Apple remains on top as shipments of wearable bands in North America rises over 10% in Q2

According to analytics firm Canalys, the value of wearable bands (which consists of basic bands plus smartwatches) in the North American market was $2 billion during the second quarter. The problem is that shipments rose 10% over that period which means that prices were weaker. In fact, Canalys' numbers show that the average selling price of wearable bands in the continent during Q2 declined by 11% during the period to $235. That came about due to a surge in demand for activity trackers.

Apple grew its Apple Watch shipments in North America by 6% during Q2

Also showing strength in the quarter was 2017's Apple Watch Series 3 which delivered a 30% annual gain in North American shipments. The best-selling smartwatch during the quarter was the Apple Watch Series 5 which matched the previous year's shipment figures for the Apple Watch Series 4. The new Apple Watch Series 6 could be unveiled as soon as later this month or sometime in October. During the second quarter, Canalys notes that Apple out shipped major smartwatch brands in North America by a 7:1 margin.

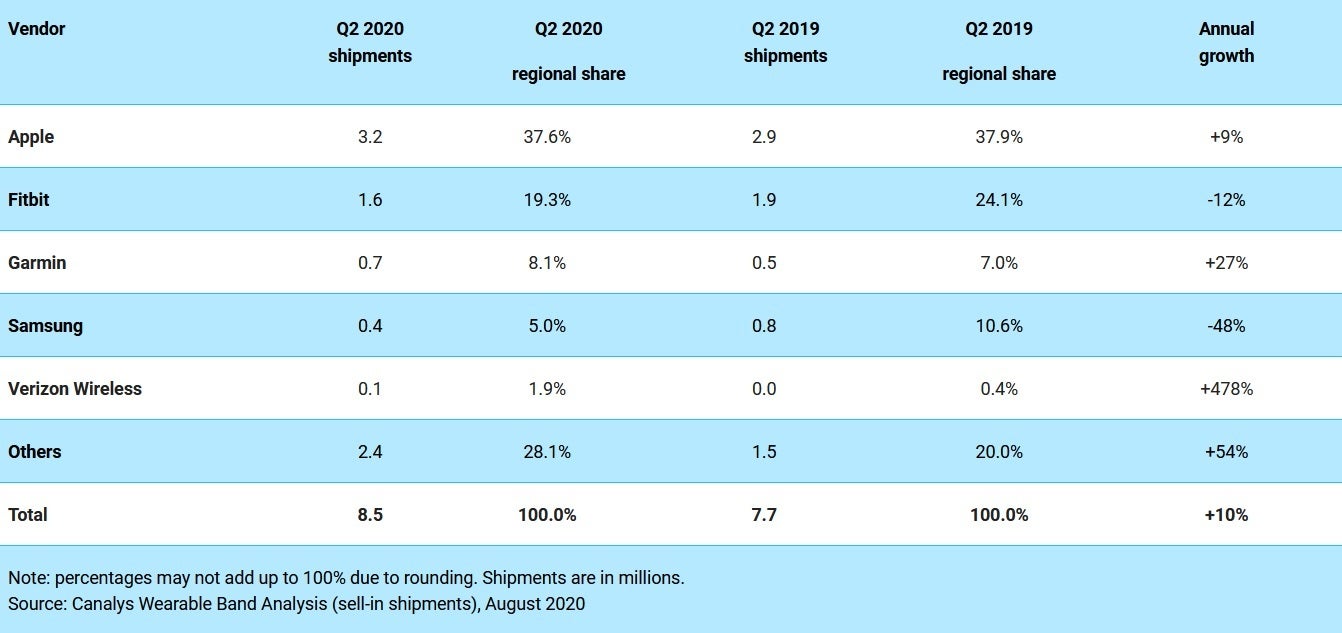

The top wearable band vendors in North America during Q2

Apple shipped a leading 3.2 million wearable bands in North America during the second quarter. The tech giant delivered 9% or 300,000 more connected timepieces year-over-year and Apple now has 37.6% of the market in line with the 37.9% it owned during the same quarter last year. Fitbit was second with 1.6 million units shipped, a 12% decline from 2019's Q2 figure. Fitbit now has 19.3% of the North American wearable bands market. The latter company is waiting for regulatory approval so that it can close on its purchase by Google parent Alphabet.

Apple had a huge lead in smartwatch deliveries in the region

Garmin delivered 700,000 units from April through June for an annual gain of 27% leaving it with an 8.1% share in North America. During last year's second quarter, Garmin accounted for 7% of wearable bands shipped in North America. Samsung was fourth after a sharp 48% decline in shipments left it with 400,000 units delivered during the three-month period. The firm's North American slice of the wearable band pie dropped off a cliff from 10.6% in the second quarter of 2019 to 5% in Q2 of this year. And Verizon Wireless saw surging demand for its own GizmoWatch. With year-over-year growth of 478%, Verizon delivered 100,000 low-priced kids watches good enough for 1.9% of the market.

Overall, in North America, 8.5 million wearable bands were shipped during the three month period. That is a 10.4% annual gain. North America was only one of two regions to register a year-over-year gain in shipments of wearable bands. Canalys analyst Vincent Thielke stated "Americans invested heavily in sub-US$50 trackers during the pandemic to stay accountable for the greater amount of time spent at home. Amazon’s Q3 introduction of the Halo tracker was timely, following two back-to-back quarters of strong activity tracker sales. Subscription-based companion apps helped Fitbit and less-familiar players like Whoop better differentiate themselves against the vast array of devices sold online. Turnkey service offerings proved a surprising pandemic winner as social distancing discouraged personal trainers and exercising in close proximity to others."

The U.S. suffered its third consecutive quarter of smartphone shipping declines and lower prices as Samsung and Fitbit cleared their channels due to the new releases they launched last month. Samsung should get a boost in the current quarter with the recent launch of the Galaxy Watch 3. WearOS models also had lower prices because of store closings and manufacturers transitioning to the latest Snapdragon Wear 4100 chipset.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: