Apple could become the new darling brand for flagship buyers in China

The global smartphone market is recovering at a much better rate than previously expected, reports Pulse, based on estimates from research firm Strategy Analytics.

The company says it's now expecting smartphone sales to fall 11 percent to 1.26 billion units this year, which is a more positive outlook when compared to the previous prediction of a 15.6 percent decline.

Samsung's smartphone sales expected to reach 2019 levels next year

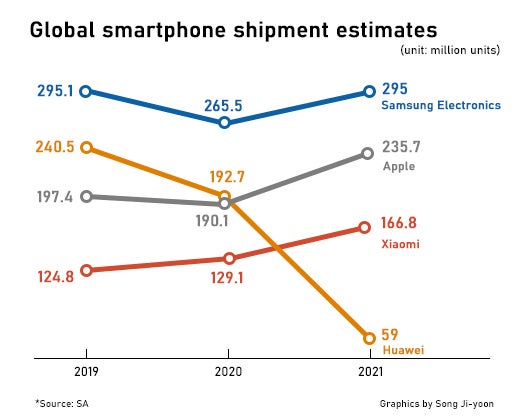

The upward trend means nothing for Huawei, which is projected to see its shipments decline. Before the US clampdown, Huawei was all set to become the number one smartphone seller in the world. It briefly met its goal in Q1, but Samsung reclaimed the crown in Q2 2020. Per the new report, Samsung is not going to give that spot away anytime soon.

The chaebol is expected to ship 265 million units this year, which will earn it a market share of 21 percent, slightly up from last year. Apple will likely come second with sales of 190 million units, which translates into a market share of 15.3 percent, an increase of 1.3 percent when compared to the same period last year.

Although Huawei is expected to lose 4.3 percent of its share to rivals, it is still expected to emerge as the third-largest vendor this year.

By the end of 2021, Samsung's sales are expected to rise to 295 million units. This is roughly the number of phones it shipped last year. The sales are expected to get a boost not just from Huawei's misfortunes, but also the popularity of foldable phones, 5G upgrades, and economic recovery.

Now that there seems to be no viable way for Huawei to procure chips, it could dramatically scale down operations or exit the smartphone industry altogether. Since Apple is more popular than Samsung in China, which barely has any presence in the country, it could benefit more than the South Korean giant.

Strategy Analytics also believes that Apple and Samsung will cater to demand for flagship smartphones in China in the future, and domestic brands like Vivo, Oppo, and Xiaomi will be the brands of choice for entry-level and mid-tier phones.

The iPhone 11 has proven to be immensely popular in China and since the fate of Huawei's 2021 flagships seems uncertain, we can only assume that the iPhone 12 would attract even more demand.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: