Some T-Mobile customers will be losing a percentage of their savings with this change by Apple

The 3 percent Daily Cash rate on Apple Pay T-Mobile payments ends July 1, 2025, dropping the reward to 2 percent for Apple Card users.

Image credit — AI generated

A recent post on Reddit contained an important PSA for T-Mobile customers who have been taking advantage of the three percent cash back discount on their monthly bill by paying with Apple Card and Apple Pay. According to Apple support documents, the higher Daily Cash rate will vanish on July 1, 2025, sliding to the standard two percent. That ends almost six years of extra savings for anyone on T-Mobile's network.

What changes on July 1

Apple has already updated its terms to reflect the new rate, and some T-Mobile customers have begun receiving emails reminding them of the upcoming change. If you rely on the perk, you have a narrow window to squeeze in one last boost. Reddit users report prepaying two or three billing cycles in advance so the larger reward posts before the deadline. Keep in mind that Daily Cash shows up instantly in your Apple Cash balance, so you will see the difference right away.

Notices are being sent reminding customers of the upcoming change in savings. | Image credit — r/Jonathan7877 on Reddit

How much the extra percent was worth

At three percent, for example, a single line on an old $120 Magenta Max plan earned about 43 dollars in Daily Cash per year. A family of four on a $200 plan pocketed close to 72 dollars. Dropping to two percent trims those figures to roughly $29 and $48. The math is not life changing, but it helped offset rising service fees and device payments.What stays the same with Apple Card

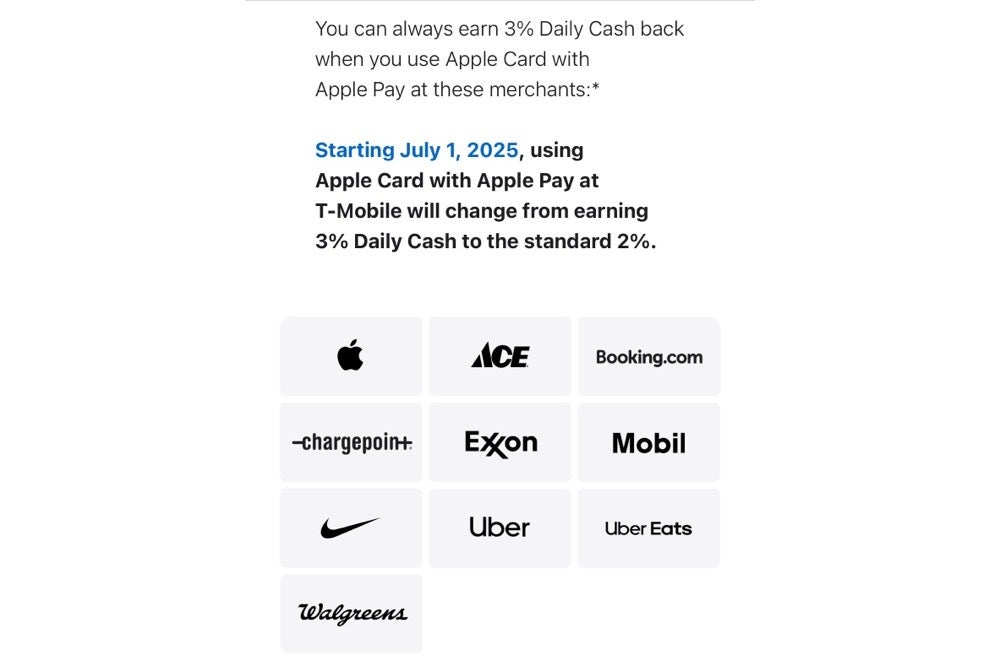

The three percent tier is still safe at Apple retail stores, the App Store, Uber and Uber Eats, Nike, Walgreens, and a handful of other long-time partners. Any purchase made with Apple Pay that falls outside that short list returns 2 percent. Swiping the physical titanium card continues to yield one percent. Apple Savings, introduced in 2023, keeps earning interest on unspent Daily Cash, and nothing about the July change alters that feature.Losing one percent on a recurring bill stings more than it sounds, especially for households juggling multiple lines. Apple Card still offers a friction-free way to collect immediate cash back, but the downgrade makes the card less compelling for people whose largest Apple Pay transaction was their T-Mobile invoice.

If you value convenience over squeezing every cent from rewards programs, Apple Card remains a tidy all-in-one solution. More rate-focused users, however, may want to explore other cards or watch for rumors that T-Mobile is planning its own co-branded option with Capital One later this year.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: