Samsung's chip business was hit hard by U.S. ban on Huawei

According to Reuters, Samsung Electronics is expected to release a preliminary look at its second-quarter earnings report this coming Friday. The numbers should show that the South Korean manufacturer was negatively affected by the U.S. ban that prevented Huawei from obtaining U.S. parts and software. Samsung's shipments of memory chips to Huawei were down sharply during the three month period that covers April through June. This has led to a backup in supplies of Sammy's DRAM and NAND chips forcing the manufacturer to cut prices in order to move its inventory. Since 67% of Samsung's profit comes from selling chips, Huawei's purchases have a lot of influence over how well the manufacturer does in any given quarter.

Huawei's inability to access its U.S. supply chain wasn't totally bad news for Samsung. With international sales of Huawei phones down as much as 40% in the quarter, it is quite probable that Samsung was able to pick up some of this business. The company's high-end Galaxy S10 line and its hot-selling Galaxy A mid-rangers might have ended up in the pockets of consumers outside of China who backed away from purchasing a Huawei model. HI Investment & Securities senior analyst senior Song Myung-sup says that if sanctions are placed back on Huawei, Samsung could sell 37 million additional smartphones a year. Despite the recent truce in the trade war between the U.S and China, consumers outside China are concerned that the Huawei phone they buy now might not be able to receive Android updates in the future.

So how bad will Samsung Electronics' preliminary second-quarter earnings be? A consensus of 29 analysts estimates that Samsung will report a 60% drop in operating profits (earnings before interest and taxes) to 6 trillion won, equivalent to $5.14 billion. So despite the decline, there is no need for the company to put up a GoFundMe page. During the same quarter last year, Samsung reported operating profits of 14.9 trillion won ($12.7 billion USD). The drop in operating profits takes place against strong sales of the firm's Galaxy S10 line of smartphones. As we told you earlier this week, shipments of Samsung's current flagship series rose 12% in the quarter compared to deliveries of the Galaxy S9 range made during the same quarter last year.

"How much Huawei will use chips ahead is definitely a swing factor in prices. When there's not many players that can buy chips instead of Huawei, then Samsung has to cut prices to sell them."-Jay Kim, analyst, Sangsangin Investment & Securities

Samsung has its own trade issues that could cut its production of smartphone displays and chips

DRAM chip pricing will probably not rebound over the remainder of the year predicts TrendForce researcher Avril Wu. TrendForce says that pricing for these chips declined by 25% over the second quarter and predicts a further decline of 15% to 20% during the current quarter that started on Monday and runs through the end of September. Micron Technologies, a U.S. competitor to Samsung in the memory chip business, says that demand for these chips will pick up in the second half of the year, which should bode well for firmer prices later in 2019. But TrendForce's Wu says that Samsung won't be able to clear its inventory of DRAM chips until the first half of next year.

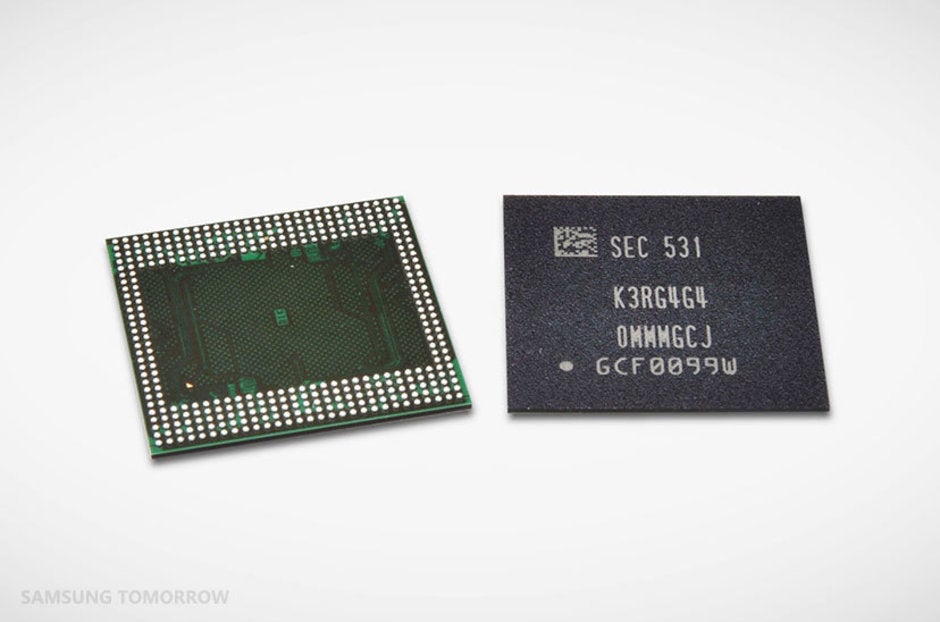

Samsung's 12GB LPDDR4 DRAM chip

Samsung could also find itself having issues obtaining important supplies needed to produce chips and smartphone displays. Materials that the company sources from Japan to help produce these parts, fluorinated polyimide and resist and high-purity hydrogen fluoride (HF), will require permission from the Japanese government to ship to South Korea starting tomorrow. Obtaining that permission could take as long as 90 days each time it is requested. The countries are arguing over a court ruling made by the South Korean Supreme Court last October. The court ordered that Japan compensate South Koreans who were forced to work for Nippon Steel during World War II. As a result, Samsung could have problems producing enough OLED panels for Apple and its other customers. And the company could lose some memory chip business to rivals as a result.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: