Apple Pay vs Samsung Pay vs Android Pay: comparison

Smartphone mobile payments have finally arrived in a big way in 2015: after Apple introduced Apple Pay in late 2014, the service started to get traction in 2015. Towards the end of the year, two other big names arrived to the space: Google finally overhauled Wallet and re-booted the system as Android Pay, and then, Samsung launched its Samsung Pay service.

Which is the best and most convenient phone payment system to use in the United States these days?

First, let's make it clear that both Apple Pay and Android Pay use NFC to pass on transactions, and both services require an NFC-enabled terminal. Many popular chains like McDonalds, Subway, Walgreens, Duane Reade and the Whole Foods Market support these terminals, but others like Best Buy do not have them everywhere yet, and smaller local stores will probably take years to upgrade their terminals.

In those places, Samsung Pay's support for the legacy MST standard comes particularly handy: you just place your phone close to the place where cards are swiped, and it sends a magnetic signal that makes it possible to pay using your phone in places where Apple and Android Pay users can't do it. While there are still lots of places that don't accept NFC payments, more than 90% of the stores in the United States have magnetic card terminals that accept Samsung Pay.

Then, there is payment within apps. As we do more and more of our shopping online, it's a huge time-saver to have one-tap payments within apps like AirBnB and Target. Apple was the first to add payments within an app, and it supports the most apps including some very popular ones (Best Buy, Starbucks, Dunkin Donuts, Etsy, Kickstarter, Uber, Target, Ticket Master just to name a few). Android Pay has only recently started supporting payments in an app, so the list of supported apps lacks some key ones, and Samsung Pay does not yet support payments within apps at all.

| Apple Pay | Samsung Pay | Android Pay | |

| Launch date | September, 2014 | September, 2015 | September, 2015 |

| Supported phones | iPhone 6, 6 Plus and later | select high-end Galaxy phones | all Android 4.4+ phones with NFC |

| Supported countries | US, UK | US, Korea | US |

| Upcoming countries | China - Q1 2016 EU countries - Q1 2016 | UK - August 2016 Spain, China - Q1 2016 Australia, Brasil, Singapore | No data |

| Type | NFC only | NFC Magnetic (MST) | NFC only |

| Shortcut to launch | Starts automatically when near NFC terminal | Swipe up from bottom of screen | Starts automatically when near NFC terminal |

| Does it work with traditional terminals? | - | ✓ | - |

| Does it work with NFC terminals? | ✓ | ✓ | ✓ |

| Does it work with ATMs? | - | - | - |

| Does it work for purchases in apps? | ✓ | - | ✓ |

Ease of use

Which of the three is easiest to use? First, we ought to say that Apple Pay and Android Pay automatically activate as you bring your phone close to a terminal, and with just a single tap on the fingerprint scanner to authorize a payment, you can be all done. Samsung Pay is also fairly easy to use: you swipe from the bottom of the display to bring the app to life, and then authorize payments with the fingerprint scanner, but it's that extra step that makes it a bit slower.

What could be a bit more troublesome is that on older terminals that only accept traditional cards (Samsung Pay works there as well), the cashiers are often not briefed that you can pay using Samsung Pay. This could result in a few weird conversations, but unless you bump into an angry clerk, this should not be an issue.

Security

It's important to know that paying with your phone is in fact secure with all three services.

All three payment solutions are secure

Then, there are MST transactions with Samsung Pay. You should know that security for those transactions is different than with NFC. In order for MST transactions to work, a magnetic coil inside your Galaxy phone runs alternating currents through an inductive loop and generates a dynamic magnetic field that a terminal can read. This exact magnetic field contains your payment information. How is this secure? First, this current appears for a very short period of time and secondly, it only spreads within 3-inch distance. These two factors make it hard to intercept this information, but for all else, this is just as secure as using a credit / debit card.

Banks and carriers support

All three services work with all major US banks and carriers.

First, on the carrier side: Apple Pay, Samsung Pay and Android Pay work with AT&T, Verizon Wireless, Sprint and T-Mobile. How are the carriers included in the picture? As far as public information is available, the carrier does not provide any physical chip to guarantee the security of mobile payments (there are no fancy chips on the SIM card, the Secure Element is actually built in the phone itself).

At the same time, though, your bank has information about your phone number which is linked to your phone. This means that if someone somehow gets a hold of your credit / debit card and starts using it to pay from a different number, your bank will know something is wrong. This adds an additional layer of security, as we've seen reporters say that their cards have been put on hold as they were testing the payment systems with various phones. The bank detected this unusual activity on the card and put payments on hold. A simple call would lift the hold on the card, but it's important to know that those safeguards to exist.

Then, looking at the list of supported banks, you will see that Apple Pay has the longest list, but Samsung Pay and Android Pay also support most bigger banks. Since those lists of banks are pretty long, we won't be reposting them here: you can take a look at all the banks supported by Apple Pay here, by Samsung Pay here, and finally by Android Pay - here.

The apps and supported devices

So what about the apps, the actual interface for making payments?

Apple Pay comes built in all iPhones: you just need to add your credit / debit card details in the Wallet app, and you are all set up to use Apple Pay. The interface will appear automatically once you approach an NFC payment terminal, and you authorize it with Touch ID and a simple tap on the home button. Apple Pay works on iPhone 6, 6s, as well as iPhone 6 Plus, and iPhone 6s Plus. Apple Pay is the only payment system that works with wearables and the Apple Watch in particular (if you have the Watch, you don't need to have the latest iPhone 6 / 6s, and you can use payments on your watch even when it's paired to the iPhone 5 and 5s).

Apple Pay

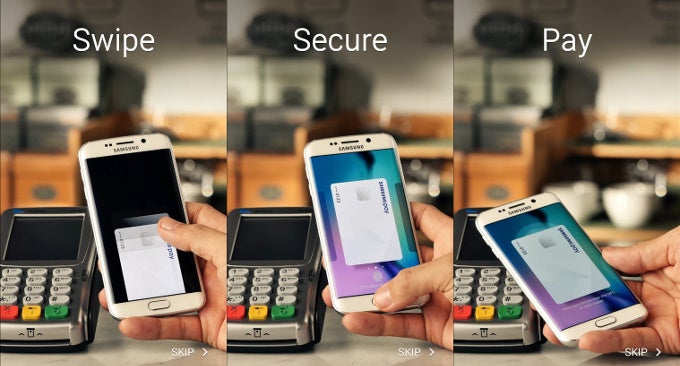

Samsung Pay is a free app that you download from the Google Play Store. In order to start the app, you swipe from the bottom of the screen, and you will see all the cards that you have. You select the one you want to use and authorize the payment with the fingerprint scanner, simple as that. It's important to know that Samsung Pay only works on top tier Samsung phones: the Galaxy S6, S6 Edge, S6 Active, Note 5 and S6 Edge+, but the company has promised to bring it to its more affordable phones in 2016 as well.

Samsung Pay

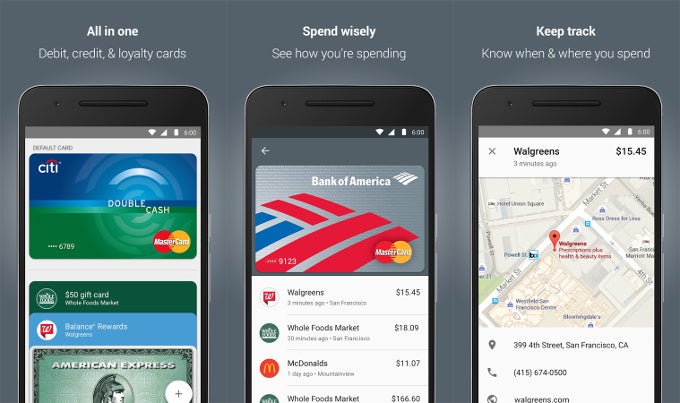

Android Pay, on the other hand, has it best when it comes to compatibility: it supports all phones running Android 4.4 KitKat (or later) and featuring an NFC chip. The app itself is a free download from the Google Play Store, and the interface seems a bit cleaner and it works in a similar manner to the other two.

Android Pay

Final words: Mobile payments in 2016

The past two years have set the stage for mobile payments: the apps are now here, all the carrier and most of the banks support them, but the one missing piece is retailers. In 2016, we expect this final piece of the puzzle to get solved: most US retailers are expected to introduce new NFC-enabled terminals and we'll see cashiers getting used to people paying with their phones.

Mobile payments will finally enter markets outside the United States: most Western European countries are in the roadmap of mobile payment vendors for 2016.

The same goes for the devices: while - apart from Android Pay - only top-end devices now support phone payments, more affordable devices will get support for payments. This will further widen the reach of mobile payments to more people.

And while we will probably still carry our wallets and our cards at the end of 2016, we might be actually using them much less.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: