Judge will reportedly rule in favor of T-Mobile-Sprint merger tomorrow

A report in tonight's online version of The New York Times says that tomorrow, Judge Vincent Marrero of the United States District Court in Manhattan will announce that he is ruling in favor of the T-Mobile-Sprint merger. The $26.5 billion deal was announced on April 29th, 2018 and eventually was approved by the FCC and the Justice Department. Several state attorneys general sued to block the deal, afraid that the 25% reduction in major stateside carriers would lessen competition and lead to higher prices.

Since no one has read the decision yet, there is the possibility that the judge will force T-Mobile to make some more concessions in return for the approval. In after-hours trading, T-Mobile stock soared $6.22 or 7.4% to $90.75. Sprint's shares are up over 68% or $3.29 to $8.09. Sprint holders will receive .10256 of a T-Mobile share in exchange for each share of Sprint they own. The spread between the theoretical price of $9.31 and Sprint's current price has cratered to $1.22 from nearly $4 earlier today. This indicates that the "smart money" believes the deal will get done under current terms. However, just last week T-Mobile CEO John Legere said that some parts of the deal, including the price, could be amended after the merger is approved.

This iteration of the T-Mobile-Sprint merger has always been about 5G

The merger still needs to be approved by the California Public Utilities Commission (PUC) and Judge Timothy Kelly extended his Tunney Act review to the middle of this month. This act requires an independent court to review any deals made by the DOJ to make sure that they are in the public interest. When the deal was first announced, experts felt that T-Mobile and Sprint would have a hard time getting the merger past the FCC and DOJ. Both agencies were against such a deal back in 2014 and as a result, no merger was ever announced.

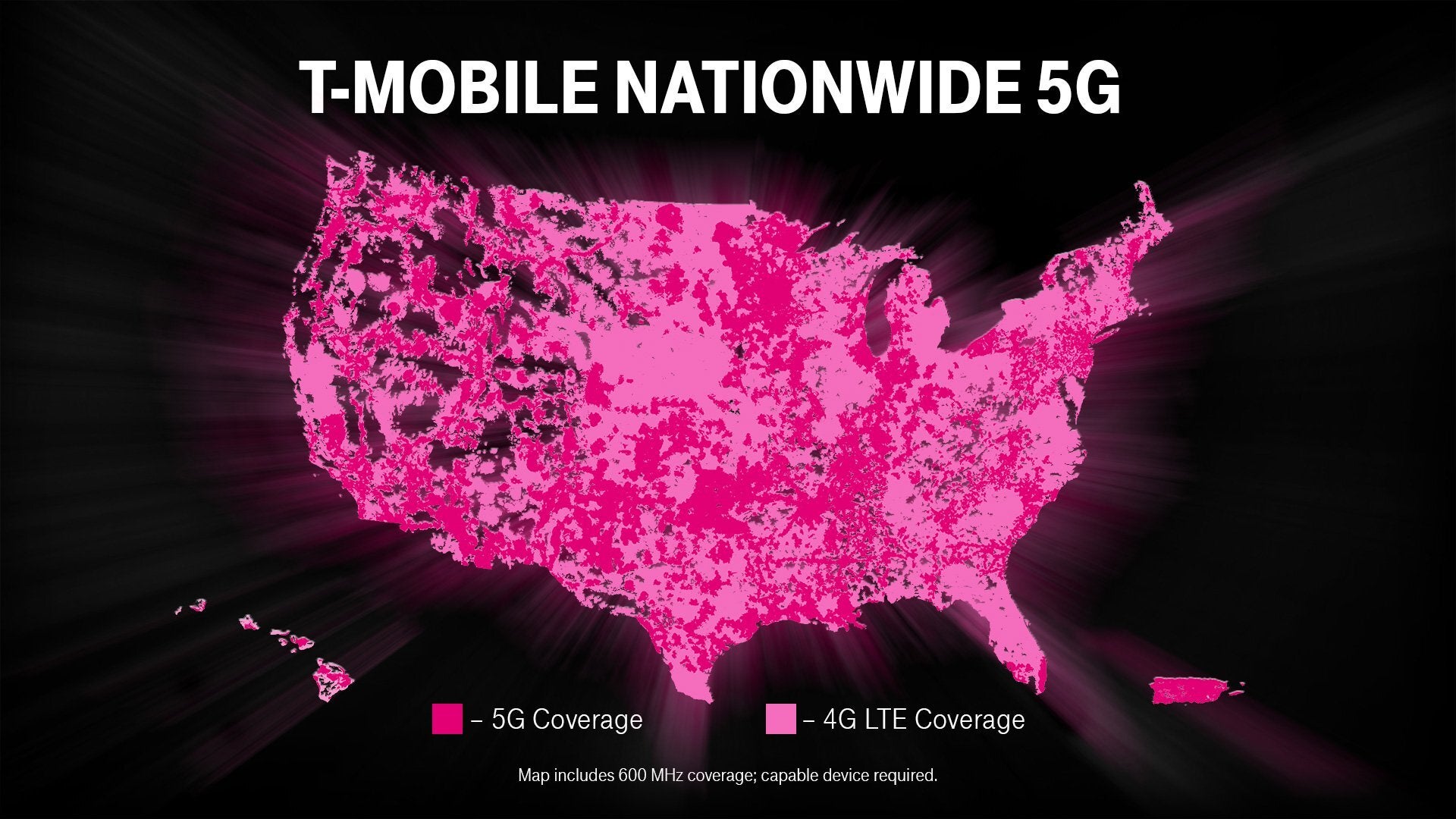

T-Mobile is the only carrier at present that offers nationwide 5G service covering over 200 million Americans

But T-Mobile made some concessions to the FCC and promised to cover certain percentages of the U.S. with 5G signals (including rural areas) and also agreed to freeze prices for three years after the merger closes. To appease the Justice Department, which was concerned about lessening competition, Sprint worked out a deal to help set up Dish Network as a new major wireless provider. In exchange for a $5 billion sum, Sprint agreed to sell the satellite television provider its prepaid businesses including Boost Mobile, 9.3 million customers, 7,500 retail offices, 400 employees, 14MHz of 800MHz spectrum and more. Dish will sign a seven-year MVNO contract allowing it to offer wireless service under its name until it is able to build out its 5G network.

Speaking about 5G, the merger has always been about the next generation of wireless connectivity. Did you ever wonder why the fastest-growing wireless carrier in the U.S. would be interested in the worst-performing of the four majors? That's because this iteration of the deal has never been about operations. T-Mobile covets Sprint's hoard of 2.5GHz mid-band spectrum. Such airwaves are hard to obtain in the U.S. and T-Mobile currently employs its low-band 600MHz airwaves to provide nationwide 5G service. It also has ultra high-speed mmWave spectrum in seven urban areas. Both 600MHz and mmWave airwaves have certain attributes. The former travels farther and penetrates structures well, but does not deliver the fastest download data speeds. On the other hand, mmWave signals can only travel short distances but do provide much faster download data speeds. Mid-band spectrum has characteristics that lie in the middle of the two extremes.

T-Mobile's Legere testified during the trial that with Sprint's mid-band spectrum, T-Mobile will have ""triple the total 5G capacity of standalone T-Mobile and Sprint combined." That will allow it to offer its services to more rural and low-income Americans while giving first responders free unlimited service with its Connecting Heroes Initiative. Without the merger, the executive says that in some markets T-Mobile will "exhaust capacity in the next two to four years."

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: