Scams involving mobile payment apps are on the rise

Mobile payment apps are being used more and more by consumers. According to a report by the U.S. PIRG Education Fund, a 2020 survey conducted by Nerdwallet found that 79% of Americans use mobile payment apps. They were originally promoted as a way for friends to split expenses.

Consumers can get easily scammed when they use mobile payment apps

The problem with these apps is that customer service is lacking with phone numbers often not appearing and security features showing up only after there is a threat to the app's reputation. For example, the aforementioned report noted that despite complaints from privacy experts, Venmo only gave users the ability to hide their list of friends after an investigative report was able to name President Joe Biden's list of friends on Venmo including his grandchildren and other members of his family.

The number of complaints lodged against mobile payment apps continues to rise

Despite this invasion of privacy, Venmo's default position is that a subscriber's friend list is public.

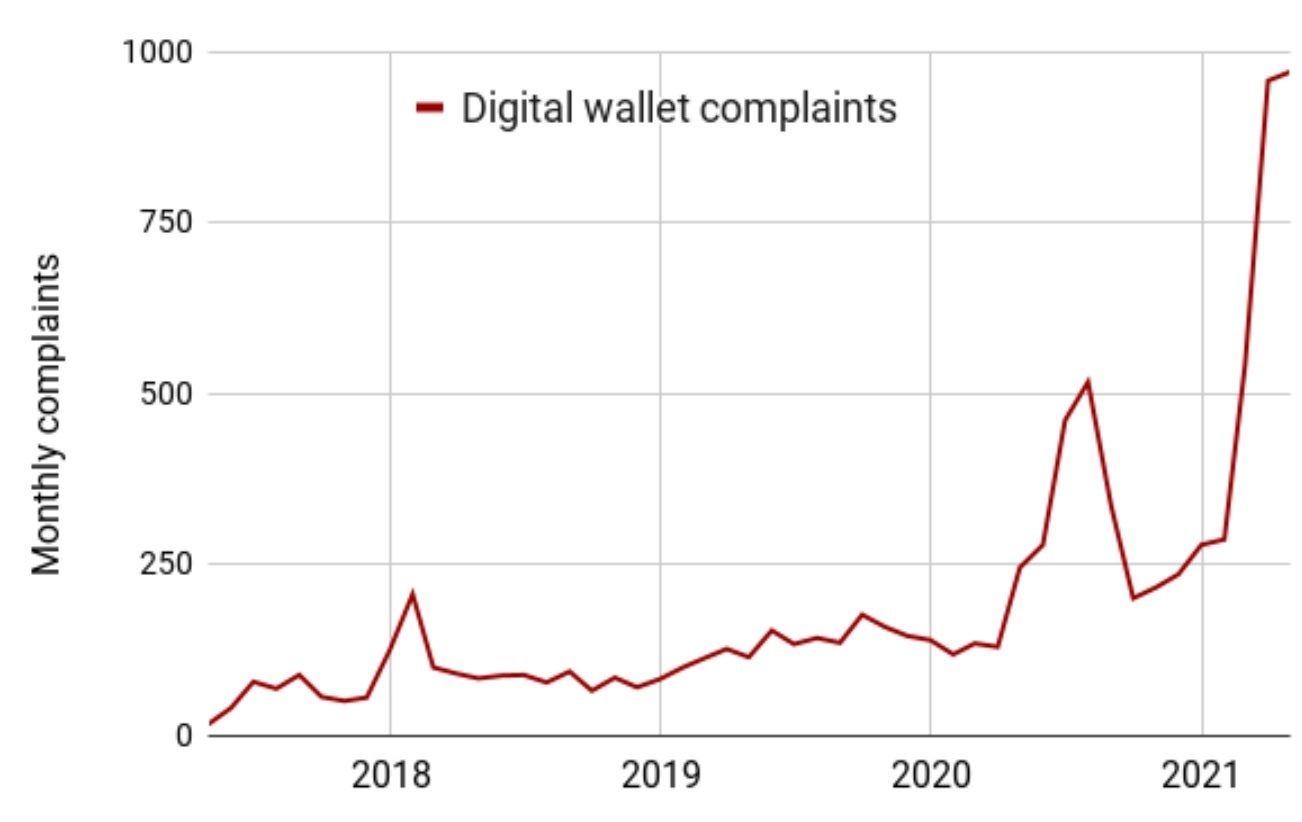

From 2017 through April of 2021, the Consumer Financial Protection Bureau (CFPB) received 9,277 complaints in the "mobile or digital wallet" category. The first year, the CFPB received 1,000 complaints about digital wallets. In the year up to April 2021, the number of digital wallet complaints was over 5,200.

In a single month, April of this year, 970 digital wallet complaints were lodged with the CFPB. That is nearly twice as many as the previous peak set in July 2020. The three most common complaints involving digital wallets include problems opening and closing accounts, dealing with frauds and scams, and issues with transactions such as unauthorized ones.

The top ten mobile payment apps with the most complaints

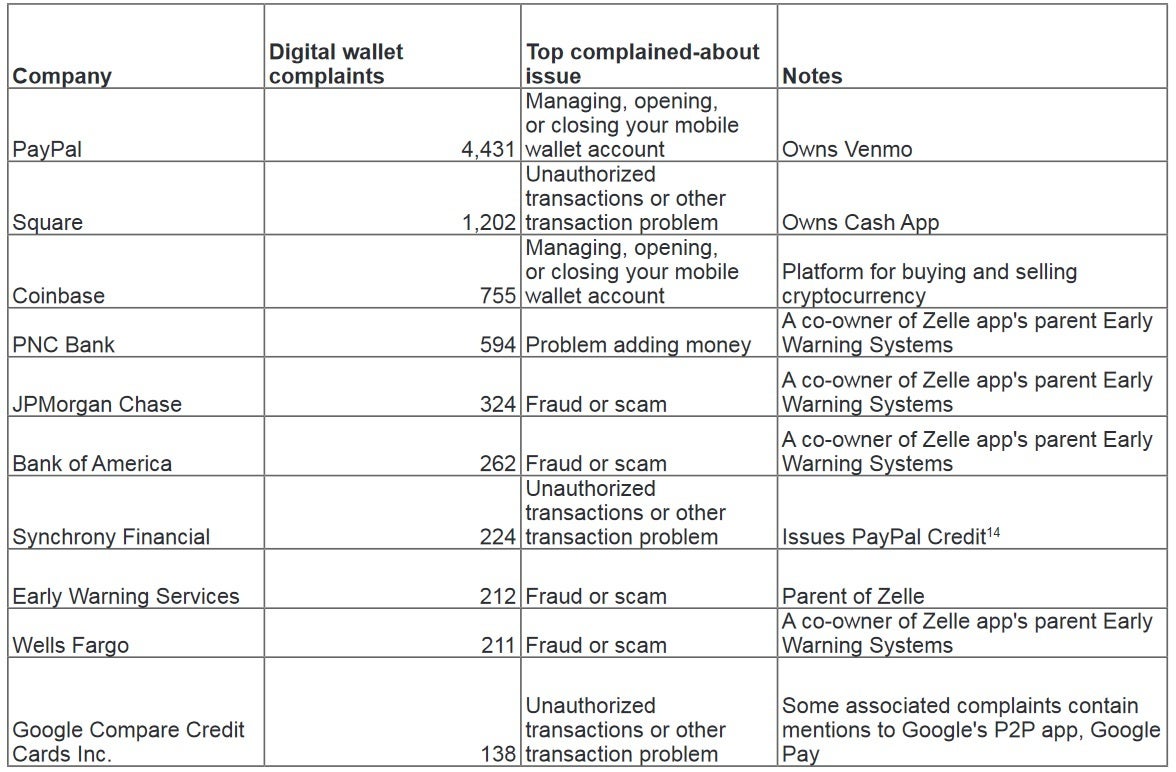

Would you like to know which mobile payment apps have the most complaints? We aim to please. With 4,431 complaints Pay Pal is number one when it comes to having the most issues and the top complaint is "Managing, opening, or closing your mobile wallet account." Square is next with 1,202 complaints mostly for "Unauthorized transactions or other transaction problem."

Wrapping up the top ten in numerical order is Coinbase (#3, 755 complaints), PNC Bank (#4, 594), JP Morgan Chase (#5, 324), Bank of America (#6, 262), Synchrony Financial (#7, 224), Early Warning Services (#8, 212), Wells Fargo (#9, 211), and Google Compare Credit Cards Inc. (#10, 138).

The mobile payment apps try to warn consumers about popular schemes by various means including Q&As such as these found on the Cash App app:

"Q: Is it safe to send money to people I don’t know? A: No! Only send payments to people who you trust. [...] Q: Can I dispute a purchase if I pay someone ahead of time? A: Never pay someone who you don’t trust for something promised to you in the future (like a puppy from an upcoming litter or a lease on a new apartment). Most payments are instant and usually cannot be cancelled."

Venmo also leaves suggestions:

"Remember: Outside of paying authorized merchants, Venmo is designed for payments between friends and people who trust each other. [...] In short:1) Be careful. Don’t use Venmo to join a pyramid, cash wheel, money circle or other get rich quick scams. 2) Don’t use Venmo to sell anything to strangers. 3) Don’t use Venmo to buy anything from anyone you don’t know and trust."

Subscribers can get ripped off by phishing schemes

Zelle also tries to get consumers on the right track by telling them that "Zelle is a fast, safe and easy way to send money to friends and family. It’s similar to cash. So you want to make sure you use it to pay only people you know and trust, like your roommate, your dad or your babysitter. Not people you don’t know, like that stranger on the internet selling suspiciously inexpensive puppies from a place you’ve never heard of."

Some mobile payment app users detailed how they get frustrated when learning that their account was closed for no reason. One said, "Venmo closed my account for no reason and will not help me with getting it back up and going." Another consumer stated, "Zelle has "no customer service department to call," and suggests that you call your own bank first.

However, Zelle does the best job in warning consumers about getting tricked by a phishing scheme: "Fraudsters spoof calls and send emails that look like they are from your bank. Beware of clicking links in emails, and never provide any information over the phone if someone stating they’re from your bank calls you. Hang up and call your bank at the phone number listed on the back of your bank-issued debit/ATM card or on the bank's official website if you must provide information over the phone."

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: