TSMC rushes to finish its US fabs quarters ahead of schedule

TSMC is rushing to finish its US fabs in Arizona after hearing from its clients in America.

As you probably know, TSMC, the largest chip foundry, has said that it will spend $165 billion to build fabs in the U.S. that can produce advanced chips. After reporting its second quarter earnings last week, TSMC held a conference call during which it updated its plans for global manufacturing. In Arizona, the company will put up six advanced wafer manufacturing fabrication facilities, two advanced packaging fabrication facilities, and a center for research & development.

Strong interest in U.S. chips from TSMC's customers has the foundry speeding up its Arizona timetable

TSMC CEO C.C. Wei says that the first fab in Arizona is complete and is up and running. The second fab has been built, and work has started on the third. The executive also said that TSMC is seeing "strong interest" from its U.S. customers, leading the foundry to speed up its volume production schedule by cutting quarters off of its production schedule. He also said during the call, "TSMC will continue to play a critical and integral role in enabling our customers' success, while also maintaining a key partner and network of the U.S. semiconductor industry."

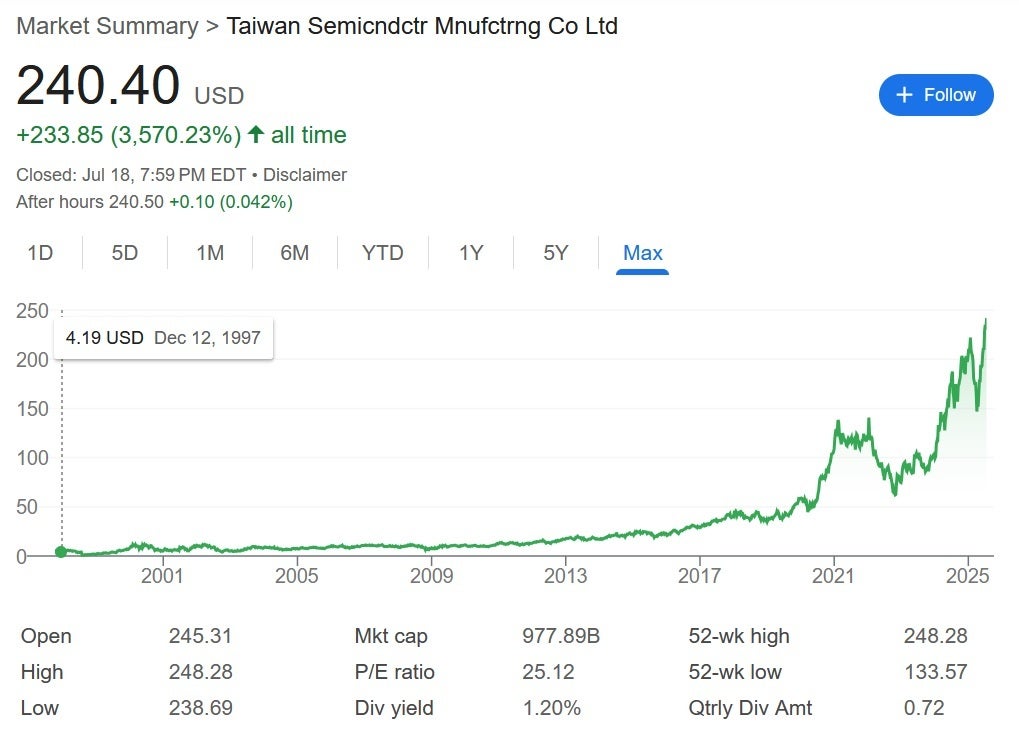

TSMC's long-term stockholders have had a great ride. | Image credit-Google

With President Donald Trump threatening to impose 25% tariffs on imported semiconductors. Most likely, the tariffs will be imposed on devices shipped into the U.S. that contain foreign-manufactured chips. For example, Apple will have to pay the import tax on an iPhone imported into the U.S. from China or India. Apple will also be charged for the semiconductor tariffs unless it uses chips manufactured in the U.S.

Will TSMC benefit from building chips in US?

Yes. It's US clients like Apple will place orders.

45.61%

No. Clients will demand chips made in Taiwan.

7.02%

Either way, TSMC will still dominate the industry.

47.37%

The U.S. fab in Arizona that started making 4nm chips last year (Fab 21 Phase 1) will continue to do so this year. What is very impressive is that TSMC's yield for production using the 4nm process node matches its yield in Taiwan. Apple chips that could come of the assembly line in Arizona include:

A16 Bionic-Used to power the iPhone 14 Pro and iPhone 14 Pro Max, the iPhone 15 and iPhone 15 Plus. Reports indicate that TSMC has begun trial and small-scale manufacturing of 4nm chips and is now ramping up mass production for these chips. Trial and small scale production has begun and production is ramping up for this chip.

S9 SiP (System in Package)-This chip is currently used in the Apple Watch Ultra 2. Later this year, it could be found inside new Home Pod mini models later this year. TSMC has completed its second fab in Arizona (Fab 21 Phase 2). This is where TSMC is rushing to start production of 3nm chips several quarters early due to strong customer demand in the U.S. Some ramping up of 3nm production in the U.S. could start in late 2025 , early 2026 ahead of schedule.

S9 SiP (System in Package)-This chip is currently used in the Apple Watch Ultra 2. Later this year, it could be found inside new Home Pod mini models later this year. TSMC has completed its second fab in Arizona (Fab 21 Phase 2). This is where TSMC is rushing to start production of 3nm chips several quarters early due to strong customer demand in the U.S. Some ramping up of 3nm production in the U.S. could start in late 2025 , early 2026 ahead of schedule.

"Looking into second half of 2025, we have not seen any change in our customers' behavior so far. However, we understand the uncertainties and risk from the potential impact of tariff policies, especially on consumer-related and the price-sensitive, end-market segment."

-C.C. Wei, TSMC, CEO

This past April, TSMC broke ground on its third fab in Arizona (Fab 21 Phase 2). This fab will produce 2nm and A16 (essentially equivalent to 1.6nm) chips.

s The first smartphones to sport a 2nm application processor will be released later this year or early in 2026. These chips will be produced in Taiwan as U.S. built 2nm and A16 chips won't be built in the U.S. until the end of the current decade.

TSMC's second quarter net income was up 61% year-over-year

During the second quarter of 2025, TSMC generated 933.80 billion new Taiwan dollars ($31.7 billion USD) in revenue. Net income, reported at 398.27 billion new Taiwan dollars ($13.5 billion USD), was $20.41 billion new Taiwan dollars ($692.6 million USD). Not only was Q2 net ahead of expectations, it was up 61% year-over-year. In other words, it was another strong quarterly report for TSMC.

For the first time in history, last week TSMC's market value closed above $1 trillion. In pre-market trading on the Robinhood trading platform, TSMC's shares were trading at $240.50, up 4.2% or 10 cents a share. The 52-week high of $248.28 is within reach. With a 52-week low of $133.57, the stock is up $19.3% for 2025.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: