Samsung recaptures the top spot in the global smartphone market during Q1

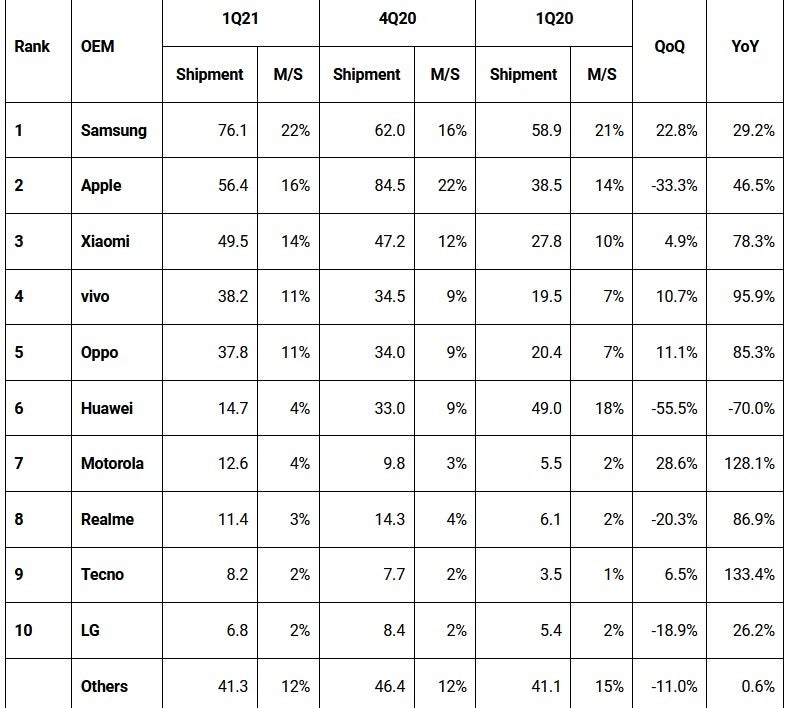

Data from Omdia indicates that during the first quarter of 2021, worldwide smartphone shipments rose a strong 28.1% compared to the number delivered during last year's first three months. The number of units shipped rose to 353 million from the 275.7 million handsets that were in transit last year. On top of the global market is Samsung with its industry leading 22% market share, rebounding from the 16% it garnered during the fourth quarter of last year, and the 21% it had during the same quarter a year ago.

Samsung returns to the top of the smartphone world after Apple's three month reign as number one

Samsung shipped 29.2% more handsets on an annual basis during Q1 2021, from 58.9 million to 76.1 million. During the quarter, Sammy started shipping its flagship Galaxy S21 series models and continued pushing its mid-range Galaxy A line which includes viable cameras and high-capacity batteries. Speaking of Samsung's latest flagship phones, if you have purchased one and want to protect the display, we have recommended what we consider to be the best screen protectors available for the Galaxy S21, Galaxy S21+ and the Galaxy S21 Ultra.

Samsung delivered a leading 76.1 million phones during the first quarter

Following Samsung, Apple was second having shipped 56.4 million iPhone units during the quarter (again, based on estimates from Omdia). That is a 46.5% year-over-year hike in the number of iPhones that Apple delivered from January through March. Yesterday, Apple announced a 65.5% gain in iPhone revenue for the quarter year-over-year.

During the three month period, Apple had a 16% slice of the smartphone pie after tallying a leading 22% during Q4 2020 when the iPhone 12 series was released. During last year's opening quarter the iPhone owned 14% of the market.

In the third position was hard-charging Xiaomi as the value-for-money manufacturer shipped 78.3% more handsets during Q1 on a year-over-year basis. The company's market share was 14% as it delivered 49.5 million phones. Vivo, which had a huge 95.9% annual gain in shipments, finished fourth after shipping 38.2 million handsets for an 11% market share.

Oppo was right behind after delivering 37.8 million phones in the period, up 85.3% from Q1 2020, and also had a market share of 11%. One must keep in mind here that U.S. restrictions on Huawei and the subsequent sale of the latter's Honor sub-unit have really led to big changes on the "leader board." Speaking of Huawei, its shipments plunged 70% on an annual basis from 49 million units to 14.7 million as the 18% market share it had same time last year has dropped to 4%.

With a 128.1% increase in phone shipments on an annual basis, Motorola is riding its new mid-range and flagship models as it seeks to complete a major comeback. The manufacturer, whose Motorola DROID helped kick-off Androidmania in 2009, had lost its way for a few years but started to gain traction with its budget and mid-rangers before returning to the flagship arena. The company shipped 12.6 million phones from January through March and owned 4% of the market during that time frame.

Realme saw shipments increase by 86.9% to 11.4 million units during Q1, giving the company a 3% share. Ninth-place Tecno had the biggest annual increase in phone deliveries as its 133.4% increase resulted in the shipment of 8.2 million handsets and a 2% share. And last on the top-ten list is LG, which recently announced its departure from the smartphone business.

LG delivered 6.8 million phones from January through March an increase of 26.2% year-over-year. LG's puny 2% market share globally shows how difficult it has been for the manufacturer to pick up any traction in the smartphone industry.

Not listed in the top ten, Honor, Huawei's former sub-unit, kicked off its brand new life as an independent phone manufacturer, by shipping 3.6 million smartphones during the first quarter. The company was valued at $15.2 billion at the time of its sale by Huawei to a consortium that includes multiple dealers such as wireless provider China Telecom and several companies backed by the state.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: