Study suggests T-Mobile-Sprint merger would cut employee pay from all remaining major U.S. carriers

A new study of the proposed T-Mobile-Sprint merger shows that if the deal is closed, employees working in the company owned stores would face wage cuts. In addition, the report from the Economic Policy Institute and the Roosevelt Institute (via The Kansas City Star) adds that wages for those working for Verizon, AT&T, and T-Mobile authorized resellers will also be lowered following the merger, if it gets approved.

The merger could reduce demand for representatives to sell phone, accessories and services at these stores. While T-Mobile and Sprint say that the merger would create new jobs immediately, the Communications Workers of America union says that 28,000 jobs will be lost if the merger goes through. Duplication of jobs would be a major reason to expect layoffs from the deal, and certain overlapping stores could be consolidated or closed.

The report says that the weekly pay packet for affected workers could be as much as 7% lighter each week. But that is the worst case scenario cited by the study. In most markets, the weekly decline will be between 1% and 3%. Among the hardest hit 50 markets, employee wages could decline by as much as $65 a week or $3,380 over the course of a year. On the other hand, some employees in those markets could end up losing $10 a week or $520 over a year. Employees in Kansas City, Kansas and in St. Louis, Missouri would feel the brunt of these pay cuts according to the study.

The report adds that employee wages could be cut even if there were no layoffs. The study's authors base this on a concept called monopsony, which allows employers to pay employees less than what they are worth due to the lack of competition for that labor.

The study doesn't make a recommendation about whether the deal should or shouldn't be approved, but does say that regulators should use the information in making their decision.The transaction reportedly has received national security clearance from the Committee on Foreign Investment in the United States (CFIUS), but still needs a green light from both the FCC and the DOJ. T-Mobile expects the merger to close in the first half of 2019.

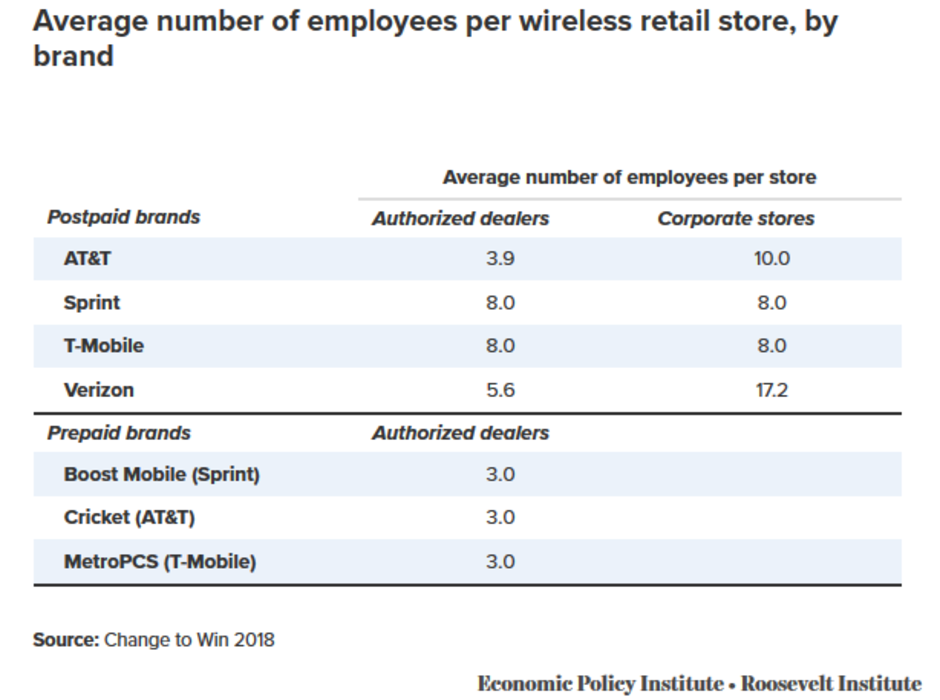

Average number of employees working inside a wireless store

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: