Feds could sue Google over its dominance of the digital ad market as soon as tomorrow

Last week the Indian Supreme Court failed to give Google what it was asking for. The tech giant wanted the highest court in the country to block a ruling made in October by the Competition Commission of India (CCI). This ruling could force Google to change the way it licenses the Google Mobile Services (GMS) version of Android in the world's second-largest smartphone market.

Google will have to make changes to the way it licenses the GMS version of Android in India

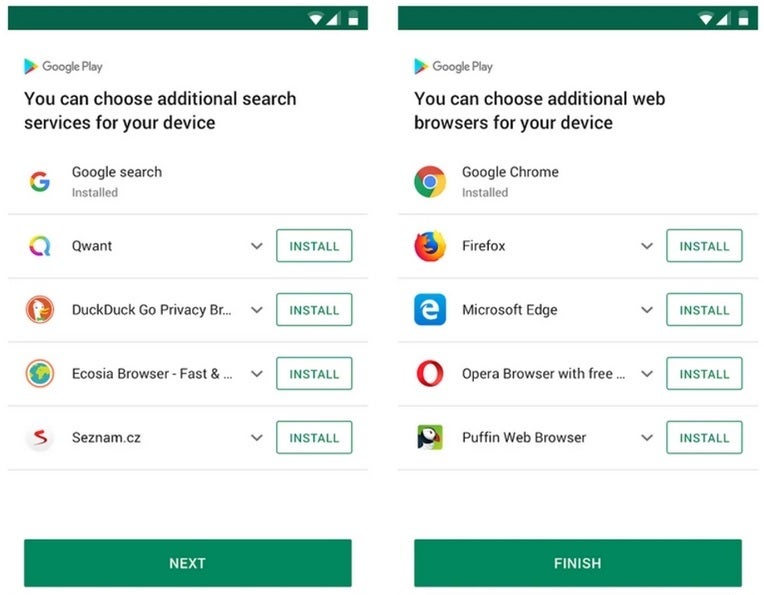

Google demands that phone manufacturers who license the Android operating system with Google Mobile Services must pre-install certain Google apps such as the Chrome browser, the Google search engine, YouTube, and other apps developed by the company. The CCI wants Google to stop what it sees as anti-competitive behavior on Google's part. It also wants Google to allow Android users in India to have the option to uninstall Google Maps and YouTube from their handsets.

Google was forced to offer Android users alternatives to Chrome and Google Search back in 2019

While Android is an open-source system, the Google Mobile Services version includes Google apps and the Google Play Store. This is the version of Android that you are probably most familiar with (unless your Android experience has been limited to Amazon's flop of a handset, the Fire Phone, which used a "forked" version of Android without Google apps. The Amazon appstore replaced the Google Play Store on that phone.

The Indian Supreme Court remanded the case back to a lower tribunal and gave Google until January 26th to change the way it licenses Android. But there's more trouble ahead for Google according to Bloomberg. People familiar with the matter tell the news agency that as soon as tomorrow, the U.S. Department of Justice will sue Google due to its massive share of the digital advertising market.

If filed, it would be the second federal antitrust complaint against Google. Back in 2020, the Justice Department filed a lawsuit against Google because of its dominance in the online search market. That case is scheduled to go to trial this September. The government wants to know how Google acquires and maintains its dominance in search and digital advertising.

Google's advertising business is responsible for 80% of its revenues. Besides collecting ad revenue from advertisers on its search platform and other apps like YouTube, Google gets paid for connecting advertisers with websites, newspapers, and other companies looking to host ads. One complaint against the company is that Google isn't always clear about how much it takes from advertisers and how much goes to the publishers hosting the ads.

Google is in legal hot water all over the globe

And in Google's defense, it can point to its declining market share in the U.S. digital ad market. Insider Intelligence says that Google's slice of the stateside digital ad market has declined from 36.7% in 2016 to 28.8% last year. Google has previously said that it faces competition in this market from the likes of Comcast, Facebook, and AT&T. Despite the erosion, Google remains the leader in this industry by a large margin.

Google boosted its presence in the digital ad market thanks to a couple of purchases it made in 2008 and 2009 when it bought DoubleClick and AdMob respectively.

There is potential trouble for Google all over the globe. Parent company Alphabet faces a $16.3 billion class-action suit filed in the U.K. that accused the Mountain View-based firm of collecting "super profits" at the expense of smaller firms. Google labeled that suit "speculative and opportunistic."

Last September, Google lost an appeal before the EU General Court. The company was fined €4.34 billion in 2018 for requiring manufacturers to install Chrome and Google Search on phones running the GMS version of Android. Google also was fined for paying manufacturers to pre-install Google Search on their devices. The more eyeballs viewing the app, the more Google could charge for ads. The EU General Court did reduce the fine to €4.1 billion.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: