T-Mobile subscriber narrowly escapes SIM swap fraud

We may earn a commission if you make a purchase from the links on this page.

Last month we told you about a woman who had $17,000 swiped from her bank account as the victim of a SIM swap. In that case, a thief went into a Verizon store and gave the rep the woman's phone number as his own, asked for a new SIM card, and when he received it he put it into the SIM slot on his phone shutting off the woman's service. This allowed the thief to rummage through the victim's apps, change passwords at will, and swipe $17,000 from her bank account.

SIM swaps often require a crooked rep to get involved in the crime

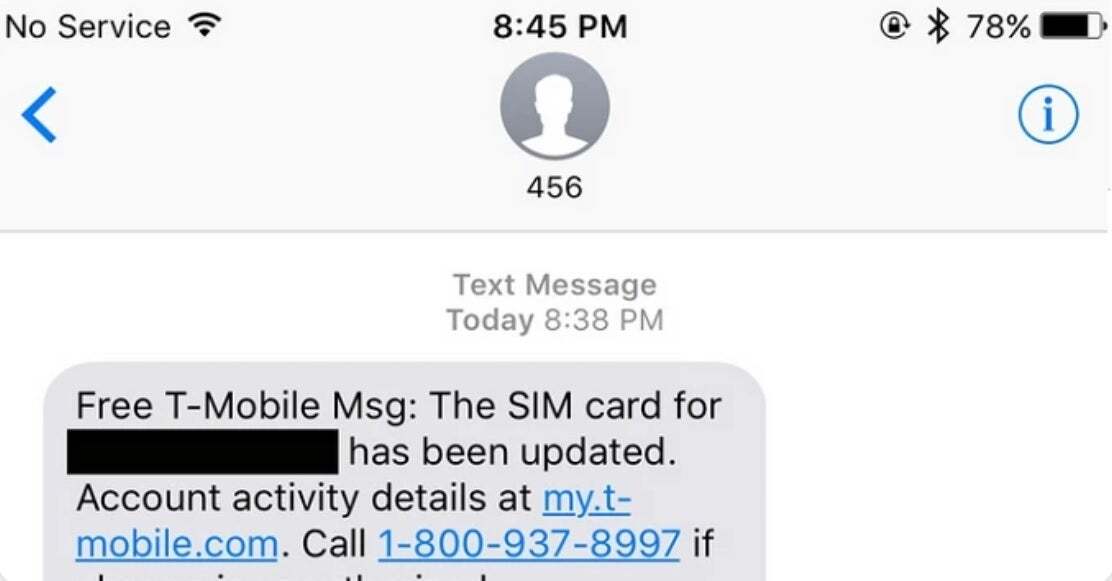

Something similar happened to a T-Mobile customer who posted his story on Reddit and perhaps by reading it, you'll know what to do should this happen to you. The T-Mobile subscriber was at home when he noticed that he had received an email from the carrier notifying him that a SIM change on his number had been completed even though he had never requested a SIM change. He quickly discovered that the ESIM on his iPhone was no longer active.

If you receive a text like this but didn't request a new SIM card, call your carrier immediately

Since time was of the essence, the man quickly got on the phone with T-Mobile although it took an hour to explain to the rep what was going on. T-Mobile was able to tell the worried consumer exactly what had occurred. Someone walked into a physical T-Mobile store about 15 minutes away from where the victim was living and claiming to be the victim, he requested a new SIM card which was placed into the thief's phone.

While on the phone with T-Mobile, the victim started getting fraud alerts from his bank which blocked pricey purchases of luxury items from department stores. The thief had changed the security settings on the T-Mobile customer's banking app and nearly got away with making several purchases valued at over $10,000. When the T-Mobile customer tried to change the SIM on his phone, the thief got a text message asking if he was trying to change his SIM and he tapped on "No" which meant that the bad guy continued to have control of the victim's accounts.

The only way that the T-Mobile customer could get back control was to visit a T-Mobile store and have an employee change the SIM without sending the criminal a verification text. Yes, this is scary but part of the problem is that these scams often require an insider working for the carrier to help make the SIM swap go smoothly. These employees do not make enough money not to be motivated by cash to put through an illegal SIM swap.

This is what the carriers need to do to make SIM swaps tougher for thieves to complete

You might ask why T-Mobile didn't send the customer a text message asking him to verify the SIM swap when it originally happened. This could have shut down the whole scam in seconds. There are two answers. One, if there is an insider working at the store, the SIM swap can be put through without generating a text. And secondly, it is T-Mobile's policy not to send a text if the SIM swap is done inside one of its stores.

However, in-store SIM swaps need to generate a text BEFORE the change is made. Actually, any SIM swap should generate a text that requires an affirmative response from the device owner before any change is made. This action needs to be taken by ALL carriers immediately or else we are going to hear even more stories about their customers getting ripped off, having their bank accounts drained, and being responsible for expensive purchases that they did not make.

Surely the carriers do not want to hear about their subscribers getting ripped off. And since they can't seem to find out which reps are being paid off, this is the least they can do. In the case, the T-Mobile subscribers was lucky that his bank caught the fraudulent purchases before the transactions were completed.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: