As consumers move from 4G to 5G, Apple grows its commanding share of global smartphone revenue

According to the latest data from Counterpoint Research, revenue from smartphone sales worldwide tumbled 3% year-over-year. The decline in shipments, at 12%, was even worse but a 10% hike in the average selling price (ASP) cushioned the larger decline in shipments. Helping out with the price hike, 5G phones made up 46% of shipments in the quarter, a new record. And Counterpoint points out that 5G-enabled phones cost five times the amount charged for non-5G handsets.

Apple saw its iPhone revenue increase 10% during the third quarter while its average selling price rose 7%

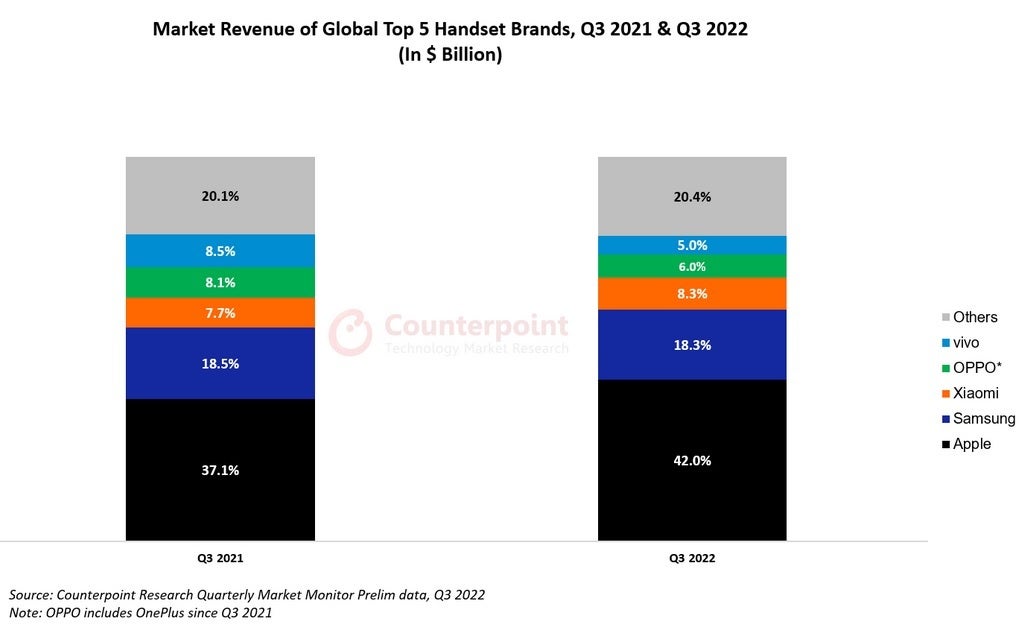

Based on revenue, Apple remained on top of the league tables for Q3 2022 accounting for 42% of global smartphone revenue from July through September. That's up from the 37.1% of global smartphone revenue Apple was responsible for during the same quarter last year. During the three months, Apple released the iPhone 14, iPhone 14 Pro, and the iPhone 14 Pro Max. The iPhone 14 Plus, with the same-sized display used on the iPhone 14 Pro Max (6.7 inches), wasn't released until the first week of October.

Apple was responsible for 42% of global smartphone revenue during the third quarter

Apple's Q3 revenue rose 10% on an annual basis while its average selling price rose 7% year-over-year during the third quarter of 2022. Counterpoint noted that a positive force on Q3 revenues, sales of the iPhone 14 Pro and iPhone 14 Pro Max got off to a great start compared to the previous year's Pro models.

During the third quarter, Samsung accounted for 18.3% of global smartphone revenue, a tiny decline from the 18.5% that the manufacturer was responsible for in 2021. Its ASP rose only 2% even though shipments of its pricey Galaxy Z Fold and Galaxy Z Flip foldables nearly doubled. Samsung's revenue during the quarter declined by 4% compared to the third quarter of 2021.

Xiaomi was third contributing 8.3% of the total amount of revenue generated by the global smartphone market in Q3. That was up from the 7.8% share it had in the same quarter last year. Thanks to strong sales in the low-to-mid-range markets, the company's global handset sales rose 4% year-over-year.

However, Xiaomi saw a nearly 1.5% decline in the revenue it collected on sales of smartphones costing more than $300. This year, Xiaomi focused on phones in the $200-$299 price range instead of the sub-$200 market. As a result, its ASP rose 14% on an annual basis to $205.

Oppo and Vivo saw their third quarters negatively impacted by China's COVID rebound

Oppo, including OnePlus (starting from Q3 2021), accounted for only 6% of global smartphone revenue during the third quarter of 2022, a decline from the 8.1% share of global smartphone revenue it was responsible for during Q3 of 2021. Oppo's handset revenue declined a sharp 27% from July through September compared with the same three months last year. Its average selling price dropped by 5%. The issue with Oppo was the COVID rebound in China which was where 40% of Oppo's total phone shipments wound up during the quarter.

Vivo had an even larger decline than Oppo as it accounted for only 5% of global smartphone revenue during Q3 compared with the 8.5% share of revenue it contributed during the same quarter in 2021. With over half of its shipments earmarked for China, the COVID outbreak helped Vivo's third-quarter revenue drop a sharp 43% year-over-year. On a sequential basis, Oppo's Q3 2022 global revenue rose 4% from the revenue reported for Q2 2022.

The "Others" group contributed 20.4% to global smartphone revenue during the third quarter of this year. That is very little changed compared to the 20.1% of global smartphone revenues that this group accounted for during the third quarter of 2021.

Counterpoint Senior Analyst Harmeet Singh Walia said, "At over $80 billion, the revenue contribution of 5G handsets reached an all-time high of 80% of global handset revenues, up from 69% in the third quarter of last year. In the same period, LTE handsets' revenue contribution fell 10% to $19 billion. This shift from 4G to 5G has been led by Apple, which alone makes up for over half of all 5G revenues as over 95% of its phones are 5G-enabled."

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: