The iPhone dominates list of top-selling OLED flagship phones like the 1964 Beatles

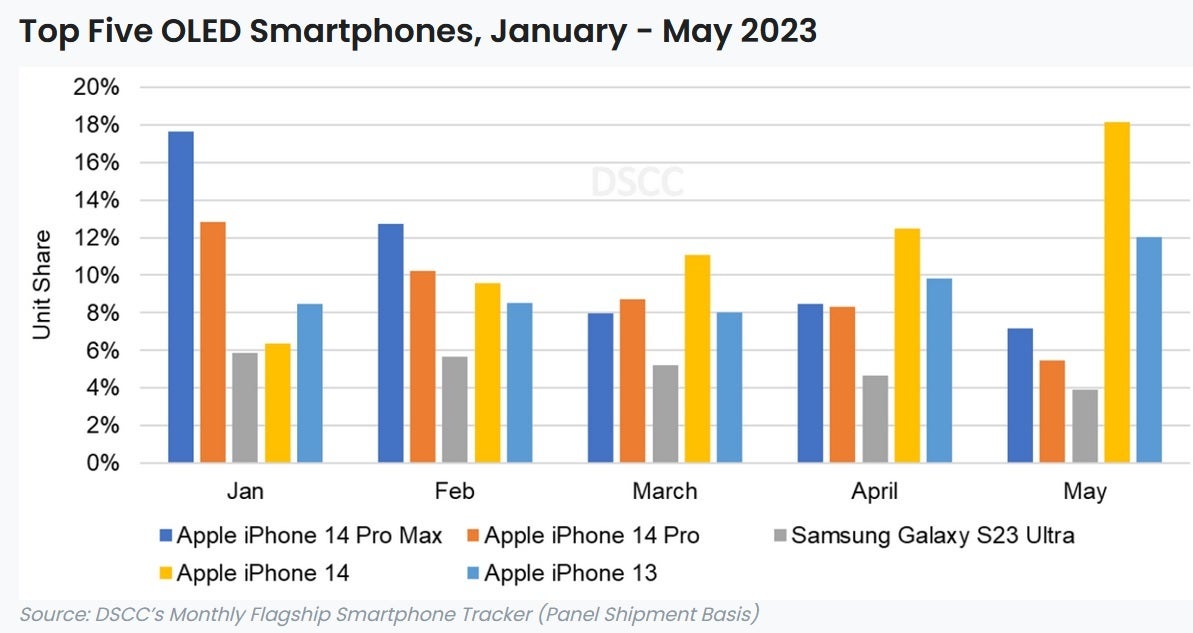

Ross Young's Display Supply Chain Consultants (DSCC) has a new monthly Smartphone Tracker service that takes a look at high-end smartphones that feature an OLED display. Most flagship phones these days have OLED panels giving Young and his staff plenty of work as they compile a list each month of the top-shipping OLED panels. Based on these panel shipments, DSCC was able to create a list of the top five OLED smartphones from January through May.

Since April and May are not yet in the books, DSCC took a look at the numbers for the first quarter of this year (January through March) and calculated that Apple and Samsung combined had a 46% share of the market. Interestingly, as the opening quarter of 2023 progressed, the top-selling model changed from the iPhone 14 Pro Max, which had an 18% slice of the smartphone pie as the year began, to the iPhone 14. The latter model has seen its share rise from 6% to a leading 11% in March as the iPhone 14 Pro Max has seen its share wither from 18% in January to 8%.

Four of the top five selling OLED flagship phones were iPhone models with one Samsung phone included

As of the end of the first quarter, Apple had four of the top five phones in DSCC's survey. As we said, the iPhone 14 (11%) was number one followed by the iPhone 14 Pro (9%), and the iPhone 14 Pro Max and iPhone 13 tied with 8% each. The one non-Apple device, which has been fifth every month of this survey, is the Samsung Galaxy S23 Ultra. Remember, the data is based on panel shipments.

Apple dominates the chart showing the top five OLED flagship phones

The report says, "By May, DSCC expects the iPhone 14 to hold a commanding 18% market share followed by the iPhone 13 (with an estimated 12% market share), the iPhone 14 Pro Max (7%), iPhone 14 Pro (close to 6%), and the Galaxy S23 Ultra (close to 4%). The report says, "DSCC expects the iPhone 14 to be the top model in April and May as a result of early adopters purchasing the Pro models shortly after launch and non-early adopters increasingly purchasing the entry level models later in the launch cycle."

"DSCC shows an 18% Y/Y increase in Q1'23 volumes as several brands launch new flexible and foldable OLEDs increasing panel shipments to take advantage of lower panel prices and look to increase revenues with premium smartphone offerings."

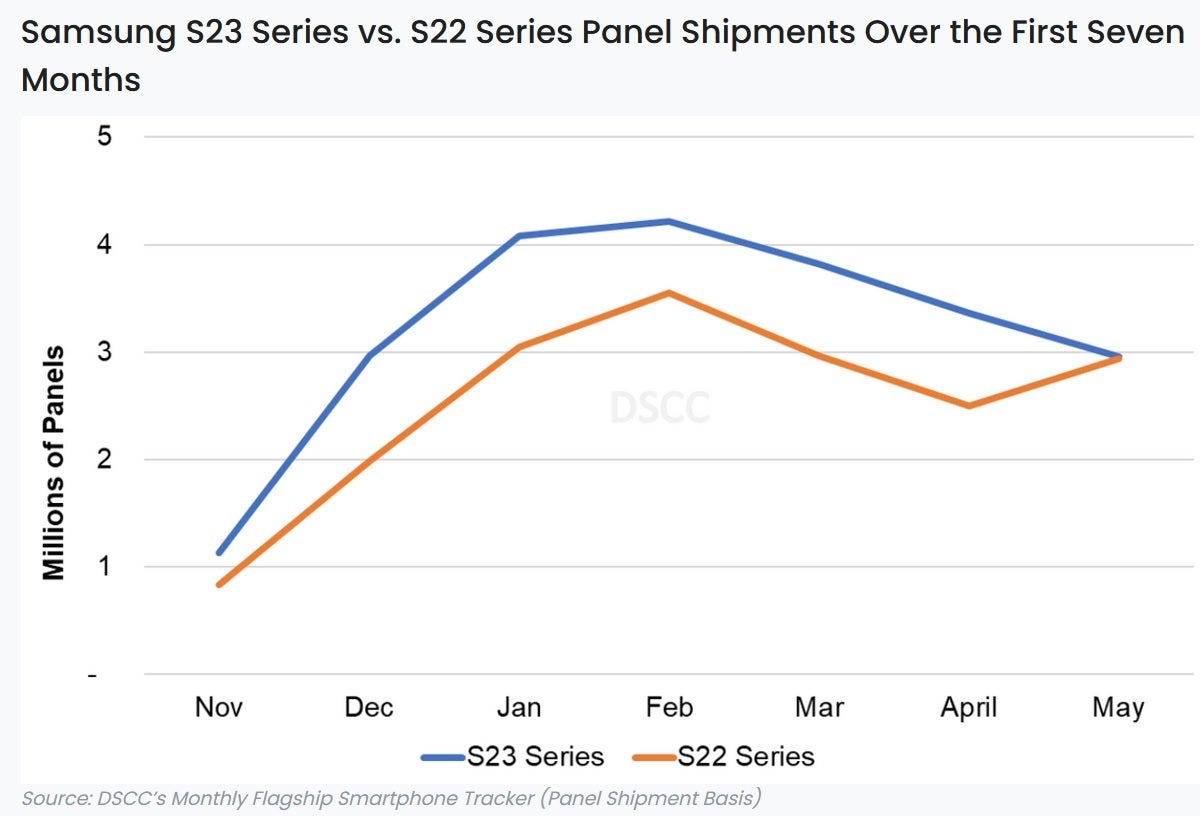

Shipments of OLED panels for the Galaxy S23 line were up 31% over the Galaxy S22 series year-over-year

The report also examines panel shipments for the Galaxy S23 Series versus the Galaxy S22 Series. Supply chain issues impacted panel shipments for the Galaxy S22 to the point that such deliveries from November through March 2023 for the Galaxy S23 line were 31% higher than for the Galaxy S22 series from November 2021 through March 2022; that gap will be 26% for the November through May period.

Comparing the Galaxy S23 series with the Galaxy S22 series from November to May (2022-2023 for the Galaxy S23 and 2021-2022 for the Galaxy S22) panel shipment volumes for the three phones in the line will show an increase according to DSCC: Galaxy S23 plus 39%, S23+ plus 19%, and the Galaxy S23 Ultra plus 20%.

The Galaxy S23 series vs. Galaxy S22 line according to panel shipments

There will be little difference in the mix of panels shipped. From November 2021 to May 2022 the Galaxy S22 panel made up 32% of shipments, the Galaxy S22+ made up 16% of panel shipments in that period, and the Galaxy S22 Ultra's panel accounted for 52% of shipments. From November 2022 to May 2023, the expectations are for the Galaxy S23 to make up 36% of the line's panel shipments, 15% for the Galaxy S23+, and 49% for the Galaxy S23 Ultra. It would seem that Samsung is expecting a little less demand for its top-of-the-line flagship model and a little more demand for the basic model.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: