Apple Pay later will reportedly have a $1,000 limit and require your Apple ID to prevent fraud

With the announcement of iOS 16 during WWDC 2022, Apple introduced a new service, dubbed Apple Pay Later, that will come to the US in the fall. The service allows you to get a loan to buy something, basically working as a Buy Now Pay Later service (but with no interest or fees).

However, the time frame it allows for you to pay everything is six weeks, and now, The Wall Street Journal reports that it will also have a maximum loan limit per transaction: $1,000. To prevent fraud, Apple will reportedly use your Apple ID information.

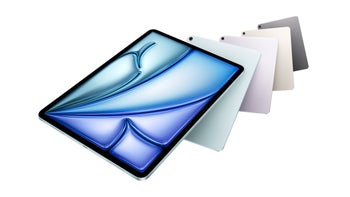

The Wall Street Journal cites 'people familiar with the matter' on the topic while listing the conditions for you to be able to use Apple Pay Later to buy something. First off, payment plans per transaction reportedly max out at $1,000. And, the amount you will be able to get will also depend on you credit score. Yes, that means you won't be able to get the latest and biggest iPad Pro (the 2021 12.9-inch iPad Pro starts at $1099) or an iPhone 13 Pro Max (starting at $1099) with Apple Pay Later.

Curiously enough, this time Apple is not using its Goldman Sachs partner to loan you money (the banking company is responsible for the Apple Card). For Apple Pay Later, Cupertino itself will act much like a bank and rely on credit reports and FICO scores to check if you will be able to get a loan. For those of you who are unaware, a FICO score is basically a number that helps lenders determine how likely you are to repay a loan.

On top of that, Cupertino will also use Apple ID data to verify your identity for Pay Later and to prevent fraud. Pretty much, Apple will factor in whatever Apple ID information it needs to determine whether or not you are likely to commit fraud using the Pay Later service.

And last but not least, you will also be required to link your debit card to the service. This means every two weeks the company will automatically charge you with the next installment until everything is paid.

As you can see, Apple is jumping head-on into the financing market with all the necessary precautions. It will be interesting to see how the service evolves over time, and whether or not Apple will be successful in this new endeavor.

It seems you won't be able to buy a 12.9-inch iPad Pro with Apple's Pay Later service

The Wall Street Journal cites 'people familiar with the matter' on the topic while listing the conditions for you to be able to use Apple Pay Later to buy something. First off, payment plans per transaction reportedly max out at $1,000. And, the amount you will be able to get will also depend on you credit score. Yes, that means you won't be able to get the latest and biggest iPad Pro (the 2021 12.9-inch iPad Pro starts at $1099) or an iPhone 13 Pro Max (starting at $1099) with Apple Pay Later.

On top of that, Cupertino will also use Apple ID data to verify your identity for Pay Later and to prevent fraud. Pretty much, Apple will factor in whatever Apple ID information it needs to determine whether or not you are likely to commit fraud using the Pay Later service.

As you can see, Apple is jumping head-on into the financing market with all the necessary precautions. It will be interesting to see how the service evolves over time, and whether or not Apple will be successful in this new endeavor.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: