Apple to take 53% of TSMC's 5nm chip production this year according to fresh estimate

Taiwan Semiconductor Manufacturing Company (TSMC) is the world's largest contract foundry. You see, many of your tech giants including Apple, Qualcomm, MediaTek and Huawei do not own the facilities needed to manufacture chips. So these companies take their chip designs and turn over the production of these integrated circuits to foundries like TSMC and Samsung. For example, last year's Qualcomm Snapdragon 865 was produced by TSMC using its 7nm process node. This year's Snapdragon 888 is being manufactured by Samsung Foundry using the latter's 5nm process node. After TSMC, Samsung Foundry is the planet's second largest contract foundry.

Apple will responsible for 53% of TSMC's 5nm chip production this year says Counterpoint

On Friday, Counterpoint Research released some data based on its estimates of the 2021 Foundry industry. Revenue in the Foundry industry was up 23% last year to $82 billion. Counterpoint shook its Magic 8 ball and is now calling for growth of 12% this year bringing revenue to $92 billion. TSMC should grow 13% to 16% this year staying pretty much in line with the industry's overall growth rate. Including chips ordered for other Samsung projects and those shipped to firms like Qualcomm and NVIDIA, Samsung Foundry is expected to post a 20% gain in 2021 revenue. Driving the growth in the industry this year will be gains in wafer shipments and a hike of about 10% in like-to-like wafer prices.

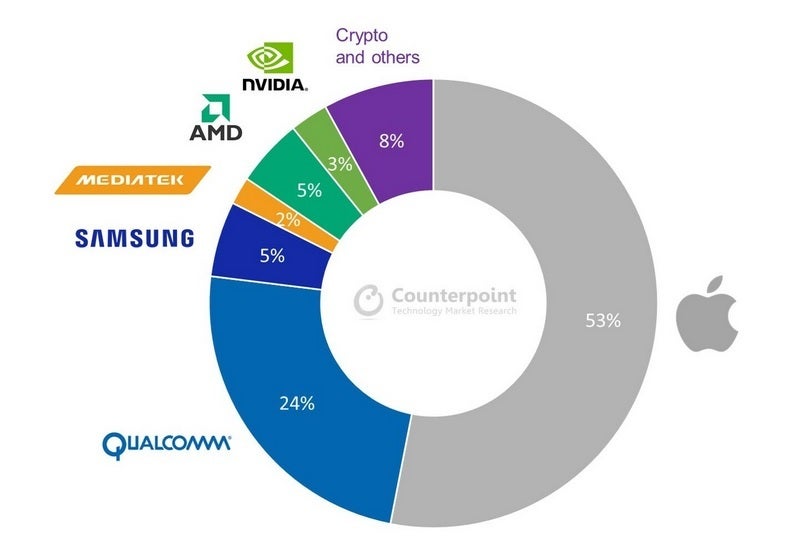

Counterpoint expects Apple to account for 53% of TSMC's 5nm production this year

TSMC and Samsung Foundry both deliver cutting-edge chips made using the 5nm and 7nm process node. Based on transistor density (the number of transistors in a square mm), the lower the process number, the more powerful and energy-efficient a chip is. The industry just started shipping 5nm chips this year with Apple's A14 Bionic the first 5nm integrated circuit found on a smartphone.

Counterpoint Research expects that Apple will be TSMC's top 5nm customer this year accounting for 53% of production thanks to the A14 and A15 Bionic chips and the M1. 5nm production will account for 5% of 12-inch wafers this year, up from less than 1% last year. Counterpoint sees Qualcomm accounting for 24% of TSMC's 5nm chip manufacturing as Apple is expected to use Qualcomm's 5nm Snapdragon 5G X60 modem in the iPhone 13. Both TSMC and Samsung are forecast to have 90% of their 5nm equipment booked for 2021 with the former grossing $10 billion from 5nm business this year.

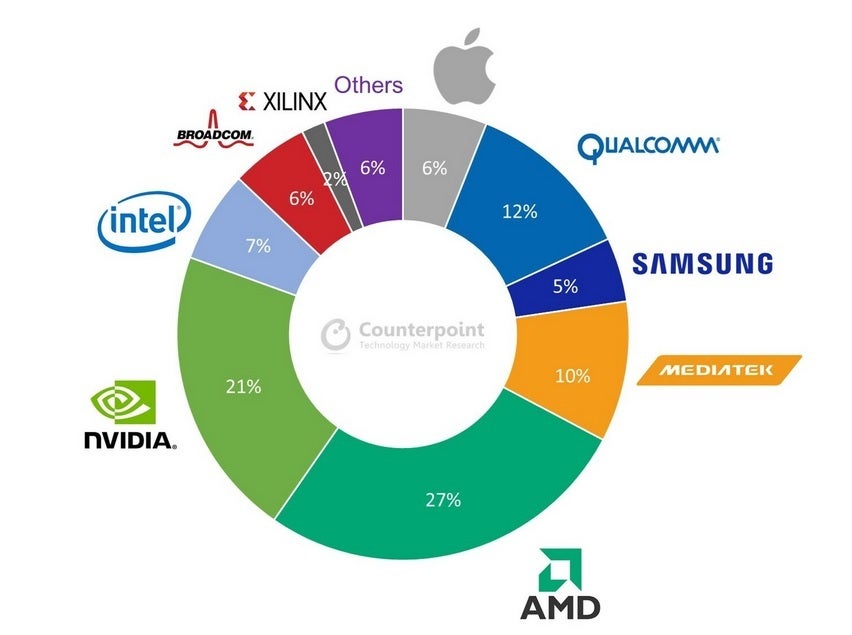

AMD will be TSMC's largest customer for 7nm chips in 2021

Unlike 5nm wafers, 80% of which are used for smartphones, 7nm chips are used more widely with only 35% of production used for smartphones. 7nm will account for 11% of 12-inch wafer use this year forecasts Counterpoint. Both TSMC and Samsung manufacture a variety of 7nm chips including those made using EUV. Extreme Ultraviolet lithography uses beams of UV light to etch out extremely thin patterns on wafers to help engineers create circuits. The use of EUV has helped foundries take their process nodes down to the current 5nm with 3nm volume production starting next year.

This year, TSMC's top customer for 7nm will be AMD; the latter will account for 27% of such production according to Counterpoint. NVIDIA is next at 21% followed by MediaTek at10% and Intel with 7%. Yes, the latter does have its own fab, but its capabilities are behind TSMC and Samsung Foundry when it comes to process node. The research firm says that Intel's decision to outsource is one necessary to maintain the long term survival of the chip maker.Apple will take 6% of TSMC's 7nm output this year as it still needs 7nm chipsets for some of its older handsets.

Counterpoint notes that higher inventory of chips, now up to 79 days from 70 days since 2016, is due to the pandemic, global trade battles, and other issues. As a result, the chip industry will get acclimated to higher levels of inventory over the course of the year. Counterpoint sees annual revenue in the industry reaching $100 billion by 2022-2023.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: