Apple's valuation has declined by more than $200 billion since last Thursday

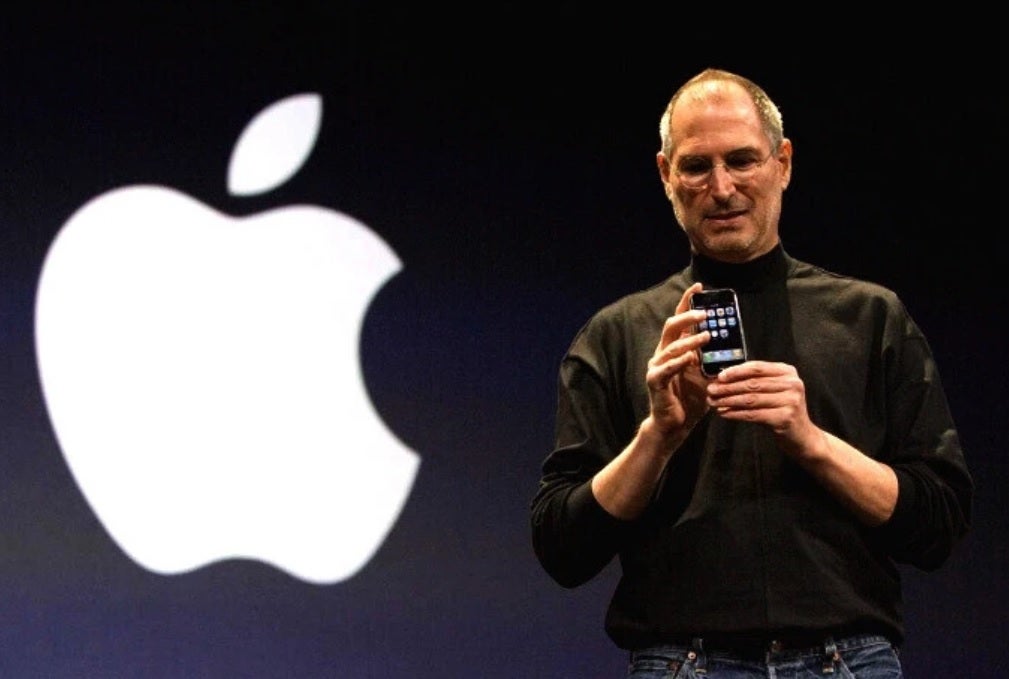

Apple's stock has been known to create wealth dating back to its IPO on December 12, 1980. Steve Jobs and Steve Wozniak instantly became millionaires on that date. What about 10% partner Ronald Wayne? He sold his stake for $800 just 12 days after Apple was formed. Apple's shares have been on an upward trajectory ever since going public with occasional sell-offs along the way. The company that the two Steves and a Ron formed back in January 1977 is now the most valuable publicly traded company in the U.S.

With the introduction of the iPhone 15 line just four and a half weeks away, you might expect Wall Street to live by one of its most well-known sayings: "Buy the rumor and sell the news." And in fact, Apple's shares recently made a 52-week high of $198.23 before losing momentum. The stock had already dropped several points heading into last Thursday's fiscal third-quarter earnings report.

Apple reported lower iPhone revenue for the period and just missed meeting Wall Street expectations.; the market responded by shaving nearly $10 off of Apple's stock price the next day. And the stock continued to decline until this morning when it rose slightly higher in afternoon trading at $179.10. The decline in the stock over the last five days has been the worst such period for Apple's shares since last November after Foxconn workers walked off the iPhone assembly line due to a Covid crackdown.

Apple's valuation has dropped over $200 billion since last Thursday and the company, which was worth more than $3 trillion, has dropped down to a market capitalization of $2.8 trillion. This doesn't mean that $200 billion has evaporated from the global economy since short sellers and buyers of put options made money on Apple's decline. But since the average investor usually doesn't short stocks or buy put options, there could be some additional headwinds on the economy.

Steve Jobs instantly became a millionaire when Apple went public in 1980

Consider this. Adjusted for the five stock splits that Apple has announced in its history, the company went public for 10 cents per share. Based on today's price, had you purchased 100 shares of Apple for $2,200 at the time of the IPO, you'd now own 22,400 shares of Apple worth over $4 million.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: