't just focus on share price and performance; it also values the influence of a company on the US. Verizon no longer innovates like it used to in its heyday.

What adds insult to injury is that T-Mobile is being discussed as a replacement. T-Mobile's addition would be a lateral move, allowing the Dow to maintain carrier representation.

T-Mobile's shares have climbed 76 percent over the last three years, and 518 percent over the last ten years. The company's 5G dominance in small and rural markets has helped it deliver double the annual growth rate of AT&T and Verizon.

Is being booted from the DJIA embarrassing for Verizon?

Signs of trouble

The DJIA typically removes troubled businesses, and Verizon's exit may be a sign that new CEO Dan Schulman has still got a lot of work to do.

Stocks that are removed from the Dow industrials do rebound a lot of the time, and the index committee is sometimes criticized for removing companies before they have a chance to make a turnaround.

Perhaps this farewell would be the motivation that Verizon needs to reclaim its dominance. Its already showing signs of resurgence. For instance, according to RootMetrics, it was the best overall carrier in the second half of 2025.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: