After announcing a record loss in subscribers, Netflix stock soared. Here's why!

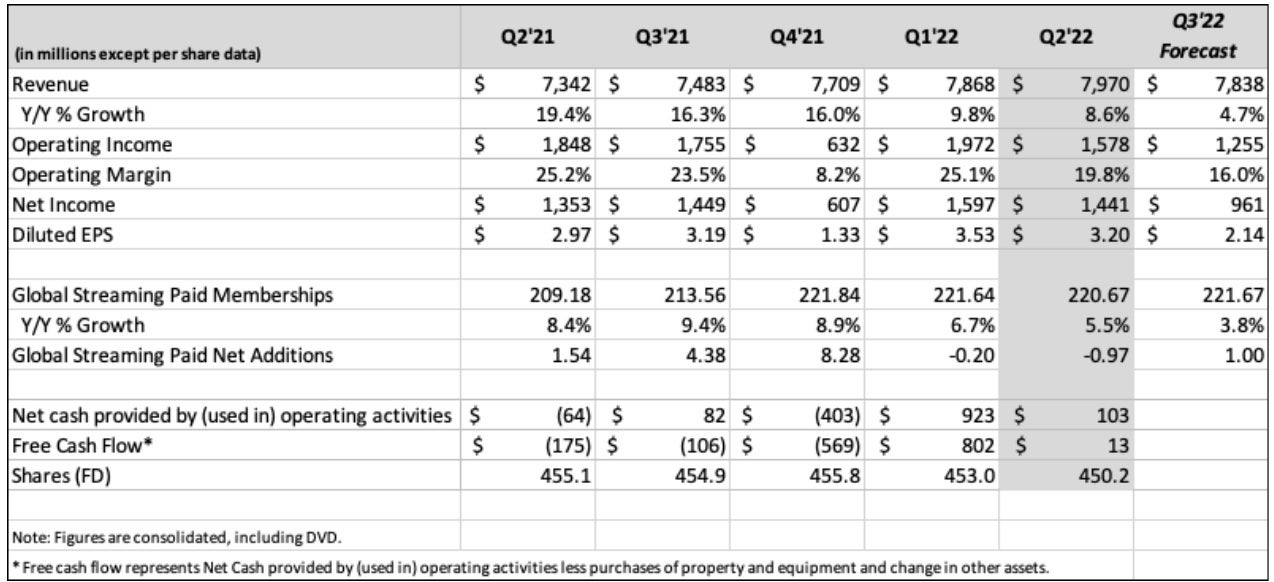

Netflix today reported its second-quarter results which showed a record quarterly decline of 970,000 subscribers. Some are considering this a big win for the video streamer considering that last quarter the company predicted that it would lose 2 million subscribers during the three months ended in June. Netflix now has 220.67 million subscribers and expects to add one million more during the current quarter ending in September.

Growth in Netflix membership numbers is trending down

Year-over-year growth in the number of paid streaming memberships has been trending downward. During the second and third quarter of 2021, that metric increased by 8.4% and 9.4% respectively. But over the last three quarters, the number of paid streaming memberships grew by 8.9%, 6.7%, and 5.5%. And Netflix expects the growth to continue slowing to a rate of just 3.8% during the third quarter of this year.

Netflix's financial numbers are trending lower

Revenue growth is also slowing with quarterly increases declining from the 19.4% recorded for the second quarter of 2021 to 16.3% (Q3 21), 16% (Q4 21), 9.8% (Q1 22), 8.6% (Q22 22), and an estimated 4.7% for the current quarter. In an attempt to right the ship, Netflix has fought harder to prevent password sharing, laid off 450 employees, and plans on launching an ad-supported lower-priced tier of service in partnership with Microsoft starting early next year.

In a letter to subscribers released today, Netflix not only announced its lower-priced ad-supported tier but also revealed that its new "add a home" feature, designed to reduce password sharing, would cost an extra $3 per month for a household to share their service with another household. In the letter, the company wrote about the ad-supported tier, "We’ll likely start in a handful of markets where advertising spend is significant. Like most of our new initiatives, our intention is to roll it out, listen and learn, and iterate quickly to improve the offering. So, our advertising business in a few years will likely look quite different than what it looks like on day one."

Wall Street investors had a very bullish reaction to the report

For the last quarter, Netflix grossed $8 billion with $1.44 billion in net income or $3.20 per share. That was a 6.5% hike in net on an annual basis while EPS rose 7.7% from Q2 2021 to Q2 2022. Wall Street loved the report with Netflix (NFLX) shares rising $10.71 or 5.61% during regular trading hours to $201.63. In after-hours trading, the stock tacked on an additional $15.21 or 7.54% to $216.84.

As usual in this business, content is king and Netflix continues to produce big-budget films like the kind you might normally expect to see in the theater. "Stranger Things" fourth season was a big hit for the video streamer as viewers flocked to the latest version of the show which was nominated for several Emmy awards.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: