Tablet shipments were lower for the fifth consecutive quarter

When Apple recently reported its fiscal fourth-quarter earnings it noted that iPad sales had declined 13.06% year-over-year during the quarter that ran from July through the end of September. For fiscal year 2022, Apple's tablet generated 8% fewer sales on an annual basis. It seems that the bloom is off the rose as the shot in the arm given to the tablet industry by the pandemic has worn off.

The global tablet market reports its fifth straight quarter with lower shipments on an annual basis

During the height of the pandemic, kids were attending classes remotely and adults were working out of their homes. Tablets were being used for both work and play. During the day, your basic everyday slate could handle streaming video from a classroom or a boardroom. And when school or work was over for the day, the same device would provide entertainment in the form of games, movies, and other entertainment available via installed apps.

Apple, Samsung, and Amazon were the top three manufacturers in the global tablet market last quarter

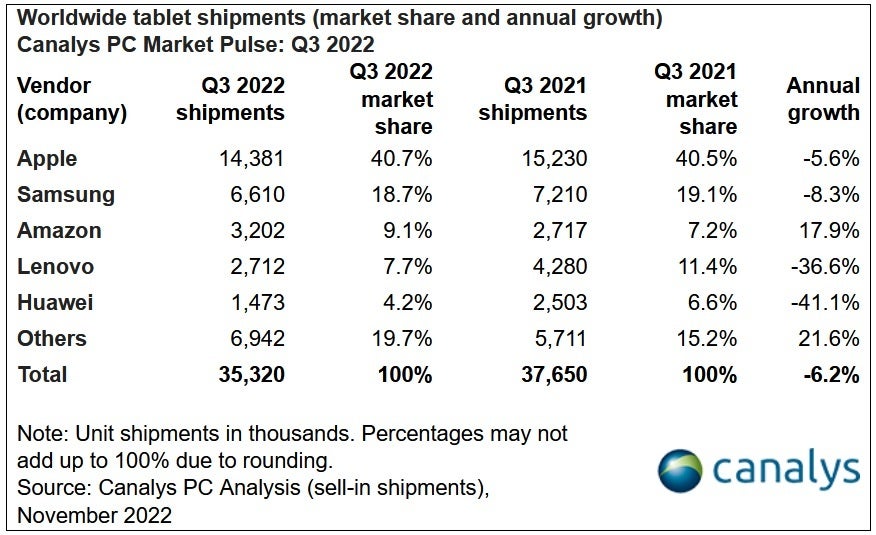

And even though COVID cases jump from time to time, kids are now physically attending class and parents are back in the office. Thus, demand for tablets has been declining. By how much? Well, we can tell you that analytical firm Canalys has reported that the tablet market has just had its fifth consecutive quarter of lower year-over-year shipments. For the third-quarter of this year, such deliveries were off 6% on an annual basis which was better than the 11% annual decline seen during the second-quarter.

Still, shipments remain above pre-pandemic levels as 35.3 million units were delivered during the third-quarter. No surprise, Apple remained at the top as it shipped 14.4 million iPad units from July through September. That figure is down 5.6% from last year's third-quarter. Thanks to the weak overall tablet market, despite the decline in shipments, Apple grew its market share from 40.5% to 40.7%. Apple has just released its redesigned 10th-generation basic iPad model along with its new 11-inch and 12.9-inch iPad Pro units.

Well behind Apple was Samsung. After an 8.3% drop in Q3 tablet shipments year-over-year, the company delivered 6.6 million slates in the quarter as Sammy's market share declined from 19.1% to 18.7%. Amazon was third after a strong quarter that saw its tablet shipments rise 17.9% on an annual basis. The company shipped 3.2 million tablets over the three months as Amazon's market share rose to 9.1% of the global tablet market from 7.2% the year before.

Lenovo shipped 2.7 million tablets during the third-quarter, a huge 36.6% decline from Q3 last year. The company's slice of the global tablet pie fell from 11.4% to 7.7%. And in fifth place for the third-quarter was Huawei. The beleaguered Chinese manufacturer saw its tablet shipments for the three months crash by 41.1% on an annual basis to 1.5 million units. This left the firm with a global market share of 4.2%.

The "Others" category, which includes a mishmash of other names we didn't mention, saw third-quarter tablet shipments rise 21.6% worldwide to 6.9 million slates. This conglomerate of tablet manufacturers combined for a 19.7% share of the global tablet market in Q3.

Despite the current weakness in the industry, the future looks good for the tablet market

Canalys Analyst Himani Mukka said, "The reduced need for tablets in the post-pandemic world has been exacerbated by increased macroeconomic pressure on consumer spending. With in-person education largely resumed and people spending less time indoors and on devices, expenditure on refreshing or upgrading tablets is plummeting as household budgets are pared back. But promotional activity by vendors and retailers, including back-to-school deals, along with rising deployments in the commercial sector, have helped keep shipment volumes at a higher level than before the pandemic."

Mukka added that "While the tablet market is unlikely to reach the highs it enjoyed in 2020 and 2021 again, the trajectory is more positive than was anticipated a few years ago, and vendors are signaling continued focus on the category."

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: