U.S. bans lead to a decline of over 81% in Huawei's phone shipments during 2021

Perhaps if you strain a bit, you can recall 2020 when Huawei managed to finish as the third-largest smartphone manufacturer in the world. Including its then sub-unit Honor, the company shipped 188.5 million smartphones worldwide for the year. That put the company behind Apple (207.1 million) and Samsung (255.6 million).

In 2019, Huawei had delivered 240.6 million phones which placed it second above Apple and below Samsung. The latter two delivered 198.1 million and 298 million handsets respectively. In the middle of that year, the U.S., citing security, placed Huawei on the entity list preventing the manufacturer from accessing its U.S. supply chain without permission from the Commerce Department.

Being put on the entity list left Huawei unable to use Google apps for its global smartphone versions

This left Huawei without access to the Google Mobile Services' version of Android and unable to include Google apps like Search, Maps, the Play Store, and others. That didn't matter much in China since most Google apps are banned in the country anyway. But there was a negative impact on the number of unit sales of global versions of Huawei's phones which normally did sport Google apps.

The Huawei P50 Pro and foldable P50 Pocket

Then, to make matters worse, exactly one year later after placing Huawei on the entity list, the U.S. changed its export rules to prevent foundries that manufacture chips using American technology from shipping cutting-edge semiconductors to Huawei. As a result, the company was unable to receive deliveries of its own Kirin 9000 5G chipsets and was forced to use the Qualcomm Snapdragon 888 (albeit a special version without 5G support) to power its P50 and P50 Pro flagship models last year.

One other big event took place that had a huge impact on Huawei's global phone shipments last year. Trying to get its Honor sub-unit out from under the same U.S. bans that Huawei was dealing with, the latter sold Honor to a consortium for over $15 billion dollars freeing up the firm to use Google's apps and software and allowing Honor phones to be powered by cutting-edge 5G SoCs.

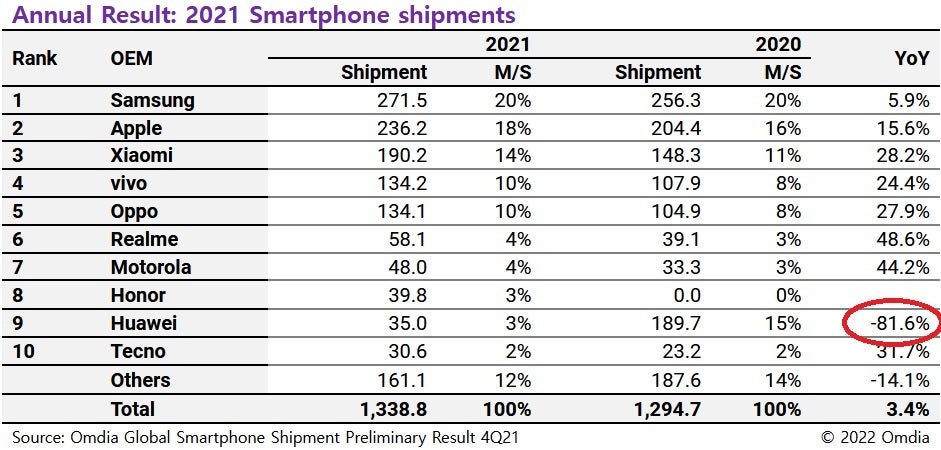

As a result, according to data from Omdia, the number of handsets shipped by Huawei in 2021 dropped by 81.6% to 35 million units. Huawei's market share worldwide dropped from 15% in 2020 to just 3% in 2021. The same data suggests that Honor shipped 39.8 million units as an independent company putting it in eighth place, one rung ahead of Huawei. Both firms had a 3% slice of the global smartphone pie last year.

Samsung saw its lead over Apple decline last year as Samsung's 5.9% year-over-year increase in shipments to 271.5 million phones paled in comparison to the 15.6% annual gain rung up by Apple in 2021. 236.2 million iPhone handsets were delivered last year cutting Samsung's lead to 35.3 million units, down from the 51.9 million lead it held in 2020.

Xiaomi was third after shipping 190.2 million phones last year, good enough for 14% of the market and up 28% on an annual basis. Vivo and Oppo practically had the same numbers with the 134.2 million phones shipped by the former edging out the latter's 134.1 million for fourth place. Both were credited with a global smartphone market share of 10% for the year.

Motorola had a strong year

Realme and Motorola had strong years with Realme's shipments rising 48.6% to 58.1 million units giving it a market share of 39.1%. Motorola delivered 48 million phones in 2021 for a 44.2% hike year-over-year. Overall, 1.34 billion phones were shipped in 2021, up 3.4% from the 1.29 billion delivered in 2020.

Huawei shipped more than 81% fewer handsets in 2021

If we look at just the fourth quarter figures, Apple (87 million phones shipped) beat out Samsung (69.1 million), and Xiaomi (45.2 million). Apple had the seasonal advantage with shipments of the iPhone 13 series picking up during the three months from October through December. It should be noted that Huawei did not make the top ten list for the fourth quarter while Honor finished seventh for the period after shipping 15 million handsets during the three months from October through December.

Motorola had the strongest annual gain for the fourth quarter with an annual gain of 27.6% to 12.5 million units shipped during Q4. Altogether, from October through December, 356.4 million smartphones were delivered worldwide for a gain of 9.3% sequentially, but a decline of 6.7% year-over-year.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: