TSMC demanded a 3% price hike to produce 2023's A17 Bionic chip; Apple reportedly said "No"

We may earn a commission if you make a purchase from the links on this page.

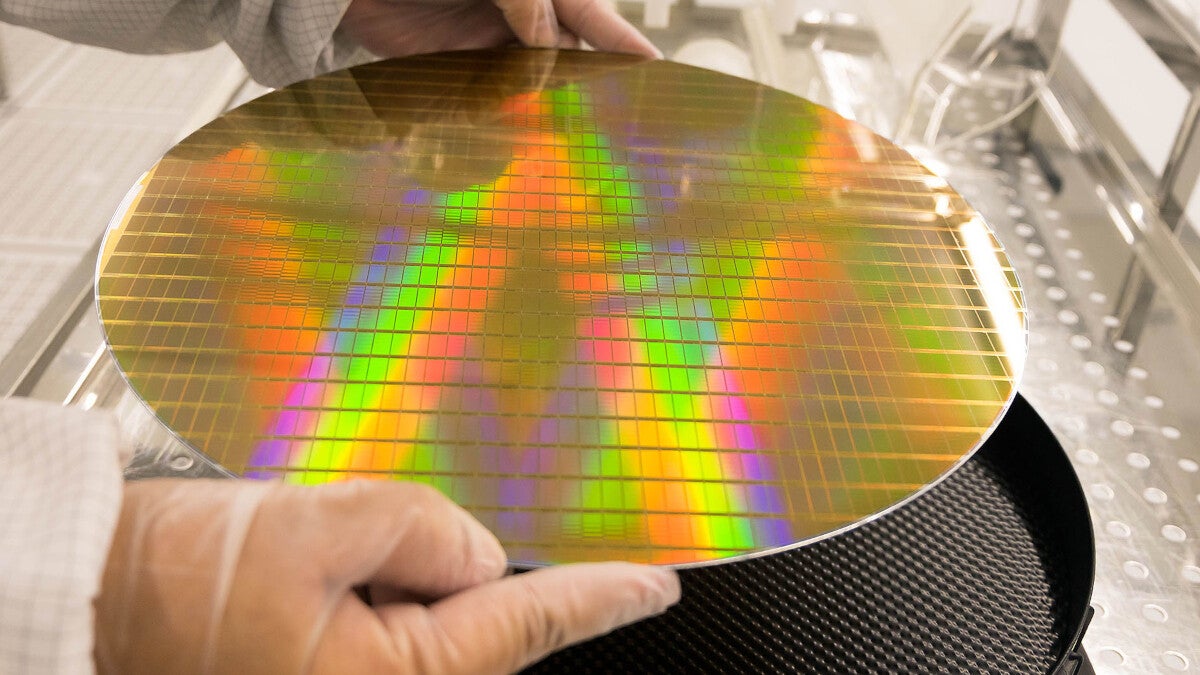

According to the Chinese language Economic Daily News, the world's leading chip foundry was hoping to institute a price hike for its next tier of cutting-edge chips. Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) is going to start shipping chips made using its 3nm process node later this year. As the process node figures come down, the transistors used to power chips are smaller enabling more of them to fit in a small dense place like the inside of a chip.

Apple refused to accept a 3% price hike for TSMC to produce its A17 Bionic chipset

This is important because the higher a chip's transistor count, the more powerful and energy-efficient a chip is. For example, the 5nm A15 Bionic used on the iPhone 13 line and the iPhone 14 and iPhone 14 Plus sports 15 billion transistors inside each chip. The new 4nm A16 Bionic, which powers the iPhone 14 Pro and iPhone 14 Pro Max, has nearly 16 billion transistors inside each component making it more powerful and less of a drain on a phone's battery than the A15 Bionic.

TSMC wanted to raise its price on production of the A17 Bionic chipset by 3%. Apple said it would not pay it

For next year's A17 Bionic, expected to be under the hood of the iPhone 15 Pro and iPhone 15 Ultra, TSMC will use its 3nm process node. The report in the Economic Daily News (via Seeking Alpha) says that TSMC was looking to hike pricing for the A17 Bionic by 3%. But the report cited sources that revealed how Apple told TSMC that it would not pay the higher price. Apple is the foundry's biggest customer and by some accounts, the company is responsible for as much as 25% of TSMC's annual gross.

About a year ago, TSMC customers like AMD, Nvidia, and MediaTek reportedly had to deal with a 20% price hike put in place by TSMC. Supposedly, Apple received a much smaller 3% price increase. Following the price hike last year, TSMC said this summer to expect a price hike of as much as 8% this year which would raise prices for 2023 shipments.

Buy the Apple iPhone 14 Pro and iPhone 14 Pro Max right now!

Since the chips produced by TSMC are such an important component, and considering that only Samsung Foundry has the technology to deliver cutting-edge chips like TSMC can, most of the company's customers pay the higher prices with a smile on their faces. But Apple's contribution to TSMC's top and bottom lines is so important that the tech giant actually can refuse to pay higher prices for the assembly of its chips and get away with it.

It is not known how TSMC responded to Apple's refusal to accept a 3% price hike for the 3nm A17 Bionic chips. One would imagine that TSMC would hold the upper hand in this situation due to the lack of foundries with the capabilities that TSMC has. It has to be worrisome enough for Apple that China seems eager to use force to take over Taiwan. China wants to be self-sufficient when it comes to advanced chips and taking control of TSMC is something that surely is on the mind of President Xi Jinping.

TSMC is expected to ship 2nm chipsets starting in 2026

This year, Apple has decided to equip the non-Pro iPhone 14 models with the same A15 Bionic chips that powered the entire iPhone 13 lineup last year while using the new A16 Bionic for the more expensive Pro models. This is expected to continue next year, and into the foreseeable future, with the iPhone 15 and 15 Plus carrying the A16 Bionic and the A17 Bionic powering the iPhone 15 Pro and iPhone 15 Ultra.

The next few A series chipsets designed by Apple, starting with the A17 Bionic, will be produced by TSMC using its 3nm and enhanced 3nm process nodes. The 2nm process node won't be shipped by TSMC to customers until 2026.

Device manufacturers had to deal with a chip shortage last year that affected older, legacy silicon as car manufacturers were blindsided by heavier demand for vehicles than expected despite the continuation of the pandemic. Even Apple saw its revenue impacted by the chip shortage to the tune of a $6 billion shortfall.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: