In one country, the Apple Tax appears to be crushed for certain apps

Stop the presses! Apple is actually allowing developers to offer non-Apple payment options to its customers. Skirting around Apple's in-app payment platform means that developers don't have to pay Apple its 15%-30% cut of in-app revenue-making such purchases cheaper for users.

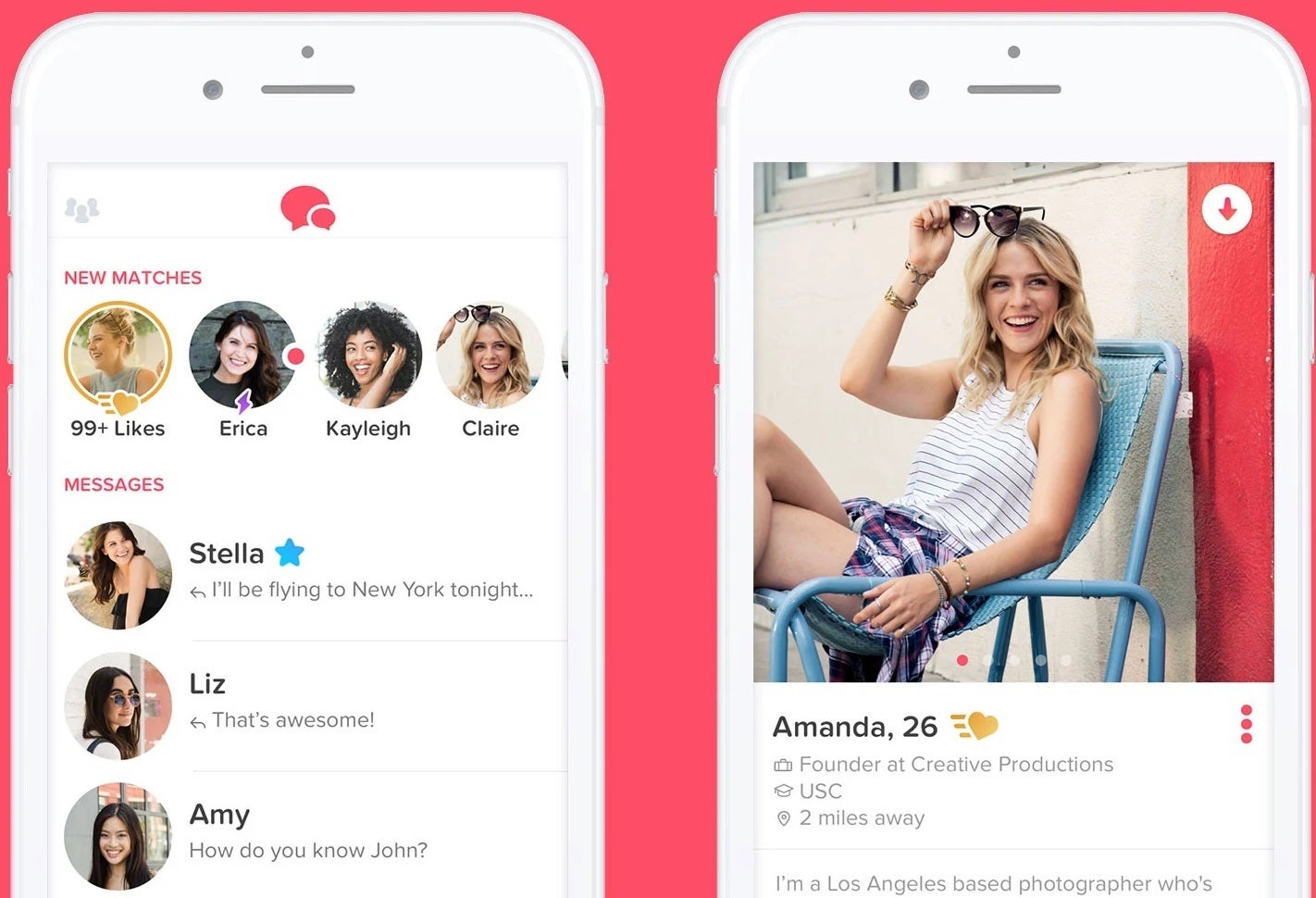

The only caveat is that according to Reuters, Apple is doing this in the Netherlands only, and only for developers of dating apps. On Sunday, a ruling made last month by the country's Authority for Consumers and Markets (ACM) kicked in forcing Apple to allow developers to use other in-app payment systems instead of Apple's own platform.

The investigation against Apple in the Netherlands started in 2019

On December 24th, the country's top competition regulator ruled that by requiring dating app developers, including Tinder parent Match Group Inc, to exclusively use Apple's in-app payment system, Apple had abused its dominant market position. An investigation by Netherlands' Authority for Consumers and Markets started in 2019 but was later reduced in scope to focus on dating apps.

The parent of Tinder was overjoyed to hear about the ACM's ruling

Last year, a judge in the U.S. hearing Epic Games lawsuit against Apple ruled that the latter must allow developers to inform their subscribers about alternative payment options other than using Apple's in-app payment platform. But the day before this ruling was to take effect, Apple was granted a stay while it works on appealing the ruling. This could give Apple another few years of collecting its 15% to 30% cut before it is forced to follow the judges' orders.

In that case, Epic Games informed users of its popular Fortnite game about Epic's in-house payment system that would save Fortnite players 20% on the purchase of V bucks, the virtual currency used with the game. Apple was not happy about this and kicked the game and the developer out of the App Store and Google followed for the same reason.

After the ACM announced its ruling in the Netherlands, Apple said, "We disagree with the order issued by the ACM and have filed an appeal." It added that "Apple does not have a dominant position in the market for software distribution in the Netherlands, has invested tremendous resources helping developers of dating apps reach customers and thrive on the App Store."

Friday's announcement by the ACM was the first public statement made about the regulator's decision even though Reuters said back in October that the ACM had found Apple's actions anti-competitive. Apple was given until Saturday to comply with the order and faced fines of $56.6 million if it failed to follow the ACM's orders.

What did Tinder parent Match think of the ruling?

Tinder parent Match was overjoyed with the ruling. In an emailed statement the company said, "We applaud the ruling issued today by a Rotterdam Court affirming the ACM's decision that Apple's forced use of its in-app payment systems and other practices violate Dutch and EU competition law, and must be eliminated by January 15th."

The ruling in the Netherlands comes after the South Korean government passed a law forcing firms like Apple and Google to allow developers to use third-party payment platforms. Google says that it will abide by the ruling though it will charge a commission on these purchases. Apple has yet to announce what it intends to do about complying with the Korean government.

Surely Apple can see that the world's legal systems are ruling against it even if it was able to obtain a stay in the states. Investors hate uncertainty and perhaps it would behoove Apple to rip the adhesive bandage off of its face in one quick (albeit painful) motion and allow third-party payment platforms to compete. Once the markets see that Apple no longer is worried about losing the revenue generated by the Apple Tax, we could see a massive rally in the shares as the uncertainty over this issue disappears forever.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: