Snapchat picks Morgan Stanley and Goldman Sachs to lead its IPO

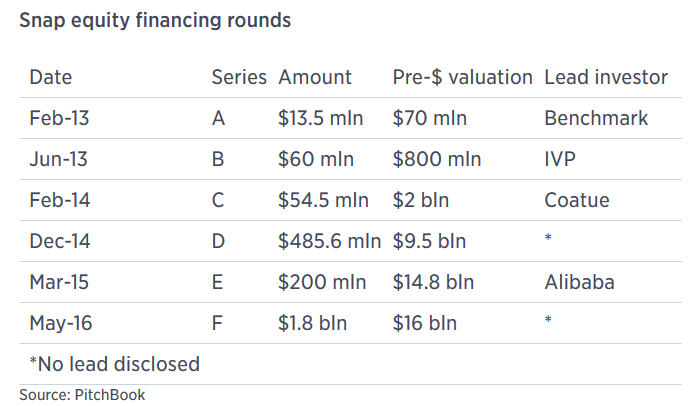

Based on financing rounds, the value of Snap has soared since 2013

Ka-ching! That's the sound of Snap's (the new corporate name of Snapchat) valuation rising from $70 million in February 2013, to the $25 billion that the company might be worth after completing an Initial Public Offering (IPO) this coming March. Along the way, there was talk of a $4 billion offer from Google that was rejected by the messaging app. If Snap goes public at $25 billion, the venture capitalist firms that invested money at the $70 million level will see their money grow more than 350 times.

source: Bloomberg, CNBC

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: