Leaked images reveal that Google is cooking up a new debit card

Partnering with Goldman Sachs, Apple launched its own credit card last year called the Apple Card. There are no fees although balances are charged interest, and users receive cash rewards daily. Now, TechCrunch obtained some leaked images that appear to show a new Google debit card. Based on these images, Google will have various bank partners including Citi and Stanford Federal Credit Union.

A Google debit card could help the company expand into consumer financial services

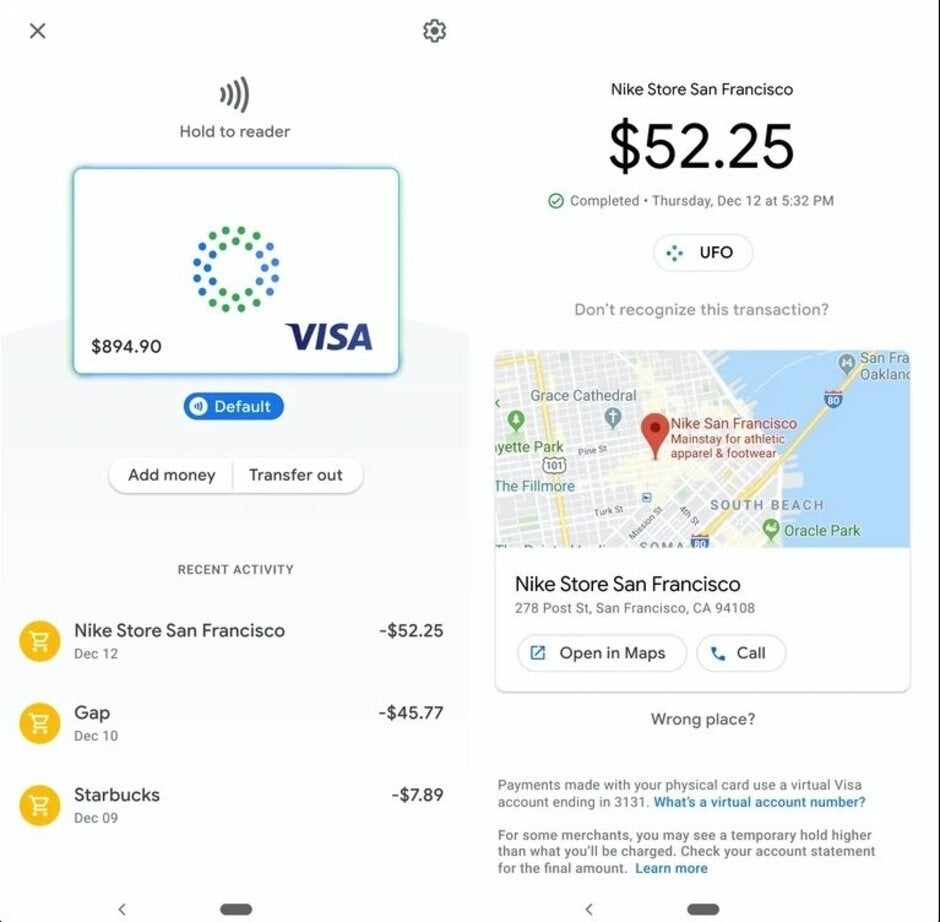

The new debit card will work with an accompanying checking account and a Google app; through the app, cardholders will be able to review their purchases, get a look at their balance, and more. A different source (other than the one that provided TechCrunch with the images) says that Google has been working on a debit card that would be the linchpin of a more ambitious Google Pay app. Currently, Google Pay users can make online and peer-to-peer payments by linking the app to a regular credit card. The app's capabilities would be enhanced with the release of the new card.

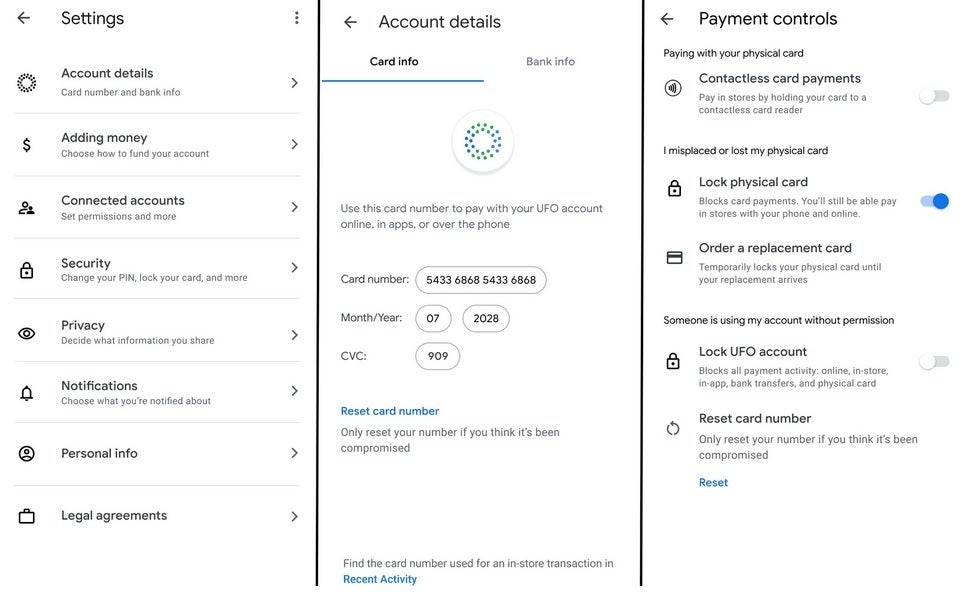

Leaked image of Google's debit card

The card could give Google entry into the world of financial services. We could very easily imagine Google offering no-fee banking and stock trading; it all fits with Google's quest to learn everything about everybody. We should point out that if Google does release a debit card, it would the second one released by the company. You might recall that back in 2013 the company introduced the Google Wallet debit card. Google shut down the card in June 2016.

A leaked image of what the card will supposedly look like shows that no account numbers appear on it. On the front will be the Google name and the name of the bank partnering with Google on this specific account. There will be a chip embedded in the debit card and it will work on the Visa network although Mastercard could also get involved. The Google Pay app will be used to transfer funds and add money to the account. A physical version of the card can be used to make payments inside stores by holding it up to a point of sale machine. A virtual version of the card that appears on a phone screen could also be placed near a point of sale machine to make a purchase; to verify each transaction, a PIN, fingerprint or facial recognition will be used. Online or in-app purchases can be made using a virtual account number.

The app will show a list of recent transactions including the name of the business the card was used at, the date and the price of transaction. If a user can't quite remember a specific merchant, the location of the store will show up on a map upon request.

Google debit cardholders will have access to all kinds of information from the Google Pay app

Because the user's account number is different from the virtual number that is used for each different transaction, if a card is lost or stolen, it can be locked and a new card ordered while the account holder continues to have access to his account via the phone or online. And if someone believes that hackers have accessed his account, the whole thing can be locked and all payments and transfers blocked.

Google debit card holders can see where on a map each transaction took place

It is important to note that the Apple Card is a credit card that offers each account holder a line of credit that he can access. What Google is talking about here is a debit card that gives holders access only to money that has previously been deposited inside an account. That doesn't mean that such a card won't be lucrative as far as Google is concerned. The financial services industry is all about generating small fees that add up over time to become large sums of money. Apple, for example, keeps .15% of the amount of each transaction paid for using Apple Pay. For every $100 transaction, Apple keeps 15 cents. That doesn't sound like much, but if you multiply it by the number of transactions that it handles every day, it becomes a solid money-making venture.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: