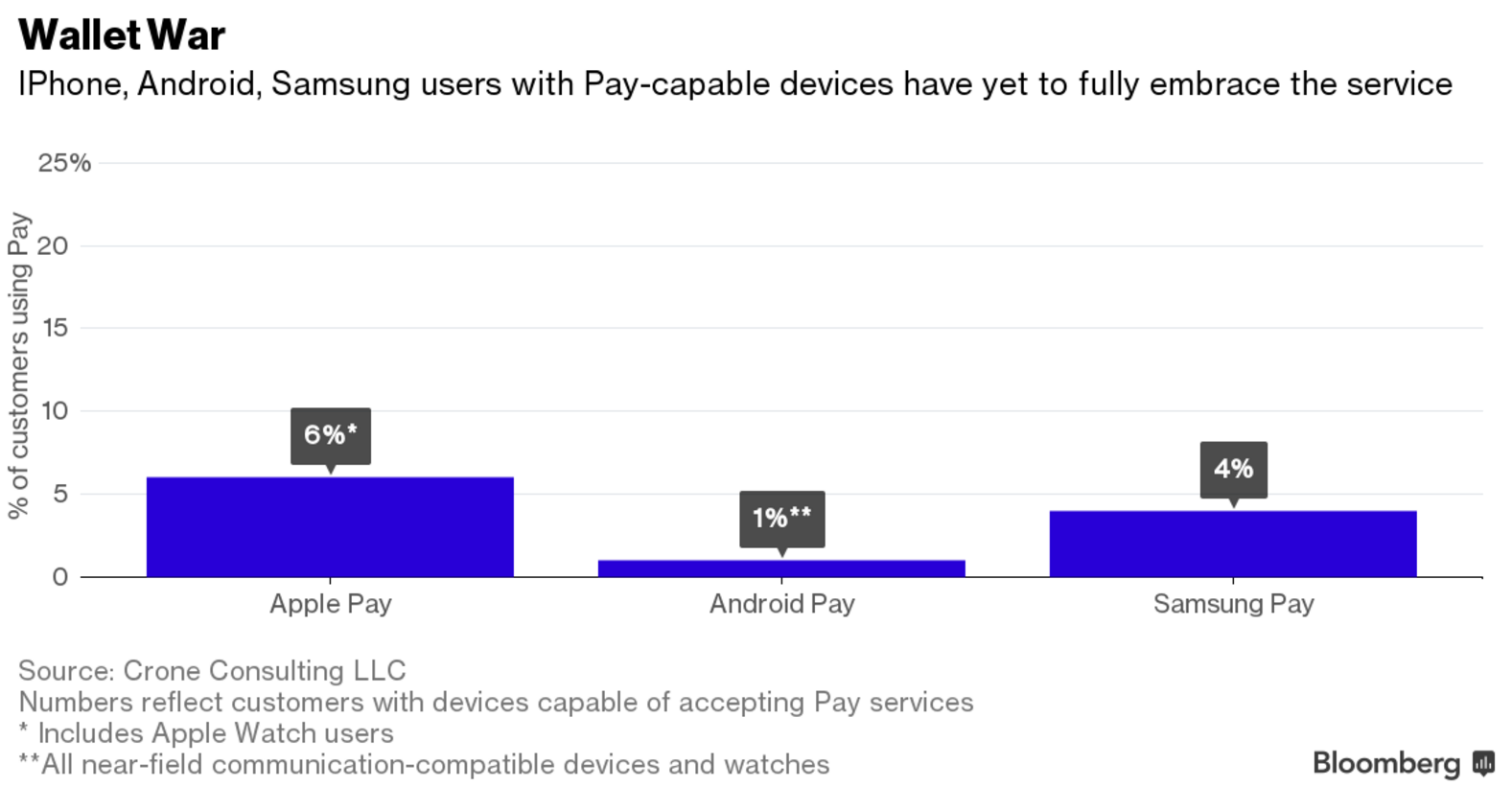

Death Magnetic: Samsung Pay adoption faster than Apple Pay

Samsung Pay allows merchants to use their existing terminals

Apple Pay requires merchants to equip their POS terminals with dedicated equipment, that is why the uptake has been somewhat slow so far, but Samsung's decision to directly use LoopPay might quickly make it the most widely used mobile payment system, if its growth trend continues unabated.

source: Bloomberg

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: