Samsung remains on top in Europe where smartphone sales declined 24% during Q2

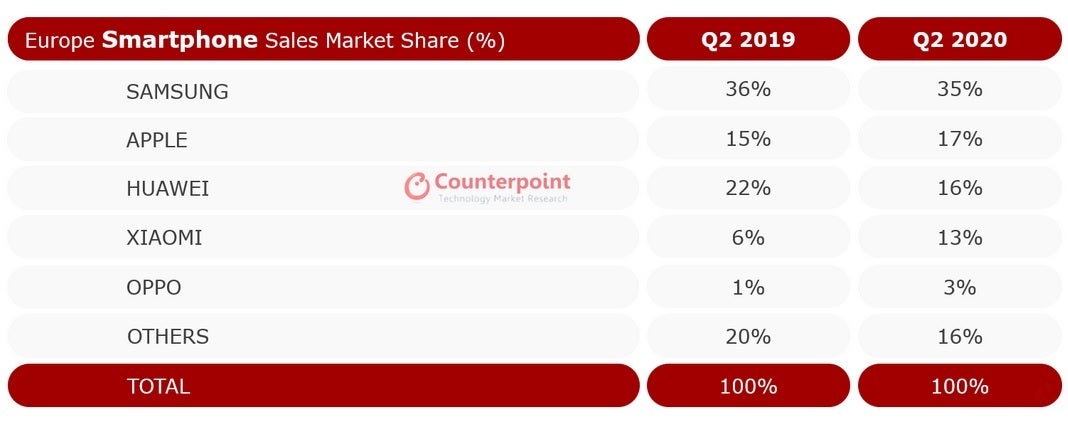

European smartphone sales were hit hard during the second quarter by COVID-19 according to new data published today by Counterpoint Research. 24% fewer connected handsets were rung up during the three months from April through June compared to the same period last year. Sales declined by 20% from the first quarter of 2020. Overall, Samsung was the top smartphone brand on the continent with a 35% market share during the quarter. That was down one percentage point from the 36% slice of the pie that Samsung held during last year's second quarter.

Xiaomi more than doubles its share of smartphone sales in Europe during Q2

Apple saw its share of European smartphone sales rise 13.3% during the quarter allowing it to pick up 3 percentage points on Samsung. The iPhone's European market share amounted to 17% for the second quarter, up from the 15% it had last year. Huawei's Q2 European sales declined 27% but with a 16% share, it still was high enough to finish third. Right behind it with a 13% slice of smartphone sales on the continent was hard-charging Xiaomi. Thanks to its value for money philosophy, the latter was able to more than double its share to 13% from April through June. And while Oppo had only a 3% piece of the action last quarter in Europe, that was triple the 1% share it had during the same quarter last year.

Samsung remains on top of the smartphone sales charts in Europe during the second quarter

Counterpoint's VP of Research Peter Richardson said,"The impact of COVID-19 gathered speed in Europe during April as it was the first full month of lockdowns across almost the entire region, causing a decline of around 45% YoY and 30% MoM. As the lockdowns started to lift across Europe in May, the sales rebounded (+33% MoM). June was equally good, posting a further sequential increase of 34%. Though MoM comparisons look good, the overall scenario for the quarter still shows a 24% YoY decline."

Chinese smartphone manufacturers made up 35% of the phones sold on the continent during the quarter. Thanks to good demand for the OnePlus 7T and OnePlus 8 lines, OnePlus saw its sales in Eastern Europe soar 128% on an annual basis. Counterpoint Research Analyst Abhilash Kumar notes that "Samsung continues to lead the market. Its market share increased from 33% in Q2 2019 to 35% in Q2 2020. This is driven by its diversified portfolio and new product lines that cater to requirement of all price bands. Apple, supported by good the performance of iPhone SE and 11 series, restricted its sales volume decline to 14% YoY. Meanwhile, Huawei declined 46% YoY amid US-China trade sanctions. Xiaomi and Oppo grew 64% YoY and 52% YoY even during the pandemic. With their attractive specs at affordable prices, they managed to woo some potential Huawei users to gain share at its expense."

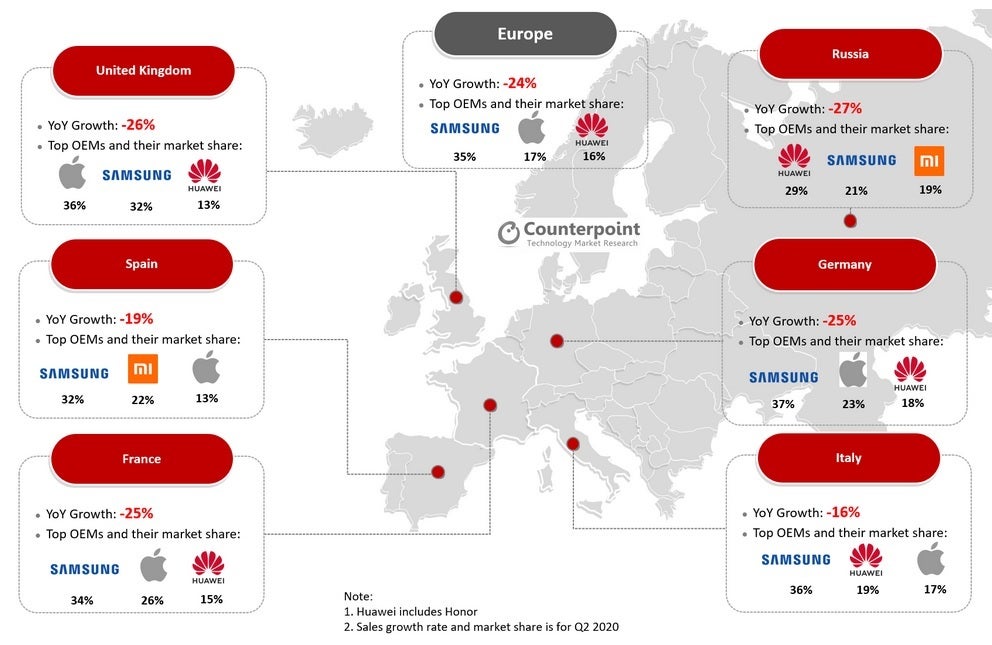

In six major European countries highlighted by Counterpoint (U.K., Spain, France, Russia, Germany, and Italy), Samsung was the leader in four of them with Apple on top in the U.K. and Huawei the leading brand in Russia.

In six major European countries, Samsung was on top in four of them

Last month Counterpoint reported its latest global numbers for the month of May (the latest global report from the research firm) and it showed Huawei with a leading 19.7% share followed by Samsung's 19.6% slice. With a 13% market share, Apple was third during the month. Finishing on top was quite an achievement for Huawei which has been unable to access its U.S. supply chain (including Google) since the middle of May 2019. And starting in the middle of September, foundries looking to ship chips to Huawei will have to obtain a license from the U.S. to do so if U.S. tech is used to produce the semiconductors.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: