Can you name the top five smartphone manufacturers worldwide during the first quarter of 2022?

With all of the things happening in the world, it might have slipped your mind that the first quarter of 2022 has ended. Yes, we are currently in the second quarter which means that over the next few weeks we will be inundated with first-quarter earnings reports and other data from the opening quarter of the year.

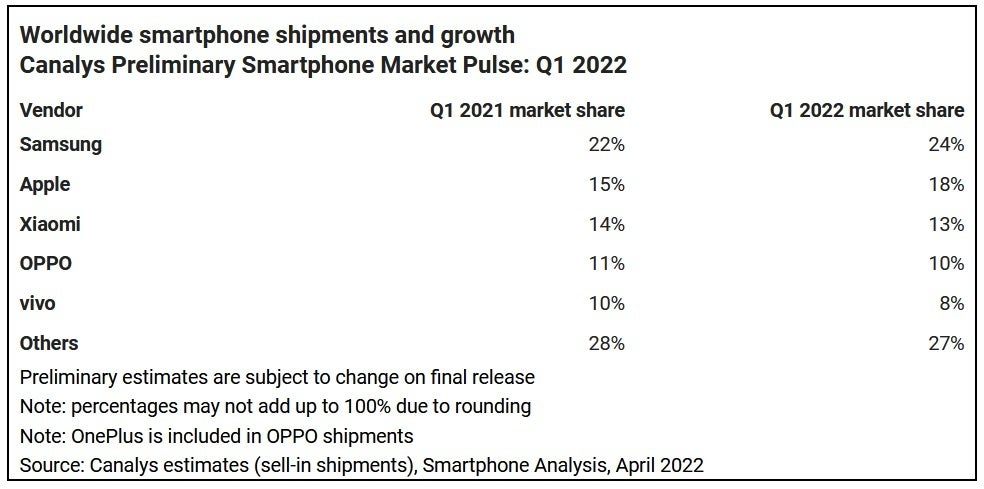

Global smartphone shipments declined by 11% during the first quarter according to Canalys

For example, Canalys this morning dropped its global smartphone shipment data for the months of January, February, and March. Overall, smartphone shipments worldwide dropped 11% thanks to a seasonal decline in demand and a weak global economy. Still, Samsung was able to grow its market share during the three months on an annual basis from 22% to 24%.

Samsung and Apple are the only companies able to expand their Q1 global smartphone shipment market shares this year

During the first quarter, Samsung released the Galaxy S22 series including the Galaxy Note Galaxy S22 Ultra. It also dropped a new line of Android tablets in the Galaxy Tab S8 series. The company's popular Galaxy A mid-range line also added new models including the Galaxy A53 and Galaxy A33. Samsung's Galaxy A series is known for its large screens, viable cameras, and large batteries.

Samsung's next eagerly awaited unveilings will be for its foldable models. The Galaxy Z Fold 4 and Galaxy Z Flip 4 will probably be released during the third quarter of this year. Last year, both models started shipping during the third quarter.

You'll never guess which manufacturer came in second behind Sams...oh, you probably already figured it out, didn't you? Apple's 18% slice of the global smartphone pie in the first quarter of this year was up three percentage points from the 15% share Apple had during last year's first quarter.

During the first three months of 2022, Apple released the iPhone SE 3 and all indications are that sales have been, in the words of super Apple analyst Ming-Chi Kuo, "lackluster." Canalys, on the other hand, lauded the new low-priced iPhone as "an important mid-range volume driver for Apple. At a similar price point to its predecessor, it offers an upgraded chipset and improved battery performance and adds the 5G connectivity that operator channels are demanding."

Apple is expected to start shipping the iPhone 14 series late in the third quarter. This year there will reportedly be a shakeup as the iPhone mini will be gone, although Apple will still ship four new models. We expect to see the 6.1-inch iPhone 14 and iPhone 14 Pro, and the 6.7-inch iPhone 14 Max and iPhone 14 Pro Max.

Xiaomi saw its share of global smartphone shipments decline by just one percentage point to 13% from last year's 14% reading. Fourth-place Oppo also dropped one teeny-tiny percentage point of market share during the first quarter from 11% to 10% (this includes OnePlus shipments). During the quarter, the company released its new flagship Find X5 Pro.

COVID continues to have an impact on global smartphone shipments

At the bottom of this list is Oppo's company-mate Vivo. Both firms are owned by China's BBK Electronics along with OnePlus, Realme, and IQOO. During the first quarter of this year, Vivo's share of global smartphone shipments was 8%, an annual decline of two percentage points. In the "other" category, Q1 shipments declined from 28% in 2021 to 27% this year.

In its analysis of the first three months of 2022, Canalys VP Mobility Nicole Peng wrote, "The global smartphone market was held back by an unsettled business environment in Q1. Markets saw a spike in COVID-19 cases due to the Omicron variant, though minimal hospitalizations and high vaccination rates helped normalize consumer activity quickly. Vendors face major uncertainty due to the Russia-Ukraine war, China’s rolling lockdowns and the threat of inflation."

"All this added to traditionally slow seasonal demand," Peng added. "Vendors must equip themselves to respond quickly to emerging opportunities and risks while staying focused on their long-term strategic plans. The good news is that the painful component shortages might improve sooner than expected, which will certainly help relieve cost pressures."

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: