Samsung forecast to recapture first place from Apple among phone manufacturers this quarter

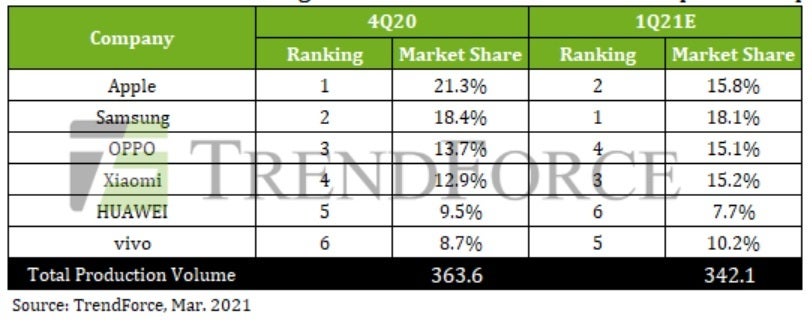

The new design and the addition of 5G support helped the iPhone 12 series lift Apple ahead of Samsung in global fourth quarter smartphone production according to research firm TrendForce. However, for the current first quarter, TrendForce estimates that Apple's leading 21.3% market share will drop by 5.5 percentage points to 15.8% taking the company back down to second place in the standings.

Apple's top ranking in global smartphone production is forecast to be short lived

If the estimates pan out, Apple's short lived stay at the top of the production charts would help Samsung regain its position as the world's top smartphone manufacturer during the three-month quarter that ends at the end of this month. During the last quarter of 2020, 77.6 million iPhone units were produced with 90% of these handsets belonging to the iPhone 12 series. That figure was an 85% increase over the previous quarter's iPhone production. That strong quarter-over-quarter gain combined with the sequential 14% drop in Samsung's handset production during Q4 2020 helped Apple reach the top during that time frame.

Apple was the top smartphone manufacturer worldwide during Q4 2020

During the final quarter of last year, Samsung garnered 18.4% of connected handset production. While TrendForce sees this figure declining to 18.1% for the current period, it would still give Sammy a healthy lead over Apple for the January through March period. The research firm expects Samsung to roll 62 million phones off of the assembly line during the current quarter. Led by the Galaxy A series, which includes models across the high, mid, and low-end spectrums of the smartphone marketplace, TrendForce sees Samsung finishing 2021 on top. The Galaxy A line will compete against the value for money phones coming out of China as Samsung keeps the specs for Galaxy A models high, and pricing for these devices low.

Oppo, which has been taking advantage of Huawei's problems with the U.S. to become the leading brand in China, finished third in smartphone production during Q4. A strong first quarter for Xiaomi will move the latter from fourth place to third in global production, according to TrendForce. Huawei, whose 9.5% share of smartphone production made it the fifth largest handset company during the fourth quarter of 2020, is expected to fall further during the current quarter. With the sale of sub-brand Honor and the continuing U.S. restrictions on chip purchases, Huawei is forecast to produce just 7.7% of smartphones during the January through March period. As a result, Huawei will swap places with Vivo based on TrendForce's estimates with Vivo moving up from sixth to fifth and Huawei going from fifth to sixth.

TrendForce forecasts a recovery in the smartphone industry for 2021 thanks to the gains made against COVID-19. The company says that total production will reach 1.36 billion connected handsets during the year for a 9% year-over-year gain. If anything causes production to be capped, it would be the current chip shortage as the lack of a typhoon in Taiwan is leaving foundries short of water which is a necessity to manufacture integrated circuits. As a result, phone manufacturers will have to make their current inventory of cutting-edge chips last as long as possible. This is something that Huawei has been forced to do since September when the new U.S. export rules for foundries started to kick in.

The research firm says that with chip supplies tight, the difference between peak and off-seasons will not be as easy to determine as they usually are and quarter-over-quarter comparisons will be smaller than normal. From the 363.3 million units produced during the fourth quarter of 2020, TrendForce predicts that a total of 342.1 million smartphones will be manufactured during the current quarter.

The bottom line is that there have been plenty of unusual events that have impacted the smartphone market over the last two years starting with Huawei's placement on the Entity List in 2019, the chip ban and the pandemic in 2020. The lasting effect of this will be the shakeup in China as the world's largest smartphone market reacts to Huawei's decline.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: