Analyst says Apple should spend more than $170 billion and buy this company now

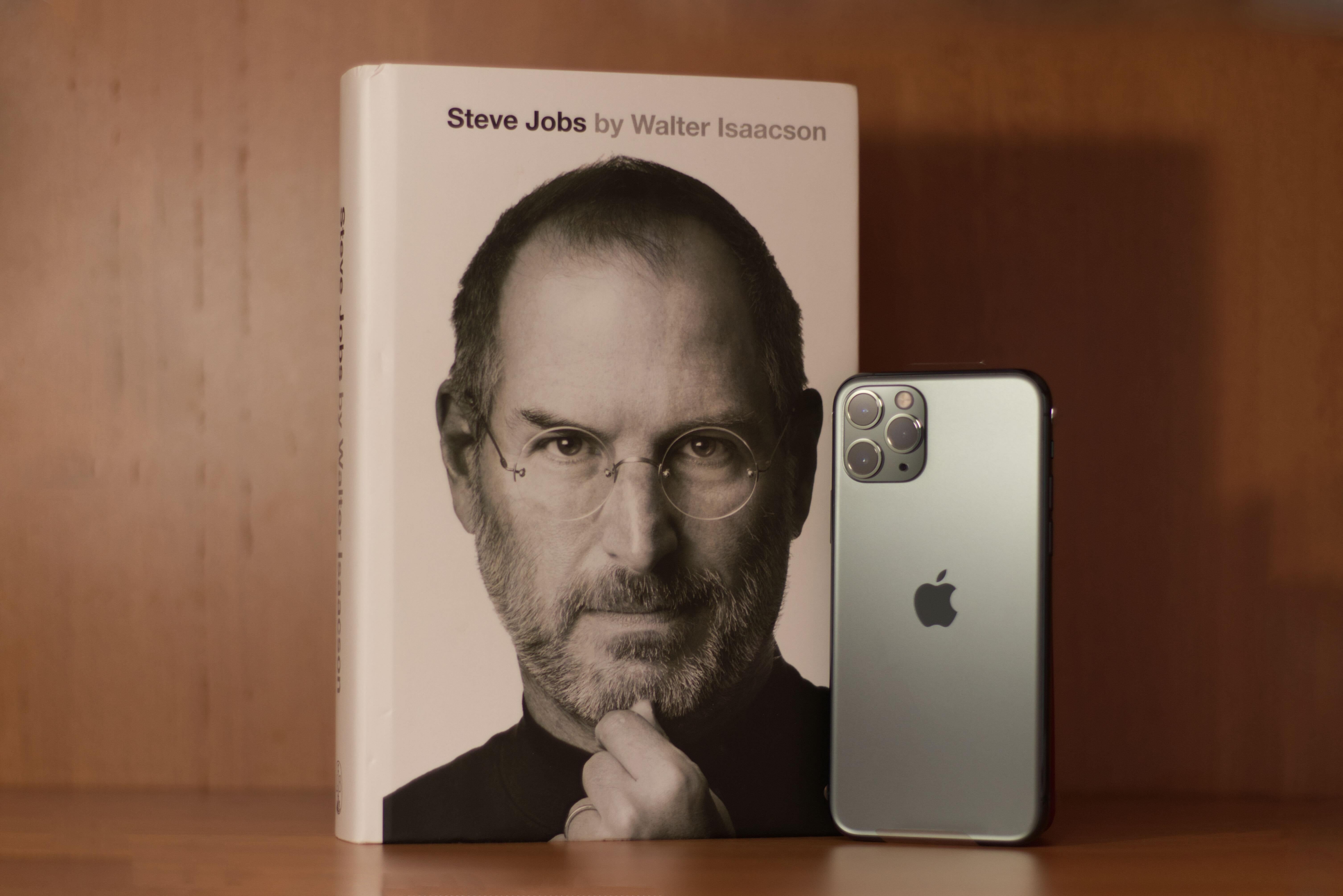

Twice before we have examined the possibility of Apple purchasing Disney. There is no question that both companies share some things in common and for some time, the late Steve Jobs and his trust were the largest individual shareholders in the entertainment giant. But right off the bat, we do know that such a deal is not really Apple's thing. The company prefers to buy smaller outfits with a specialized product or technology that can be used on an Apple device within 12 to 24 months.

Analyst says that buying Disney would give Apple top-notch content and make it a world-class streamer

With Disney valued at $171.5 billion, even a small premium of 30% would value such an acquisition at close to $223 billion. Apple would have to offer some debt, borrow from the bank, or use its own shares to make such a purchase. And the latter would force Apple to issue many more new shares defeating the purpose of the stock buybacks it has been doing. Consider that the largest acquisition ever made by Apple was its 2014 purchase of Beats Audio, a transaction that cost it only $3 billion.

Apple co-founder Steve Jobs was once the largest individual Disney stockholder

But this line of thinking hasn't stopped Rosenblatt Securities Vice President Bernie McTernan from telling clients that now is the time for Apple to pull the trigger on such a deal. According to Yahoo Finance, McTernan noted that even before the coronavirus hit, there were rumors about Apple making a major acquisition. Disney would help provide Apple with content, strong cash flow, and a combined Disney+/Apple TV+ would certainly do much better than Apple TV+ alone. Putting an Apple Store inside some of Disney's high traffic theme parks is sure to be beneficial for Apple's top-line growth.

The analyst says that while Disney's theme parks will suffer over the next two years, his forecasts for 2022 and beyond are unchanged indicating that strong growth is ahead. And with Disney's streaming business off to a strong start, the huge decline in the company's stock makes this a great opportunity for Apple. The analyst notes that over the last three weeks, Apple's shares have outperformed Disney's by 10%, and he also points out that Apple has at least $107 billion of cash on hand.

Apple co-founder Steve Jobs became Disney's largest individual stockholder after Jobs became an investor in Pixar. The company, spun off from Lucasfilm, needed an investor and Jobs paid $5 million for the rights to the technology and made a $5 million investment in Pixar. The executive had been fired from Apple by his own hand-picked successor John Sculley and was founder and CEO of NeXT (Apple eventually purchased NeXT bringing Jobs back into the fold). Jobs became Chairman and CEO of Pixar and received a ton of Disney stock when the latter purchased Pixar for $7.4 billion in an all-stock deal in 2006. The deal gave Jobs 7% ownership of the House of Mouse valued at $3.9 billion.

Ironically, when Disney purchased Lucasfilm in 2012, sales of Motorola DROID branded handsets actually benefited Steve Jobs' estate. That's because Verizon had made a deal with Lucasfilm to use the Droid name on its Android phones, and Disney was then reaping the rewards of that transaction. And at the time, Jobs' estate was still considered the largest stockholder in Disney.

Former Disney CEO Bob Iger, who just quit as CEO of Disney last month, is quoted in his book as saying, "I believe that if Steve (Jobs) were still alive, we would have combined our companies or at least seriously discussed the possibilities." McTernan says that Disney+ gives the entertainment giant an ecosystem that it can share with the public for the first time. He feels that bundling the Disney ecosystem with the iOS ecosystem "could create some interesting synergies." Buying Disney would also give Apple ownership of ABC and ESPN. But we wouldn't count on such a deal being proposed.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: