Apple Card holders can buy an iPhone and make 24 monthly interest-free payments

Sure, Apple iPhone buyers can purchase an iPhone from their carrier and pay it off interest-free by making 24-monthly payments. Starting tomorrow, that option will be available to Apple Card holders purchasing a new iPhone from the Apple Store. According to CNBC, the monthly amount owed for the phone will be added to each month's minimum amount due for 24 months. Cardholders using the Apple Card to make purchases at the Apple Store will receive a 6% cashback bonus until the end of this year. That is twice the usual 3% that they get back on Apple Store purchases made with the card.

Apple CEO Tim Cook, after Apple reported its fiscal fourth-quarter results in October, announced that the company was going to allow Apple Card holders to pay for iPhone purchases monthly. At the time, Cook said, "One of the things we are doing is trying to make it simpler and simpler for people to get on these sort of monthly financing kind of things. That’s a part of what we announced with the Apple Card earlier in the call and so we are cognizant that there are lots of users out there that want sort of a recurring payment like that."

Consumers can apply for the Apple Card from the Wallet app or the Apple Card web site

The company does offer the iPhone Upgrade Program, which includes 24 interest-free monthly payments for an iPhone bundled with the AppleCare+ extended warranty. After 12 monthly payments, the iPhone being paid off can be exchanged for the latest model and the payments continue. For example, those signed up for the upgrade program are paying $54.08 monthly for the 64GB iPhone 11 Pro Max.

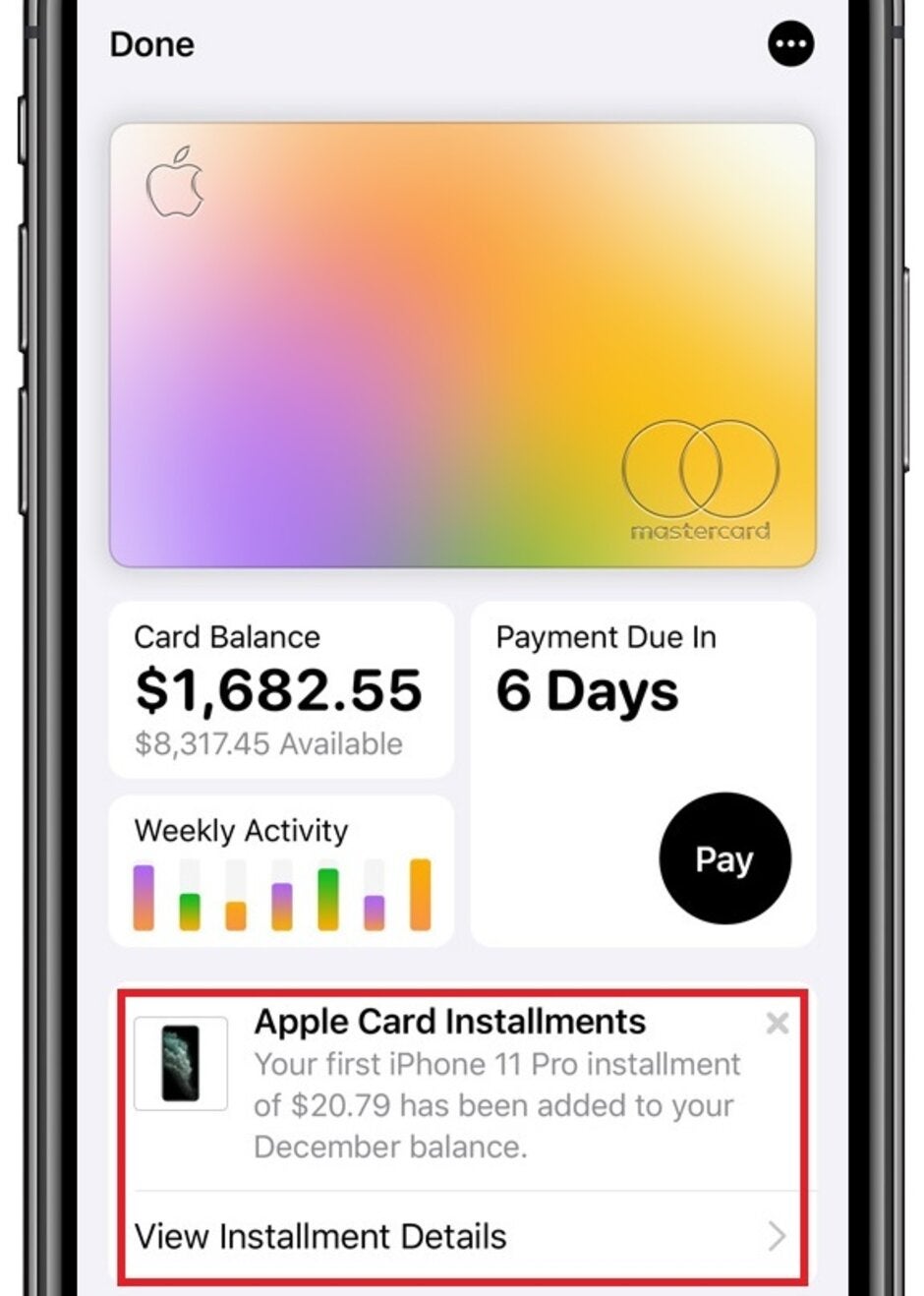

Apple posted a message about installment payments inside the Wallet app on Monday that read "Installments are not subject to interest like other purchases made with Apple Card. If you pay more toward your installment balance, you may reduce the overall number of payments, but are still scheduled to pay your installment payment the following month." The tech firm introduced the Apple Card in March and launched it in August. The card is the result of a partnership between Apple and securities firm Goldman Sachs. In addition to receiving 3% back on purchases of Apple products using the card (as we pointed out earlier, until the end of the year this is doubled to 6% for Apple Store purchases), users get a 1% cashback bonus on purchases while Apple Pay transactions give users back 2% of the amount charged. These cashback payments are computed and added to the user's account daily. And there are no fees for Apple Card holders; Apple does not collect late fees, annual fees, or over-the-limit fees.

Use the Apple Card at the Apple Store and pay off your new iPhone by making 24 interest-free payments

Apple iPhone users can apply for the card through the Wallet app or from the Apple Card site. And once they are approved, the card can be used immediately using Apple Pay and the Wallet app. While those approved can use the card immediately, a physical titanium card is subsequently mailed to the account holder. And while most credit card companies clap their hands together in glee and drool when customers pay the minimum amount due each month, Apple will show users how much interest they can expect to pay over time based on the amount they are paying each month. This might give cardholders the incentive to pay down more of their balance each billing cycle.

With the Wallet app, users can see their account as it stands right at that moment. And if a subscriber spots a charge that he or she doesn't remember, tapping on it will show the location where the transaction took place on a map.

So if you have an Apple Card, starting tomorrow, you can purchase a new iPhone from the Apple Store and make 24 monthly installment payments interest-free; there’s no additional application required to finance the purchase of an iPhone using the card.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: