While Barron's says T-Mobile needs to copy Verizon and AT&T in fiber, it already has in wireless

T-Mobile has caught the eye of Barron's, the weekly financial magazine published by Dow Jones, and not for the reason you might expect. The carrier's achievements in wireless are highlighted as Barron's points out how T-Mobile managed to take customers away from larger firms like Verizon and AT&T. The article notes how T-Mobile was able to shake up the wireless industry with its "un-carrier" branding, lower prices, flexible contracts, and a 5G rollout that took advantage of mid-band spectrum beating its rivals to the punch.

But the story focuses on T-Mobile's fixed wireless and fiber businesses. The company has a lead in fixed wireless which sends 5G signals to homes. The carrier recently hiked its forecast and now expects to have 12 million fixed wireless customers by 2028 from the eight million expected next year. But T-Mobile might have already reaped the rewards from picking low-hanging fruit and might be having problems finding new customers for the service. During the second quarter of this year, the company added 406,000 fixed wireless subscribers which was down 27% year-over-year.

S&P expects revenue from fiber to triple fixed wireless revenue by 2027

As a result, T-Mobile is looking to join Verizon and AT&T by offering fiber connections to the home. Fiber is more expensive for the consumer which leads S&P to expect revenue from the service to triple the revenue generated by fixed wireless by 2027. By that year, S&P also expects the number of fixed wireless subscribers to reach 16 million by 2027 from 11 million this year. The same forecast calls for the number of fiber subscribers to hit 30 million by 2027 up from 23 million this year.

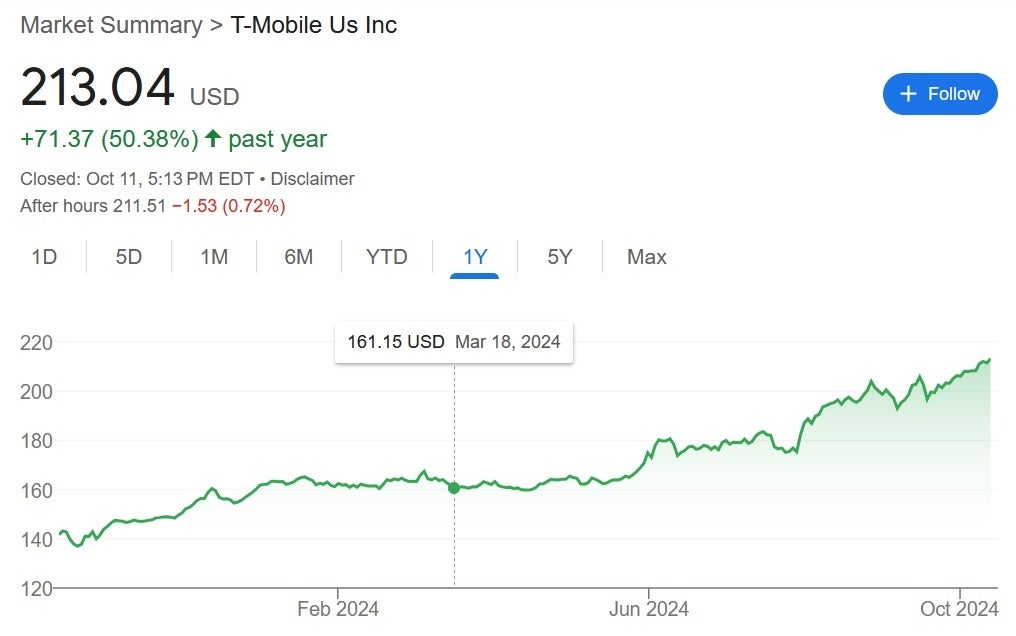

T-Mobile shares are up 50% over the last year. | Image credit-Yahoo

T-Mobile recently invested $6 billion in joint ventures to acquire broadband providers Lumos and Metronet while last month Verizon purchased Frontier Communications for $20 billion. T-Mobile plans on having fiber inside 12 million to 15 million homes by 2030 and Verizon (with Frontier) will reach 25 million homes with 9.6 million subscribers at the same time. AT&T has the lead with 28 million consumer and business fiber locations and 8.8 million subscribers presently. That gives it the advantage of having made the expenditures for fiber that T-Mobile and Verizon will still have to lay out in order to catch up or surpass AT&T.

"There's nothing that beats fiber in terms of the marginal cost of carrying the next unit of traffic. And as a result of that, it's always going to be more cost-effective and better performance than any other technology out there. And it will carry the lion's share of workloads, and that's why we're making the bet on that infrastructure investment."-John Stankey, AT&T CEO

Why T-Mobile investors should be concerned

T-Mobile has promised to return $50 million to stockholders through dividends and buybacks. But the money might be put to better use by purchasing companies with fiber. Barron's mentions Google Fiber, Lumen Technologies, and Windstream as three possible candidates for T-Mobile to go after. Oppenheimer analyst Timothy Horan says that T-Mobile has put aside $20 billion for possible mergers. That might not look good for investors who would prefer that the funds be distributed to them through dividends, or used to reduce the number of shares outstanding by announcing a share buyback.

Barron's also notes that while T-Mobile's shares trade at 23 times earnings, both AT&T and Verizon trade at less than 10 times earnings. On Wall Street, T-Mobile's stock has earned a premium perhaps because of the reputation it earned under John Legere as the fastest growing and most innovative of the major wireless providers.

The company might still be the fastest-growing carrier among the major wireless firms, but as more and more stories about shady activities are published, we've seen many posts on social media from T-Mobile subscribers saying that it feels as though T-Mobile has become no different than Verizon and AT&T when it comes to how wireless subscribers are treated. Legere put customers first which made T-Mobile stand out under his leadership. Under current CEO Mike Sievert, the focus appears to be on stockholders. Need we add that T-Mobile executives own a significant number of shares?

Should investors feel that too and decide that T-Mobile is no longer worth a premium P/E ratio, T-Mobile could end up trading closer to the 10x earnings that AT&T and Verizon trade at which would knock the stock down sharply.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: