Negotiating with Apple: why is it hard to bring Apple Pay to Israel?

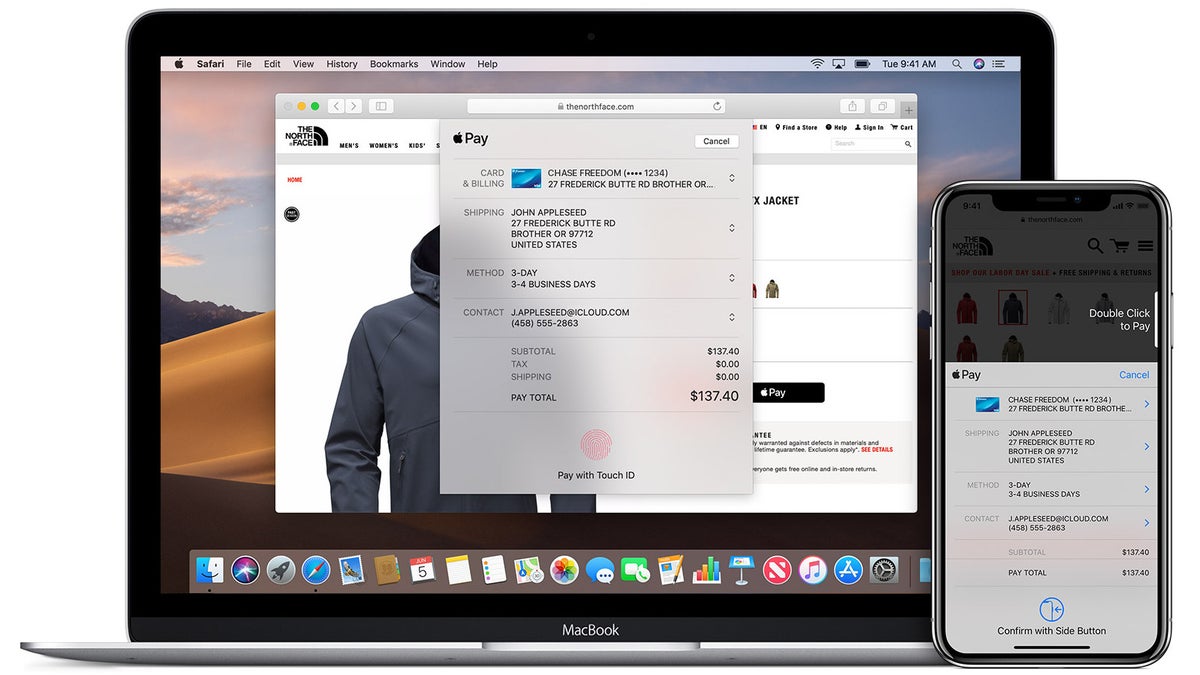

The Israeli website Calcalist has recently published information concerning ongoing negotiations between Apple and financial system entities of Israel about the adoption of Apple Pay in Israel. The Hebrew publication informs us that banks of the country have already adopted Europay, MasterCard and Visa EMV standard for mobile payments, which allows payment to be done using the NFC chip in the smartphone directly in contactless transactions.

Apple is famous for its closed hardware, which also applies to the NFC chip configuration in iPhones. Unlike in Android phones, this hardware functionality in iPhones is locked, possible to be accessed only by the iPhone’s built-in app, Apple Wallet. As a consequence, if payment is to be done via the NFC chip, the bank entities should negotiate a deal with Apple, as no third party apps are allowed access.

However, as reported on Calcalist’s website, the representatives of the Israeli financial institutions are dissatisfied with the requests that Apple had stipulated. The demanded fee for using Apple Wallet is reported at around 0.15% - 0.25% per transaction. This amounts to around a quarter or a third of the bank’s own commission per transaction. According to a source close to the parties, Apple’s demands are considered disproportionate and even overstepping the company’s power. As stated in the Hebrew publication, Apple’s commission from major US banks is around 0.1%.

Although Apple’s commission for using Apple Pay is present in every country the service is available in, some countries argue that Apple’s trademark closed-off system freezes competitiveness. Australia and Germany have sought legislation to regulate this functionality, even though, according to Apple’s objections, the opening of the NFC chip to third-party apps can impose security and confidentiality risks.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: