Apple iPhone 11 is hot stuff in India

The second-largest smartphone market in the world is India. Because it is a developing market, consumers in the country typically buy low-to-mid-range phones or older flagships. Last year, Apple advertised "the incredible" iPhone 6s locally made in India for less than the equivalent of $250. Apple has continued building iPhone models in India including the iPhone 7, iPhone X, and iPhone XR. This helps Apple avoid an import tax that India charges and it also allows Apple to follow Indian Prime Minister Narendra Modi's "Make in India" initiative.

- iPhone 13 release date, price, features, and specs

Value for money manufacturer Xiaomi remains the top smartphone brand in India

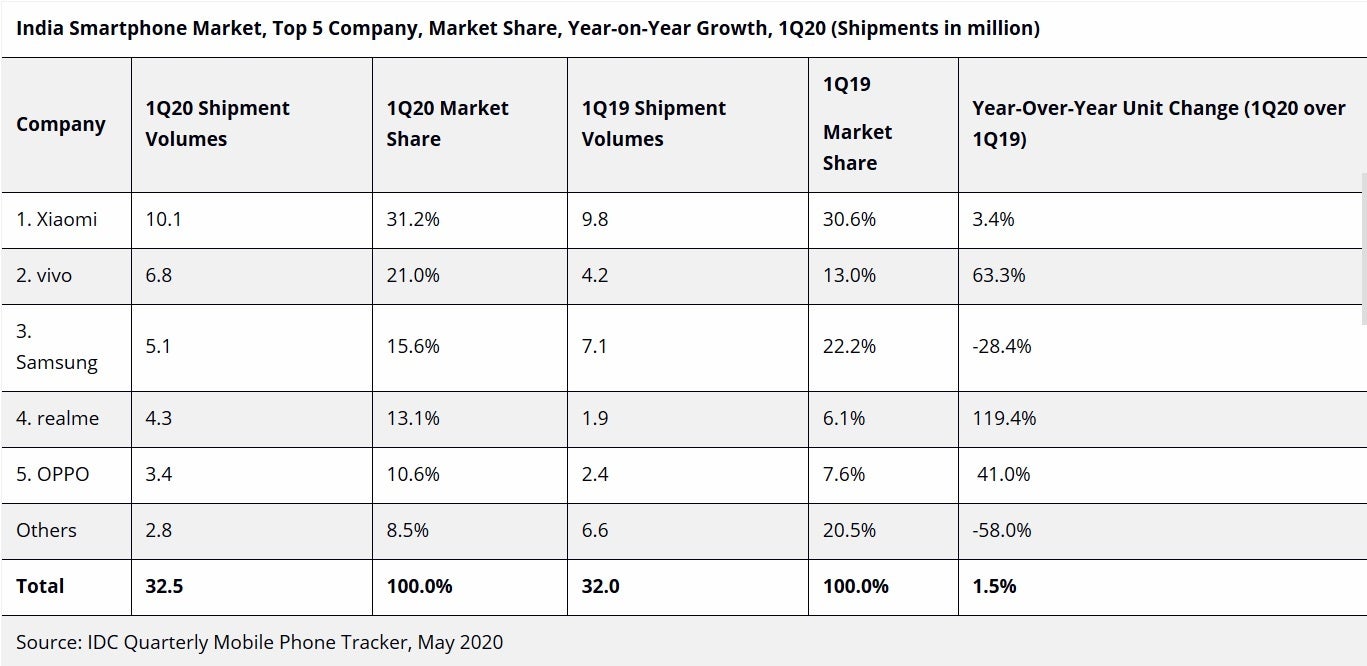

But the economic conditions in India being what they are (25% of Indians were making less than $1.25 per day last year), value for money manufacturer Xiaomi is doing very well in the country. Samsung too has hit the ball out of the park in India with its mid-range Galaxy A models. These handsets have viable cameras and better than average battery life for an affordable price. According to the latest numbers from IDC, Xiaomi is indeed the top smartphone manufacturer in India with a share of 31.2% for the first quarter. For the three months from January through March, Xiaomi delivered 10.1 million handsets up 3.4% from the 9.8 million it shipped during the same period last year.

Xiaomi, Vivo, and Samsung were the top three smartphone manufacturers in India during Q1

Late last month, we told you that by Canalys' reckoning, Vivo had overtaken Samsung to become the second most popular smartphone brand in India during the first-quarter. As it turns out, IDC confirms this as it too lists Vivo ahead of Samsung during Q1. Vivo got here by increasing its smartphone shipments by a whopping 63.3% for the first three months of the year. The company rose its first quarter shipments in India from 4.2 million to 6.8 million and had a 21% slice of India's smartphone pie during the period. Also helping Vivo leapfrog Samsung was the latter's 28.4% year-over-year decline in Indian smartphone shipments during the quarter. Samsung shipped 5.1 million phones giving the manufacturer a market share of 15.6%.

The largest year-over-year improvement during the first quarter belonged to China's realme. With a 119.4% rise in shipments, the company shipped 4.3 million smartphones in India, up from the previous year's 1.9 million. For the first quarter, realme had a 13.1% share in the country. Rounding out the top five was Oppo. The latter delivered 3.4 million handsets in India during this year's first quarter, 41% more phones than the number it shipped in last year's Q1.

The Average Selling Price in the Indian smartphone market was $171 USD from January through March, up 5.5% on an annual basis. Smartphones priced at less than $200 made up 76% of shipments in the quarter. In the mid-range sector that includes phones priced between $200-$299, shipments rose 87%; this segment doubled its market share to 18.2% and was led by handsets like the Samsung Galaxy A51, Vivo S1 Pro, and Redmi Note 8 Pro. Apple was the leader in the premium segment of the market ($500 USD and higher) with a 62.7% share followed by Samsung and OnePlus. The iPhone 11 had a commanding 68% market share in the tier containing phones priced between $700-$999 USD.

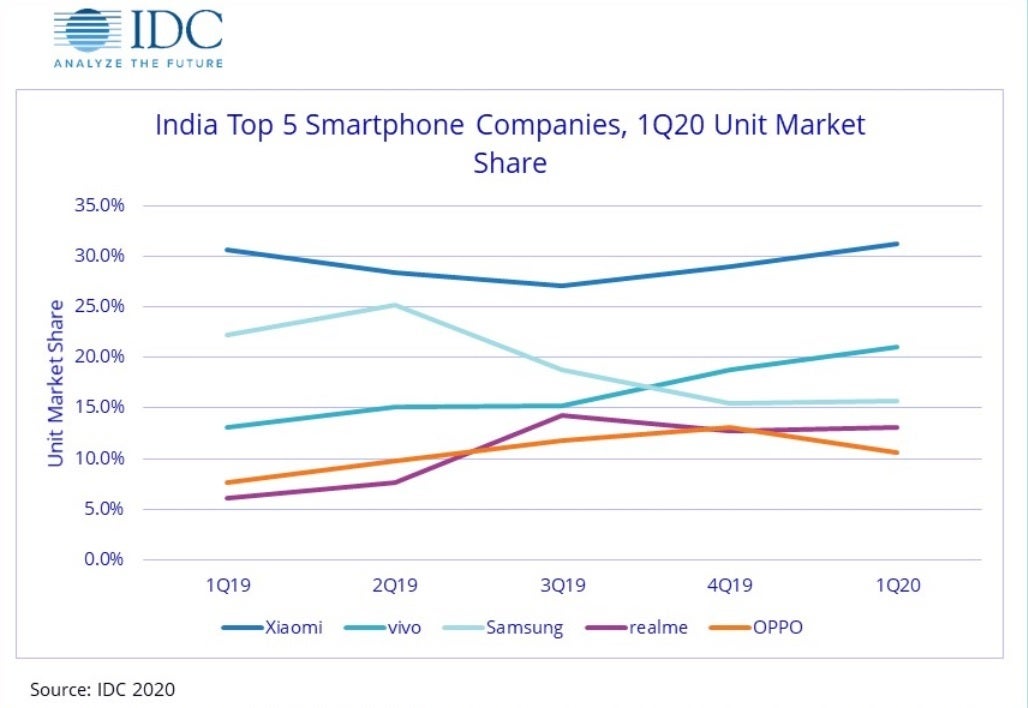

Tracking the smartphone industry in India over the last 12 months

Overall 32.5 million smartphones were shipped in India during the first quarter. That is a gain of 500,000 units or 1.5% from last year's first quarter. Feature phones made up 41.2% of India's overall handset market during the first quarter, but this segment is declining in importance. The 22.8 million feature phones shipped in India during the three months was a 29.4% year-over-year decline. Of the top three global markets for smartphones, India was the only one to show year-over-year growth in Q1. India's 1.5% growth compares to a 20.3% decline in China and a 16% drop in U.S. smartphone shipments.

Navkendar Singh, Research Director, Client Devices & IPDS, IDC India forecasts tough times ahead for the smartphone market thanks to the pandemic. "COVID-19 will have a substantial impact on the Indian mobile phone market in 2020, with potential supply chain disruptions and slower-than-expected consumer demand for the next few quarters. IDC expects the India mobile phone market to follow a U-shaped recovery from 3Q20 onwards." Singh adds that "The pent-up demand from the first half of the year will gradually shift to the second half, rolling over to 2021 as well. A revival in consumer demand is expected around the festive quarter of 4Q20; with amplified marketing and promotional activities. In these challenging times, brands must relook at their marketing investments, supporting offline channels with hyperlocal delivery initiatives in key cities and try to make up for the lost ground in the all-important second half of year, under the assumption that normalcy will gradually resume Q3 onwards."

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: