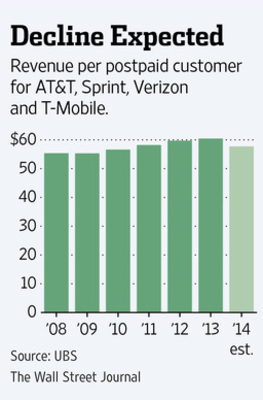

Average revenue per post paid customer is expected to decline this year

Investors, sensing troubling times ahead for the top four mobile operators in the U.S., have whacked $45 billion off the combined market capitalization of AT&T, Verizon, Sprint and T-Mobile just since the middle of November. There are two things that seem to be worrying investors. One is the amount of money spent by carriers for more spectrum. The second worry stems from a recent warning from Verizon, saying that tough competition will affect profits.

Since the middle of last month, the U.S. government has sold $43.7 billion worth of spectrum to the mobile operators, and another auction is coming in 2016. The high quality airwaves being offered in two years are coming from television broadcasters,

and are expected to raise $47 billion from mobile operators. At the same time, each carrier is becoming more aggressive, trying to persuade consumers to switch to its network. Sprint recently offered a plan

that cuts a consumer's Verizon or AT&T bill in half, while keeping the same amount of data. This past week, T-Mobile announced a family plan with unlimited data starting at $100 for two lines.

Since November 12th, Verizon shares are down 10%. Last Monday, the nation's largest carrier said that profits are slipping as it becomes more aggressive in procuring new subscribers. AT&T shares are down 9% since the same date, and it has told investors to expect higher churn and lower margins when it announces its fourth quarter earnings. Sprint is off 18% in the last month, and even industry upstart T-Mobile has suffered though an 11% drop in its stock price since November 12th.

As far as the top four U.S. carriers are concerned, revenue per post paid customer is expected to decline this year for the first time in years. The price wars that are driving the industry will have to end some time as the mobile operators will have to spend money to protect their networks. UBS analyst John Hodulik says that the only way to end the price wars would be if regulators start to allow mergers in the industry, or if at least one carrier decides to focus on profits and stops cutting prices. The analyst sees neither of these things coming to fruition.

One thing that is helping the bottom line for the major U.S. carriers is the slow move away from subsidized phones to the use of installment plans. The only downside there is that once the consumer pays off his phone, there is no contract forcing him to stay with his current carrier.

source:

WSJ

Read the latest from Alan Friedman

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: