Who needs the U.S.? Huawei's 5G networking equipment is raking in big bucks in China

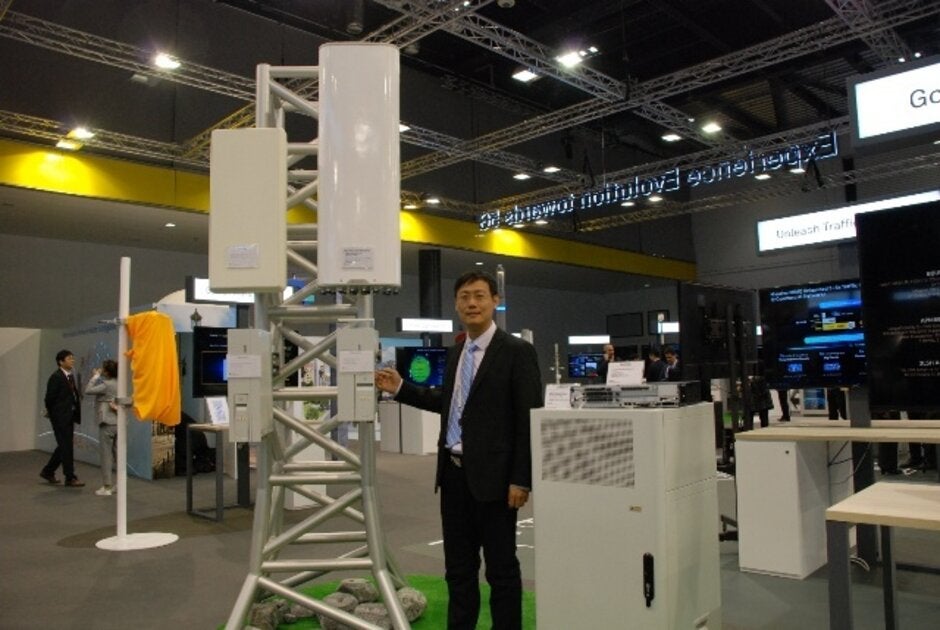

Dating back to November 2018, Trump administration officials warned U.S. allies not to use Huawei's networking equipment for the 5G networks that they were building out. Many of you know that Huawei is a successful phone manufacturer; last year the company shipped 240 million units to surpass Apple as the second-largest smartphone producer in the world. But what is not as well known is the fact that the company is the largest supplier of networking equipment in the world.

The U.S. fears that Huawei's alleged ties to the communist Chinese government mean that it has built backdoors into its products-including networking equipment that gathers information on consumers and companies, and sends that info to Beijing. Huawei has repeatedly denied this and no proof of this has ever been discovered. While Australia and Japan heeded the warning from Washington, two high-profile U.S. allies refused to do so. Both Germany and Britain have decided to allow Huawei's networking gear into their 5G networks although Britain is keeping Huawei's parts away from "sensitive functions."

Huawei was awarded 58% of the value of China Mobile's 5G contracts for the year to date

As try as it might to stop countries from using Huawei's networking equipment in their 5G networks, the U.S. has no control over this decision. And with global powers trying to become the first country to harness the speed of 5G connectivity to help create new technologies and industries, there is much at stake. Bloomberg reports that Huawei is receiving the vast majority of orders for 5G equipment in China where $170 billion will be spent to build the networks needed for the next generation of wireless connectivity in the country.

Huawei is the leading provider of 5G base stations for Chinese wireless providers

During last year's third quarter, a wave of patriotism in China helped Huawei take an amazing 42.4% share of domestic smartphone shipments; the runner-up, Vivo, had a 17.9% slice of the pie. This year, Huawei is counting on carriers inside China to award it huge contracts to supply them with 5G networking gear. The largest wireless provider in the country, China Mobile, has given Huawei $4 billion worth of such contracts since the beginning of this year beating out rivals such as ZTE and Ericsson.

Some of these awards could be due to Huawei's technology which is reportedly 12 to 18 months ahead of what the competition is offering. Additionally, Huawei is able to offer generous financing terms to customers allegedly due to connections that the company has with the Bank of China. When British Prime Minister Boris Johnson said earlier this year that there really aren't any alternatives to Huawei in the 5G market, he echoed many in the Trump administration who came to the realization that the statement is true. Attorney General William Barr floated a wild idea in February that called for the U.S. government to buy Huawei rivals Nokia and Ericsson. The government also reportedly approached U.S. networking firms Oracle and Cisco to see if they would like to take on Huawei. Both firms supposedly replied that they did not have the required time or money to engage in such a project.

Being the global 5G leader is important to both China and the U.S. In a meeting with his senior officials last May, Chinese President Xi Jinping said that 5G leadership will help the country restart its flagging economy. China expects to spend $169.4 billion on 5G networks over the next five years which will create 3 million new jobs. Spending on the technology won't peak until 2022 or 2023 according to IDC telecom analyst Cui Kai.

Of the $5.2 billion in 5G contracts that China Mobile awarded to networking equipment firms, Huawei garnered slightly more than $3 billion or 58% of the total. Next was ZTE which received $1.51 billion or 29% of the total. Ericsson was third with $579 million in contracts which amounts to 11.1% of the orders.

Paul Triolo, head of global technology policy at Eurasia Group says, "The focus on buildouts, handsets, and other metrics misses the fact that 5G will be a platform where innovative Chinese companies such as Alibaba, Tencent, Baidu, and a host of new tech unicorns will be able to build new applications and use cases. Beijing wants Chinese companies to lead in this race to innovate on top of 5G."

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: