Judge wants quick resolution of trial that seeks to block T-Mobile-Sprint merger

It appears that we might be finding out whether T-Mobile and Sprint will be able to close their merger faster than we anticipated. The suit filed by 13 state attorneys general and the AG of Washington D.C. seeking to block the merger kicked off in Manhattan today and according to The Wall Street Journal, U.S. District Judge Victor Marrero made it clear that he wants the case decided quickly. First, he asked both sides to skip their opening arguments so that they could go straight to asking questions to witnesses. He also asked both sides to cut down on the number of witnesses they each present. The non-jury trial will run through Christmas and perhaps even longer.

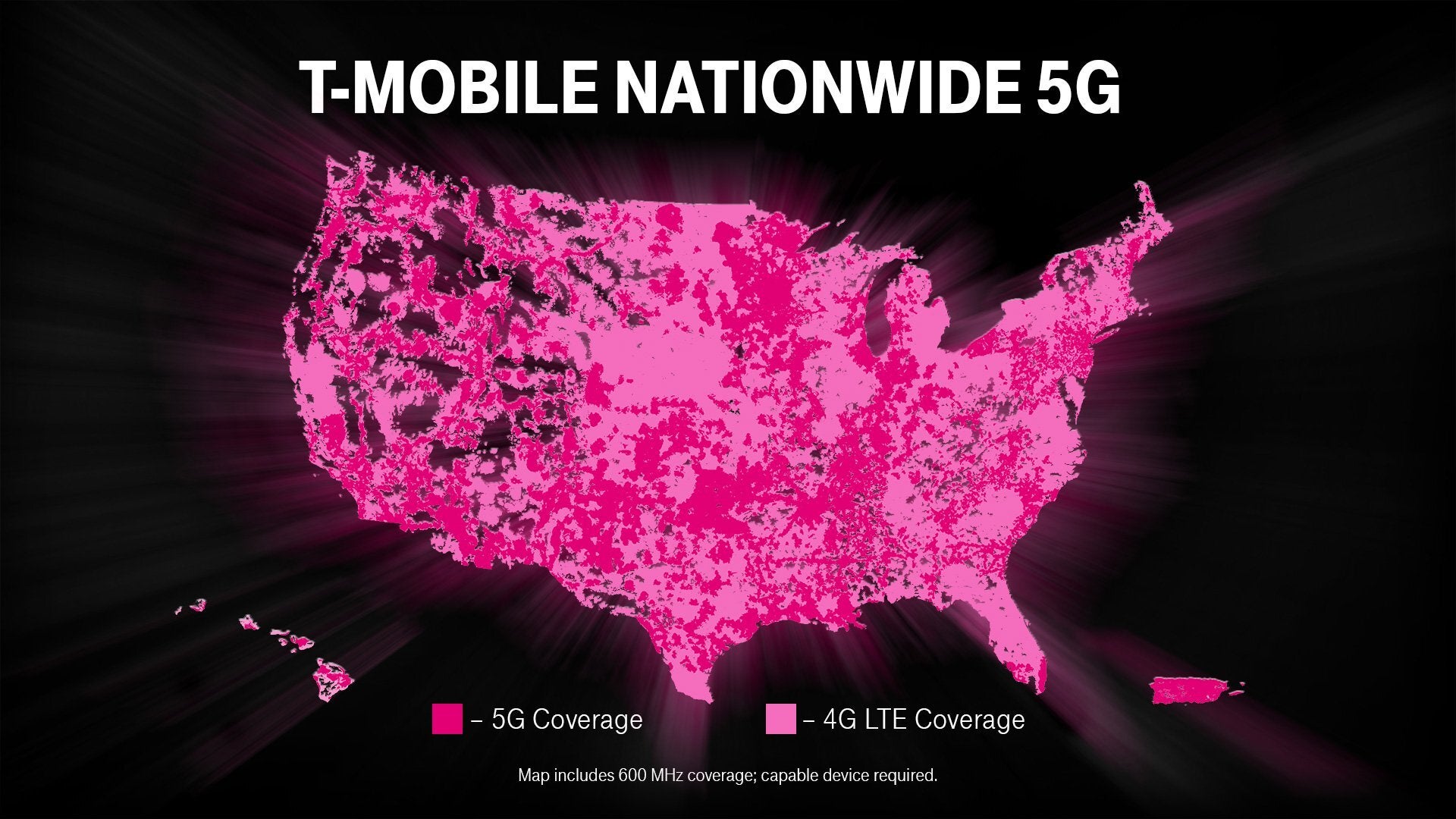

There is plenty at stake here. With approvals from the FCC and DOJ already in T-Mobile's pocket, the suit is the last thing that stands in the way of completing the $26.5 billion merger. T-Mobile is looking to acquire Sprint's hoard of 2.5GHz mid-band spectrum to help it build out its 5G network. This past Friday, T-Mobile officially launched the first nationwide 5G network in the U.S. using the 600MHz spectrum it won at auction two years ago. These airwaves travel farther and penetrate structures better, although they don't deliver the data speeds or offer the capacity that mmWave airwaves do. With Sprint's mid-band spectrum, T-Mobile will be able to provide 5G service to rural Americans and help broaden its 5G coverage by offering the next generation of wireless connectivity over low, mid and ultra-high band airwaves.

The plaintiffs might not understand that this merger is not about the number of major U.S. carriers left standing; it is about helping the U.S. get a head start on leading the new global 5G economy

The plaintiffs argue that allowing T-Mobile to merge with Sprint will drop the number of major stateside carriers by 25% to three companies. However, as part of a deal it made with the Justice Department, once the merger closes Dish Network will acquire Sprint's prepaid businesses including Boost Mobile and Virgin Mobile. Dish will get 9.3 million customers, 7,500 retail locations, 14MHz of Sprint's 800MHz spectrum, and more. Dish will also sign a seven-year MVNO deal with T-Mobile that will allow it to offer wireless service under its own name even while it starts building its own standalone 5G network. But this deal, while placating the DOJ, hasn't impressed the plaintiffs who complain that Dish Chairman Charlie Ergen has no qualms about not following the rules if doing so helps his business.

T-Mobile consumers can now access nationwide 5G in the U.S.

California Deputy Attorney General Paula Blizzard said that Dish is an unproven quantity when it comes to the business of selling wireless service. Blizzard called Dish a struggling satellite television company. And speaking with reporters before the trial, California Attorney General Xavier Becerra said, "We have yet to be shown how going from four competitors to three competitors would be good for consumers." But there is potentially plenty of good for consumers in the form of faster signals that will be available with 5G. The nations that are first to harness the latest generation of wireless connectivity will enjoy an economic boom as new technologies, industries, and corporations are created. While the plaintiffs see this as an antitrust case, for T-Mobile it has been all about obtaining Sprint's mid-band spectrum so that it can quickly complete a well-rounded 5G network that covers the entire country. For now, Verizon's 5G rollout is limited to the use of mmWave spectrum. And while the latter has the advantage of delivering faster data speeds and offering huge capacity for data traffic, it just does not travel far enough to allow the carrier to quickly complete a nationwide 5G network. And mmWave signals do not penetrate buildings well. One could make the argument that the merger needs to be allowed so that the U.S. can better compete in the new 5G economy that is in its early days.

T-Mobile's 5G network now covers over 200 million Americans

During the court session today, the states tried to show that Sprint, which many believe will be out of business if the merger is not approved, simply needs its deep-pocketed parent to lay out some cash. As an example, the plaintiffs called Deutsche Telekom CEO Timotheus Höttges to the stand. Deutsche Telekom is the parent company of T-Mobile and the states tried to show that the German telecom giant simply dug into its pockets to turn T-Mobile into the fastest-growing major carrier in the states. The plaintiff's attorney, Glenn Pomerantz, was trying to show that if SoftBank were to do the same with Sprint, the latter wouldn't need a merger to survive. That argument fails for a couple of reasons. One, when AT&T was blocked by the DOJ from buying T-Mobile in 2011, as part of the terms of the busted deal it had to give T-Mobile $3 billion which Höttges called the "real ignition" for T-Mobile's turnaround. And secondly, much of the credit for T-Mobile's success goes to its departing CEO John Legere whose unconventional leadership played a big part in the growth of the company.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: