Apple does it again, becomes first publicly traded U.S. firm to be valued at three trillion bucks

For a short period of time today, Apple's stock market valuation exceeded three trillion dollars. The tech company and iPhone manufacturer hit that valuation when it topped $182.856 a share on Monday, briefly reaching a new high at $182.88. By closing time, the stock had dropped back to $182.01. Apple's shares rose $4.44 on the first trading day of the new year.

Remember the early days of the pandemic when investors dumped big tech names like Apple? Since its pandemic low, Apple's stock has tripled adding two trillion dollars in market capitalization. Apple's shares are up 41% since the start of last year making it one of the best performers among the Dow Industrials.

Apple became the first publicly traded U.S. firm to reach a value of one trillion in 2018

You might recall the race that Apple had with Amazon more than three years ago to see which firm would be the first U.S. publicly traded firm to reach $1 trillion in value. Apple hit that mark on August 2nd, 2018. After hitting that mark, Apple's shares declined 30% as it cleared the decks in anticipation for its run to a two trillion dollar valuation which it hit on August 19th, 2020.

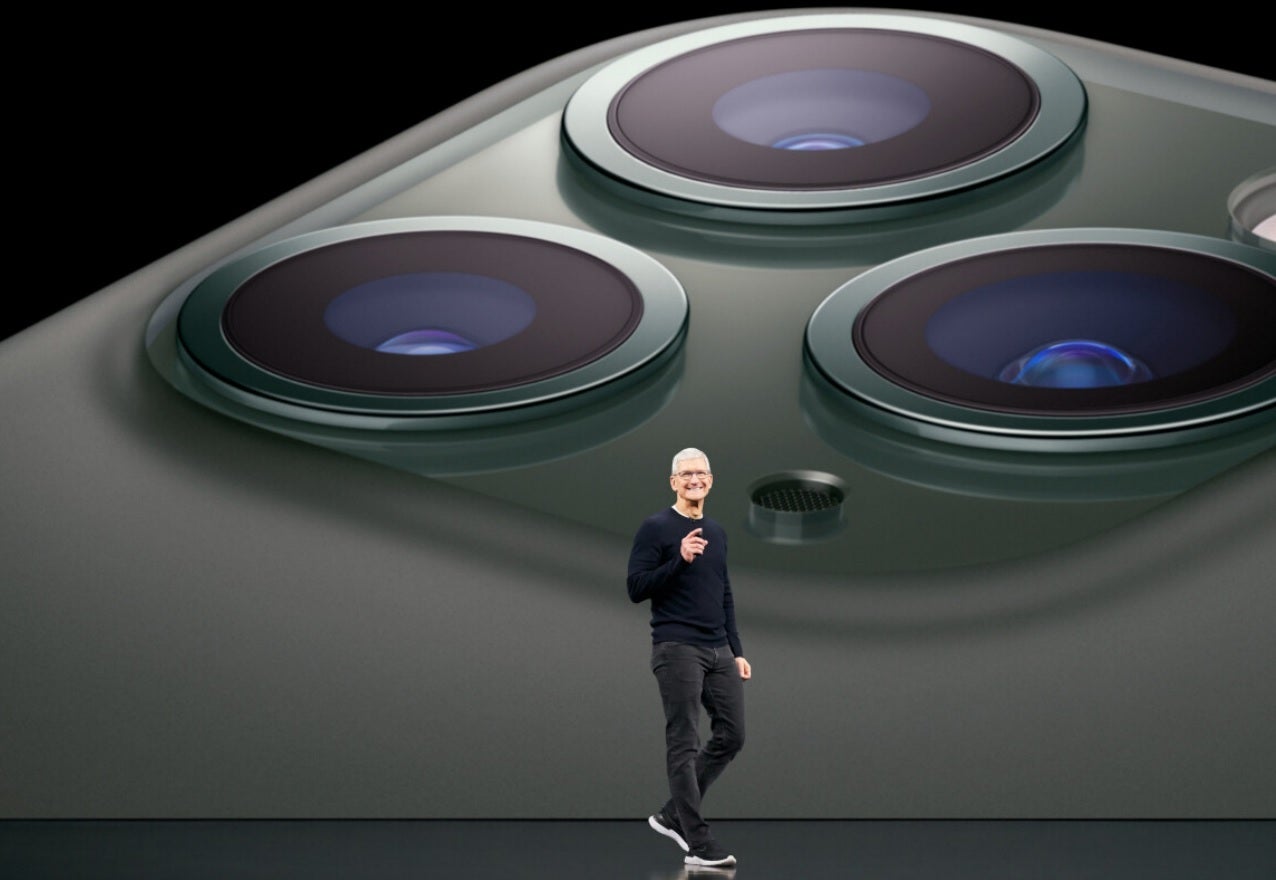

Tim Cook has done a good job adding value for Apple stockholders

Apple has all engines on "go" right now with the iPhone 13 series continuing to be red hot, and with iPads selling well thanks to the never-ending pandemic. The Apple Watch remains the world's top-selling timepiece and next year Apple is expected to enter the mixed reality space with a new headset. Interestingly, the company has seen its valuation surge by a factor of nine since the death of co-founder and co-CEO Steve Jobs from pancreatic cancer in 2011.

Ironically, at the time he passed, Jobs owned just a small amount of Apple shares. His fortune came from an 8 percent stake in Disney that he received from the $7.4 billion acquisition of Pixar by Disney in 2006. Based on the current valuation of Disney, Jobs would be worth $22 billion today which is well behind the $226 billion that Elon Musk is reportedly worth. Amazon founder Jeff Bezos is believed to be worth $202 billion (you don't suppose that Bezos still uses an Amazon Fire Phone, do you?)

According to The Wall Street Journal, tech stocks, including Apple, played a big role in the 27% gain earned by the S&P 500 last year. Apple, Tesla, Microsoft, Nvidia, and Alphabet combined to produce a 31% increase.

The Journal's iconic "Heard On The Street" column noted that it has taken nine months for Apple to tack on its latest trillion bucks in valuation even though the prospects for the company haven't changed during that time period. In fact, the Journal mentions research firm Visible Alpha and its forecast that iPhone unit sales will rise only 1% this year compared with 24% last year.

This is not a short-term slowdown say analysts surveyed by FactSet. Over the next three years, Apple will grow its top line by only 5% a year putting Apple dead last among other tech giants including Amazon. The latter's valuation is $1.3 trillion less than Apple's even though the Echo manufacturer garnered 25% more revenue than Apple last year

Next stop for Apple: four trillion dollars?

Amazon is also expected to see its revenue grow 16% a year over the next three years compared to the aforementioned 5% for Apple. Apple's products and services are doing quite well but the iPhone still makes up half of its revenue and has benefited from deals offered by the carriers looking to get more 5G phones into customers' hands.

Apple certainly enjoyed a bountiful fiscal 2021 with revenue up 33% to $365.8 billion, meaning that the company took in one billion clams each and every day. That was a company record, by the way, and operating income soared 64% to $108.9 billion. This was the first time Apple produced a double-digit growth rate in three years.

Once Apple's shares stabilize over three trillion dollars, it will be time to watch out for the rise to four trillion. However, one day the growth just won't be there and then it truly will be the time to see what Apple has under its sleeves as the next big thing.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: