Trading app goes down costing its customers big bucks

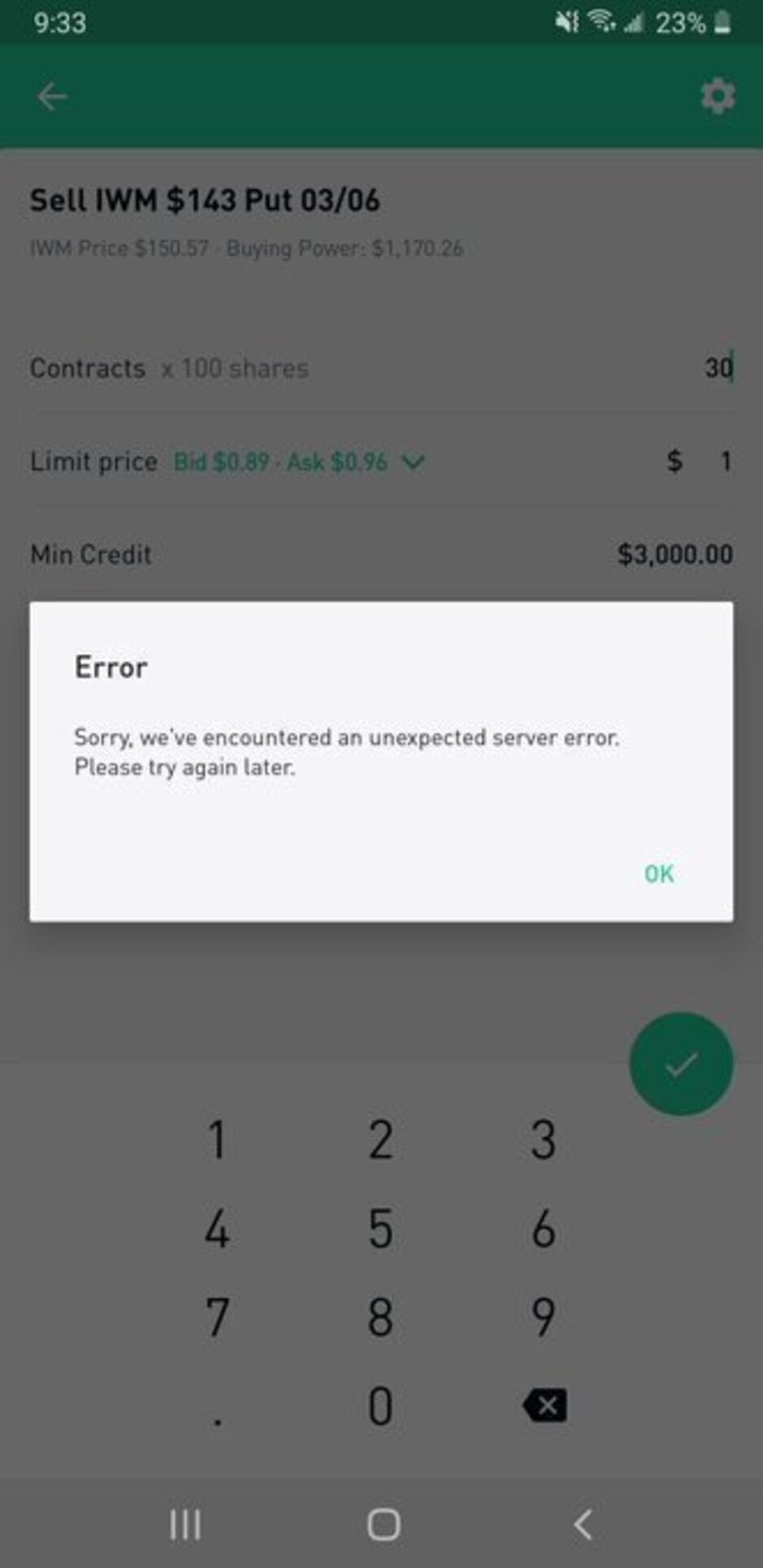

The stock market is as volatile as it has ever been because of the rapidly spreading COVID-19 virus. As a result, stock and option traders using the Robinhood app must have been pulling their hair out on Monday and Tuesday. That's because the app had a "major outage" on both days. CNBC reports that while updates posted on the Robinhood website said that its platform was "operational" yesterday, screenshots posted on Twitter by account owners showed that users of the trading app were receiving error messages.

Robinhood account holders could not take advantage of the record rally on Monday

Imagine owning a declining stock in a market that is dropping like a rock and being unable to exit the position. Robinhood clients trading options could easily find their account wiped out if they are unable to close out a position in a fast-moving market. Robinhood offers its clients commission-free stock and option trades. For $5 a month, the premium "Gold" service allows subscribers to trade on margin, receive research reports, and make bigger instant deposits.

A problem with the Robinhood app on Monday and Tuesday cost its account holders some of its clients serious money

On Tuesday, a notice on Robinhood's website alerted clients that "We are experiencing a system-wide outage." The problems started to occur on Monday and lasted the entire day. Robinhood account holders were unable to take advantage of the largest single-day point gain in the history of the Dow Jones Industrial Average by exiting existing positions or by riding the rally for a day trade. And then yesterday, the market opened sharply higher and continued to rally as the U.S. Federal Reserve Board cut interest rates by 50 points. By the end of the day, the market had given up all of its gains and was sharply in the red again.

Even before the outage extended into a second day, a Robinhood spokesman said, "We realize we let our customers down, and we’re committed to improving their experience." The spokesman also explained that the outage was caused by a problem with "infrastructure that allows our systems to communicate with each other." That prevented customers from using the Robinhood app, website, and help center.

"When it comes to your money, we know how important it is for you to have answers. The outages you have experienced over the last two days are not acceptable and we want to share an update on the current situation. Our team has spent the last two days evaluating and addressing this issue. We worked as quickly as possible to restore service, but it took us a while. Too long. We now understand the cause of the outage was stress on our infrastructure—which struggled with unprecedented load. That in turn led to a “thundering herd” effect—triggering a failure of our DNS system."-Robinhood

Since Robinhood is a broker-dealer, it is required by regulatory agencies including the Securities and Exchange Commission (SEC) to have a backup plan to cover situations when account holders cannot make changes to their holdings. A spokesman with the Financial Industry Regulatory Authority (FIRA) said that it has been in touch with Robinhood and is closely monitoring the situation.

Robinhood account holders could start a class-action suit

The firm's 44-page customer agreement states that it will not be responsible for "temporary interruptions in service due to maintenance, website or app changes, or failures," and isn’t liable for interruptions that occur beyond the company's control. Robinhood does point out that it doesn't guarantee that its trading platform will be "error free every minute of the day." However, it will discuss compensation with its account holders on a case by case basis. Already, a new Twitter account titled Robinhood class action (@RobinhoodClass) has been created. However, it would appear that account holders might be out of luck. James Angel, associate professor at Georgetown’s McDonough School of Business, believes that for Robinhood clients, "it’s most likely tough luck. This won’t stop the class-action lawyers from launching nuisance lawsuits, however."

Some Twitter users were sharing the process for transferring their holdings out of Robinhood and into an account opened with another broker. But if you're interested in using Robinhood and trading commission-free, you can install the app from the Apple App Store or the Google Play Store. Over 10 million people use the app and besides stocks and options, account holders can trade cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. There is no minimum account size.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: