T-Mobile introduces its no-fee banking service

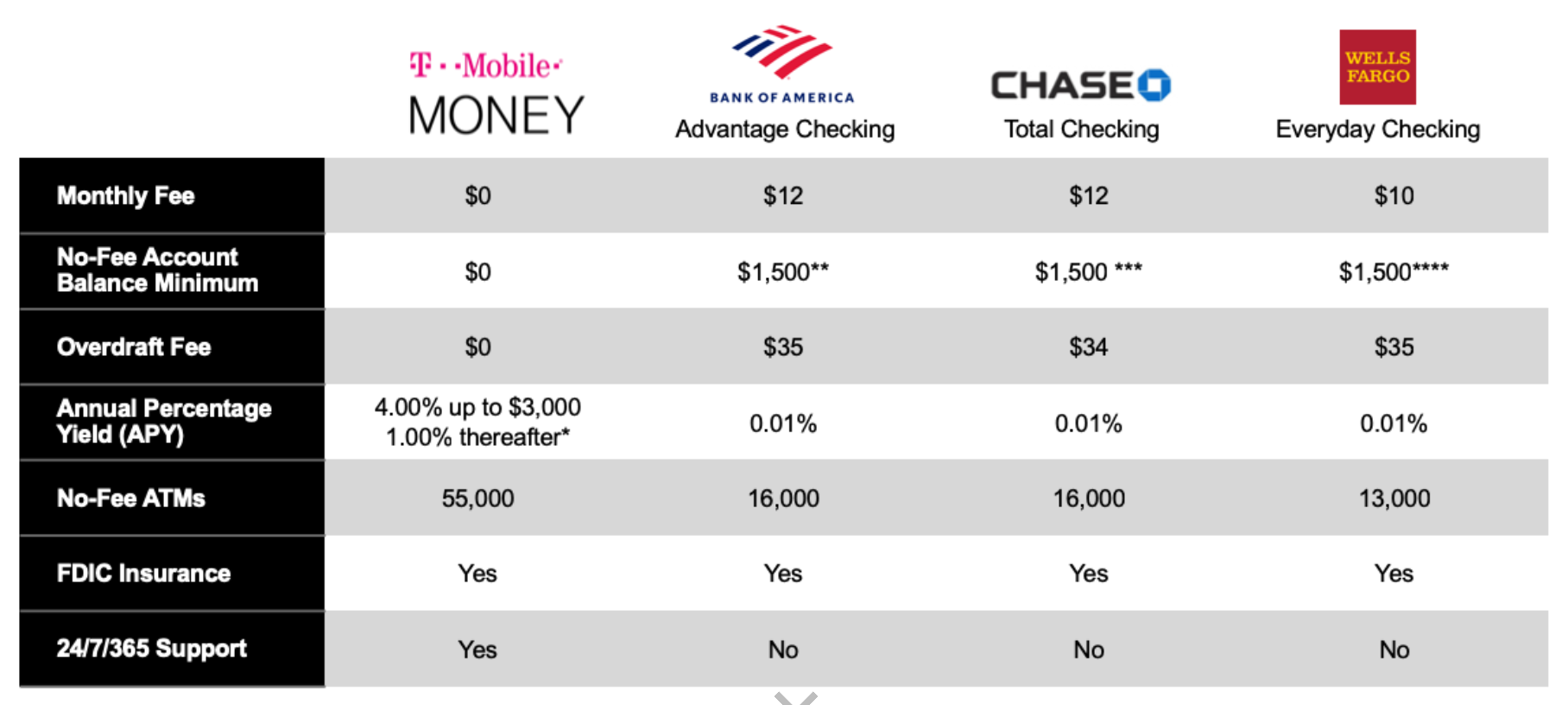

T-Mobile has become the fastest growing of the four major U.S. wireless providers by removing consumer pain points. Today, the company is doing the same for banking customers. T-Mobile today has introduced its new banking service, T-Mobile Money. As you might imagine, the carrier is offering banking services using a mobile-first platform. No minimum balance is required, and eligible T-Mobile postpaid customers will earn as much as a 4% Annual Percentage Yield on balances up to $3,000. That interest is 50 times higher than the interest paid on the average U.S. checking account, but it requires a $200 deposit from a T-Mobile customer every month. T-Mobile Money members who aren't customers of the wireless carrier will earn a 1% APY.

"Traditional banks aren’t mobile-first, and they’re definitely not customer-first. As more and more people use their smartphones to manage money, we saw an opportunity to address another customer pain point. You work hard for your money … you should keep it … and with T-Mobile MONEY, you can!"-John Legere, CEO T-Mobile

T-Mobile Money carries FDIC insurance up to $250,000. To sign up, you can download the T-Mobile Money app from the Apple App Store or Google Play Store, or by visiting the website. Customers will be able to handle transactions such as depositing checks, paying bills, arranging direct deposits, making money transfers and more. The app requires that the customer verify his or her identity by using a fingerprint scanner or Face ID.

T-Mobile introduces T-Mobile Money

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: