Android forks are now 20% of the ecosystem. What is Google's plan?

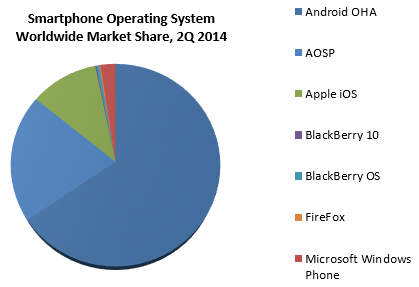

Last week, news came out that Android has widened its gap over competing mobile platforms, and is now accounting for 85% of all smartphone shipments around the globe. That is an absolutely dominant number, but the hidden story in those numbers is that not all of those smartphone shipments are running Google Android. There are plenty of forks around the world, and actually about 20% of the Android ecosystem is made up of non-Google, or forked Android devices.

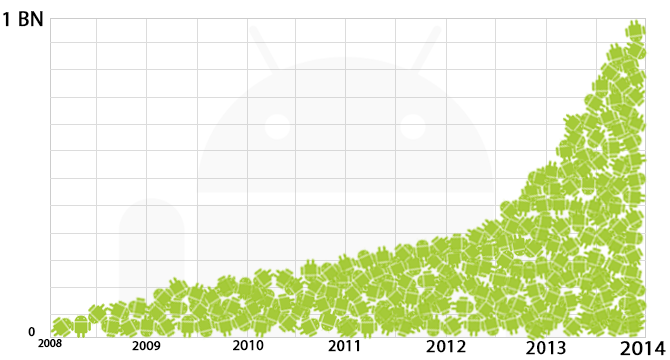

Forked Android devices have been a part of the ecosystem essentially ever since Google first released Android into the Android Open Source Project (AOSP). For a while, Google didn't have much to worry about, because of just how much work was required to put out a truly compelling offering using stock AOSP or with a properly forked AOSP handset. In the early days, there weren't many third party app stores; and, without apps, smartphones are far less enticing. Eventually, reliable app stores popped up, but it was still a lot of work to replace Google Apps, especially Maps on a forked platform. These days, Google has competition coming from multiple fronts.

Unsurprisingly, the majority of the growth for AOSP came from Asia, specifically in China and India. According to Nick Spencer, senior practice director, mobile devices, ABI Research:

Chinese and Indian vendors accounted for the majority of smartphone shipments for the first time with 51% share. While many of these manufacturers are low cost, some are making inroads in the mid-tier, including Xiaomi and Gionee, hence the growing challenge to Samsung in particular.

In terms of hardware, that is true. Samsung should be worried about AOSP devices in those markets. But, I'm a bit more interested in looking at the Android ecosystem as a whole, and the threat that AOSP poses to Google itself. Google has always said that it welcomes forked versions of Android. Google wants the competition and innovation that comes from keeping Android open. In no small way, it forces Google to make Play services and the Google Apps as good as can be, because otherwise, Google will lose control of its own platform. So, let's take a look at the competition.

AOSP making moves

The biggest names in the forked Android space are Xiaomi, Gionee, and Amazon. Nokia wanted to make a name for itself in that space as well, but its Nokia X project has a very uncertain future now that the acquisition of Nokia by Microsoft has become official. Amazon has a respectable market share in tablets in various developed markets, and is attempting to enter the smartphone market with not so impressive results. So, while Amazon has a lot of brand awareness here in the U.S., it still doesn't rate too highly on a global scale.

Gionee is an Chinese brand that grew quickly in China before setting its sights on India. It hasn't made much of a dent in India yet, but it is a brand to watch, especially since Google Android handsets from Samsung, Micromax, Karbonn, and Motorola dominate that country, and Gionee is coming in with forked Android devices. Though, it should be noted that as in China, Samsung was recently unseated as the top smartphone manufacturer in India by local company Micromax. So, sometime soon, we're also going to have to take a look at how Samsung has found itself on shaky ground recently.

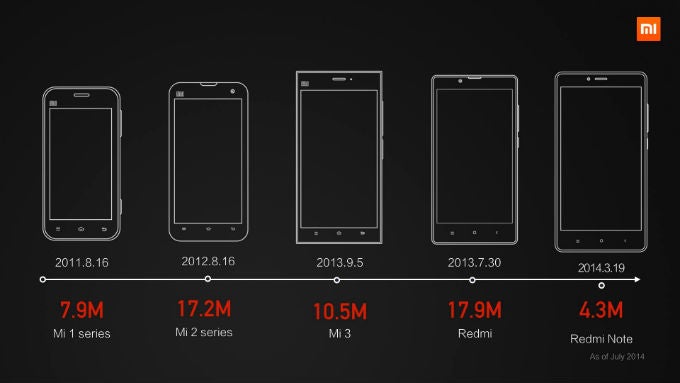

Xiaomi is by far the biggest AOSP maker threat to Google, because Xiaomi is dominating the Chinese market (the largest smartphone market in the world), and has begun to expand outwards. It was recently revealed that Xiaomi has surpassed Samsung in order to become the number one smartphone manufacturer in China; and, Xiaomi passed LG on the world stage to become the fifth largest smartphone manufacturer globally, only a tiny margin away from passing Lenovo to become number four on that list (at least until the Motorola deal finalizes and Lenovo can combine its market share with Motorola). Even more impressive is that in just one year, Xiaomi's global market share leapt from 1.8% to 5.1%, and the company shows no signs of stopping.

Xiaomi has made its brand using a few different tactics, including selling premium hardware at cut-rate prices, and taking hardware "inspiration" from Apple. But, Xiaomi's success is also in large part due to its MIUI software which is easily the most popular fork of Android in the world at this point. The MIUI interface is (unsurprisingly) reminiscent of iOS 6 and earlier, complete with a skeuomorphic tape recorder layout for the recording app. But, the real key to MIUI's success is the MIUI app store, which reached the one billion download plateau after just 391 days, a mark only bested by Apple in the mobile app store sphere. As noted earlier, a reliable and safe app store is one of the hardest things to replicate in an Android fork, and MIUI has created the best one around.

Beyond the big name manufacturers, there are myriad smaller makers and white label products that are flooding all markets around the world with extremely low-cost Android devices, including in the bargain bin at your local Walmart. There are plenty of users out there who don't want to spend much money, and will take whatever they can get within their budget. Those users are prime targets for white label Android devices sold at cut rate prices.

Of course, Google isn't just sitting around and waiting for AOSP to take over the Android ecosystem, it does have a couple of ways to fight back. The established tactic is embodied by Google Play services.

Google Play services brings value to all (and control for Google)

Google Play services and Google Apps effectively make up Google's fork of Android, but we tend to refer to it as stock Android, rather than giving that title to the arguably more deserving AOSP. It gets billed as stock Android, because it is what you'll see most often (it makes up 65% of all smartphones shipped around the globe, and 80% of all Android devices). And, at the center of it all is Google Play services. The aim of Google Play services is relatively simple: bring the best features and security to the largest possible number of Android users. Ever since Sundar Pichai took over the Android division, Google Play services has been at the forefront. Part of the reason is that Google could push updates to 98% of the Google Android ecosystem without having to deal with pesky manufacturer or carrier delays.

The other big reason is that it creates a valuable lock-in mechanism for Google. Remember, manufacturers have to clear a number of requirements, including software update timelines and minimum Android version requirements simply to get the privilege to have Google Apps and Play services pre-installed on hardware. This means all hardware has to be updated to the newest version of Android that is released within 18 months of said hardware; and, newly released hardware must be running one of the newer versions of Android when it launches, if the manufacturer wants to include Google's layer.

It also creates a lock for developers, because there is a lot of great functionality to be had within the Google Play services world. This includes options to hook into Google Now, Google Maps, Google Play Games, and more. Adding in these hooks gives developers better functionality and a wider reach with users, but it also means more work if those developers want to send their apps to other app stores. If you are a developer and you want to submit your app to the Amazon Appstore, it will be rejected if it includes any Google Play services code. This may seem like a trivial matter, but it creates more testing and bug fixing for devs, and they have to weigh whether that extra support work is worth reaching a more limited customer base in a non-Google Android app store.

Lastly, it obviously creates lock-in for users. Some users are perfectly happy with that lock (guilty as charged) and some aren't. The split there is pretty simple: either you like Google Apps or not. If you are a Gmail user, a Drive user, Google Calendar, Play Music, Play Books, Hangouts, YouTube, etc. there is a lot of value to be had in getting a Google Android device and doubling down with Play services. If you are wary of Google, it can cause some issues, but luckily you aren't forced to even have a Google account when using a Google Android device. The experience is simply better if you are in the Google world, as can be said of using Windows Phone and being in the Microsoft world, or using iOS and being in the Apple world.

And, that is really the key: offering the best possible experience. Google is attempting to offer that with Google Apps and Play services, and hoping that users prefer that option. Given that Google Android is found on 65% of smartphones shipped globally, it seems reasonable to assume that Google has been successful in its efforts. But, Play services is not the only thing Google is using to fight back against AOSP forks, there is also the new option...

Android One for emerging markets

Google Play services is a strategy to offer value for everyone, but as you can note from the earlier portions of this article, the threats to Google Android are mostly coming either from emerging markets or in the low-cost device segments of various regions (the exception being Amazon's Fire OS, which is debatably a threat). In order to tackle that segment of users, Google announced its Android One initiative at this year's Google I/O.

The idea of Android One is that Google will be working with manufacturers to offer high-quality, low-cost handsets to customers in emerging markets. The aim is to bring smartphones to market that cost less than $100. And, there are unconfirmed possibilities that the Android One initiative will also include Google subsidizing cell phone plans for those devices. Unconfirmed, but it seems reasonable, given that when Android One was first unveiled, Sundar Pichai said, "We are working with carriers to provide affordable connectivity packages for these devices." It seems unlikely that Google could convince carriers to cut mobile rates without getting something in subsidies from Google.

Google has known for a long time that emerging markets are the next big growth market for smartphones, which is why I assumed that is what Google would use Motorola for, back when that acquisition was first announced; and, it is more than likely why Motorola targeted emerging markets with its Moto G and Moto E handsets. It is also why Project Svelte was such a big part of Android 4.4, because the system needed to be optimized for low-spec devices that would be better for those low-cost market segments. Those segments have mostly been dominated by manufacturers using Google Android, like Samsung (everywhere), Micromax (India), Mi-Fone (Africa), and Lenovo (Asia). But, as noted earlier, AOSP forks have been arriving in a big way.

Conclusion

You might think that Google could assume that the wealth of manufacturers it has on its side will hold off the AOSP competition, and that Xiaomi is the exception to the rule; but, Google would rather be safe than sorry. It has already made moves with software to create incentives for manufacturers and users to choose Google's version of Android. For manufacturers, it is frankly a very difficult proposition to create a successful fork of Android, which is why so few companies have done it successfully. For users, if you are choosing Android, there is a higher probability that you are a fan of Google's services anyway.

Android One extends Google's efforts to hardware, and sub-$100 smartphones are a very enticing option for many. The question remains as to whether Google's efforts will help stem the tide of AOSP devices. It seems relatively unlikely that anything can stop Xiaomi at this point, so Google's efforts may be better targeted at the off-brand and white label devices. The trouble there is that the Android One initiative would have to expand quickly to a huge portion of the globe in order to really disrupt those AOSP devices. Google is a company that often goes for "moonshots", but it is also a company that often starts the ball rolling and doesn't finish seeing it reach the finish line, or moves very slowly in expanding promising products.

At the end of the day, Google knows that AOSP forks are out there; it's a reality of how Google created Android. By far, the easiest way to kill the AOSP threat would be to stop making Android open source, but that will never happen. Instead, Google has chosen to create its own competition, in an effort to force itself to be better. So far, it has succeeded, but it's unclear if that can last forever.

reference: ABI says AOSP is 20% of Android devices

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: