Samsung execs accused of doctoring 5nm chip yield results to hide stolen funds

On the heels of a report claiming that Qualcomm is so upset about the low 35% yield achieved by Samsung Foundry's 4nm process node that it dumped Sammy for TSMC, another alarming report has surfaced. According to InfoStockDaily (via wccftech), Samsung is investigating the possibility that fraud occurred inside the company's foundry business.

Unnamed Samsung Foundry executives are being accused in the Korean media of fabricating the yield rate data achieved by Samsung Foundry for its 4nm and 5nm process node. This data, expressed as a percentage, shows how many chips in a wafer meet quality testing standards. Yesterday's report indicated that the yield for Samsung Foundry's 4nm process node was a poor 35% compared to the 70% yield achieved by rival TSMC.

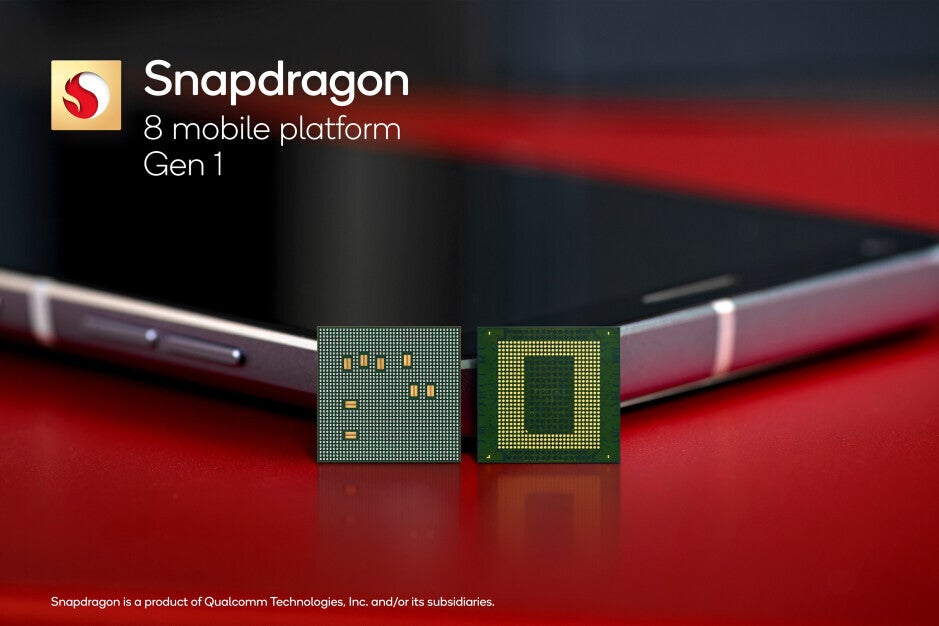

Samsung's poor 4nm yield has reportedly cost it the business of building the next-generation Snapdragon AP

The poor yield was mentioned in a report as the reason why Qualcomm supposedly replaced Samsung Foundry with TSMC for the production of next year's Snapdragon 8 Gen 2 Application Processor. The new report claims that the 4nm and 5nm yields were faked by Samsung Foundry executives to make it seem that everything was going well with the division.

Samsung's yield on production of the Snapdragon 8 Gen 1 SoC was only 35% according to reports

Samsung officials are trying to track down funds that were supposed to be used to improve the yield at Samsung Foundry. Reports of the poor yields and missing funds at Samsung Foundry come at a poor time for Samsung since it and TSMC are the only two foundries in the world able of churning out chips at a process node of under 5nm. Both are working hard to become the first foundry able to ship 3nm components.

TSMC already has plenty of business as its customer list includes heavyweights such as Apple, MediaTek, Nvidia, and more. TSMC is believed to be running into yield problems of its own at the 3nm process node although volume production is only supposed to be reached later this year.

The lower the process node, the higher the number of transistors that can fit in a chip. That is key to the performance of the component since the more transistors used, the more powerful and energy-efficient a chip is.

Samsung will investigate what has turned into a theft of company funds

A Samsung official familiar with the situation said in a quote translated by Machine Learning, "Since the delivered quantities is struggled to meet the recent foundry order volume, we have doubts about the yield of the non-memory process, which has was known to be achieved."

The official added, "The management consulting investigates the claims on the yield of a semiconductor foundry by former and current DS division executives. The consulting will determine whether the claims are false."

If this story sounds strange and bizarre, that's because it is. Frankly, we can't think of a story that is similar to this one. And that means that until more official statements are issued by Samsung or even the police in Korea, we should take this report with a grain of salt.

Samsung's foundry business set a company record for revenue during the fourth quarter of 2021. On a sequential basis, profits declined from the third quarter of last year as Samsung had to spend more money to ramp up advanced process nodes such as 4nm and 3nm. Whether some of that money has to do with the funds allegedly missing is not clear.

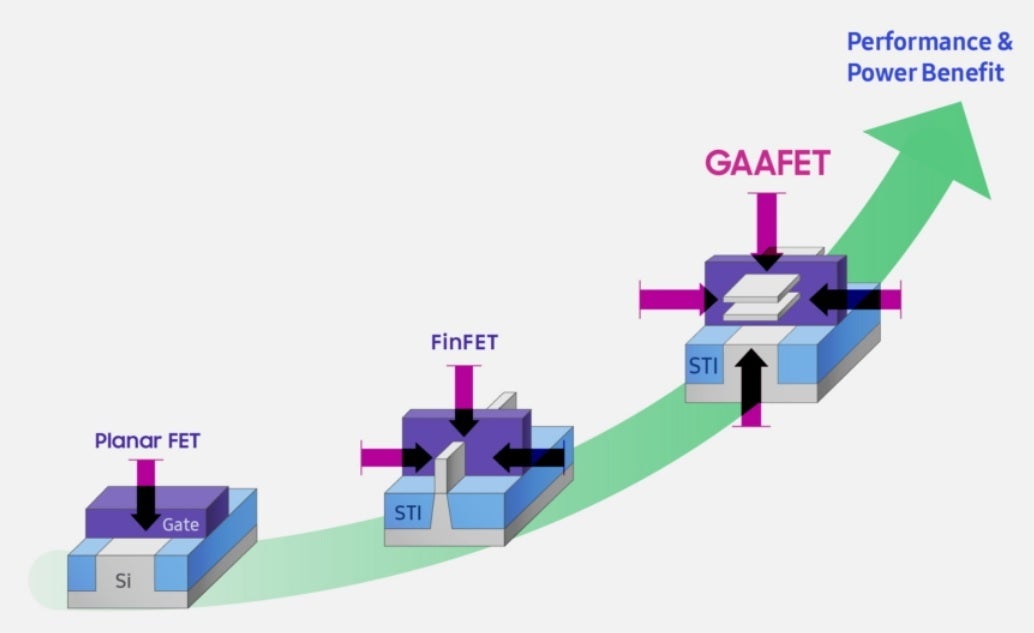

Samsung is spending money on its GAA transistor structure for 3nm chips

The increase in revenue to a record high in the foundry business came from increased sales to HPC (High Performance Computing) customers. For the current quarter, the first quarter of 2022, Samsung said that its foundry would "focus on improving its advanced process yield to improve its supply stability. Also, the Company will continue technical leadership through mass production of the 1st generation GAA process in the first half of 2022."

The evolution of transistors to Samsung's Gate All Around

GAA, or Gate All Around, is a transistor structure associated with Samsung's 3nm process node. It replaces (for Samsung, anyway) the FinFET structure used presently.

Samsung Foundry says that the chip market will remain "tight" as 5G penetrates more market, and demand from High Performance Computing firms remains solid. Additionally, the need for manufacturers to have more chips than needed just in case there is a supply shock from an external event, and outsourcing demand from integrated device manufacturers (ISDMs) who design and build their own chips (like Intel) will keep the assembly lines humming in 2022.

For this year, Samsung expects supply to remain tight due to rising penetration of 5G, solid HPC demand, growing out-sourcing from IDM players and continued needs for securing safety inventory. The Company aims to exceed market growth by expanding capacity at advanced nodes, adjusting prices and adding new customers.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: