Top secret internal T-Mobile documents leak revealing plans to merge with Sprint and Comcast

So let's say T-Mobile does merge with Sprint and the carrier's current CEO John Legere leaves triumphantly next May. Is that the end of the T-Mobile story? Not according to confidential internal T-Mobile documents (via The Verge) created by third-party consultants McKinsey & Co. in December 2015 at the request of T-Mobile board member Thorsten Langheim. The report was presented to T-Mobile executives and executives of its parent company Deutsche Telekom. T-Mobile tried to get the documents excluded from the current non-jury trial because they contain comments written by third-party consultants McKinsey & Co (and might not have expressed the thoughts of T-Mobile itself). Some of McKinsey's comments might cast doubt on Dish Network's ability to compete as a major U.S. wireless operator while relying on an MVNO agreement with T-Mobile.

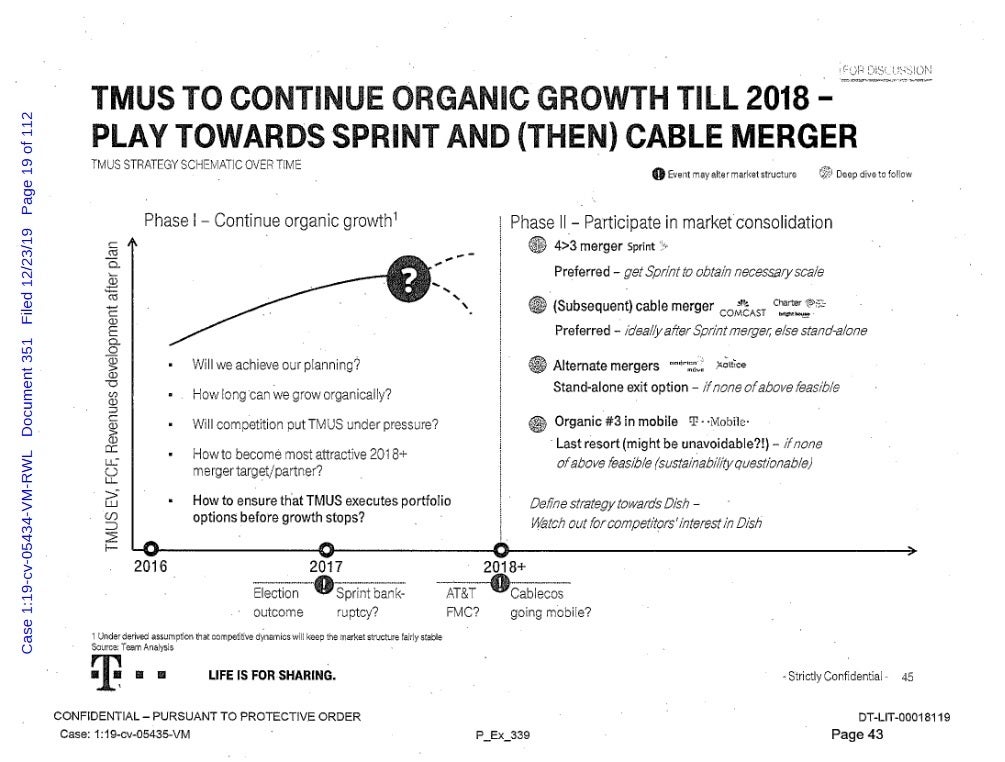

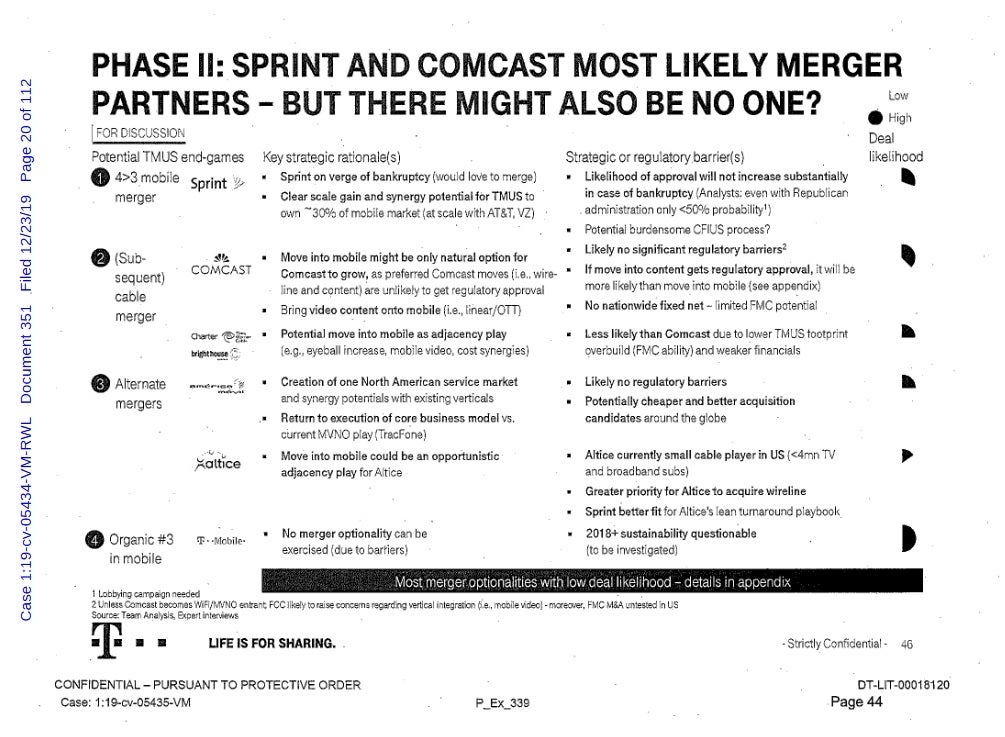

The documents reveal that at the time, the consultants saw organic growth for T-Mobile until 2018; McKinsey suggested a plan that included a merger with Sprint followed by another acquisition with a player in the cable industry. During his testimony last week, Legere (wearing a suit and tie!) said that T-Mobile considered purchasing Dish Network back in 2015. However, the documents give various reasons why Comcast should be T-Mobile's first choice for a follow-up acquisition.

T-Mobile's confidential document suggested that a merger with Sprint be followed up with an acquisition of Comcast

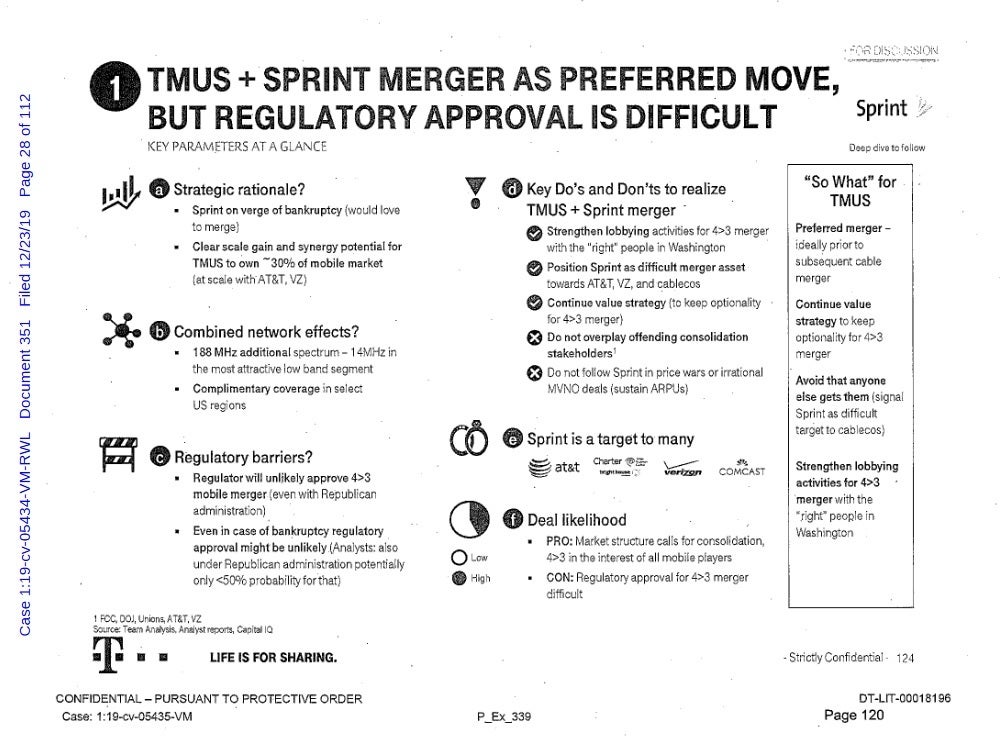

Interestingly, the rationale given by the consultants for merging with Sprint in 2015 did not mention 5G or the necessity of obtaining Sprint's mid-band spectrum. Remember, this document was prepared two years before T-Mobile spent nearly $8 billion to purchase 31MHz of 600MHz low-band spectrum in an FCC auction. Instead, the top-secret document notes that Sprint, on the verge of bankruptcy, would likely welcome a merger and that a deal would give T-Mobile 30% of the U.S. market, nearly equal at the time to the share owned by Verizon and AT&T. McKinsey put the likelihood of a T-Mobile-Sprint merger receiving regulatory approval at less than 50%, even if a Republican administration took control in 2016 (which of course, did occur). Unlike the acquisition of Sprint, a subsequent merger with Comcast wouldn't face any regulatory issues according to the document.

Confidential internal T-Mobile documents revealed a possible growth scenario involving the acquisitions of Sprint and Comcast

McKinsey said that the best game plan for T-Mobile at the time was to continue the Un-carrier growth strategy, bid in FCC auctions for spectrum (which is exactly what occurred), lobby for the merger with Sprint in Washington D.C., and signal interest in both Sprint and the subsequent deal with Comcast or another cable firm. The internal document states that as far as T-Mobile is concerned the merger with Sprint should be the "preferred move.

Odds of regulatory approval for a T-Mobile -Sprint merger was seen as less than 50%

We have to give McKinsey some props for some of its forecasts. It called for T-Mobile to be a strong third major carrier by 2019, which it most certainly is. But the predicted 76 million subscribers for 2019 has been surpassed with the wireless operator counting over 84 million customers at the end of the 2019 third quarter.

Back in 2015, Sprint was considered a possible target for several firms including Verizon and AT&T

The $26.5 billion merger was announced on April 29th, 2018 and has been approved by the FCC and the Justice Department. All that remains is a favorable resolution to the lawsuit filed by 14 attorneys general of 13 states and Washington D.C. The plaintiffs seek to block the merger which they call anti-competitive and believe its approval will lead to higher prices. If the merger goes through, it will be interesting to see if T-Mobile goes ahead with the road map presented by McKinsey and makes a play for a cable company down the road.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: