Only one of the top five smartphone brands showed growth in global shipments last quarter

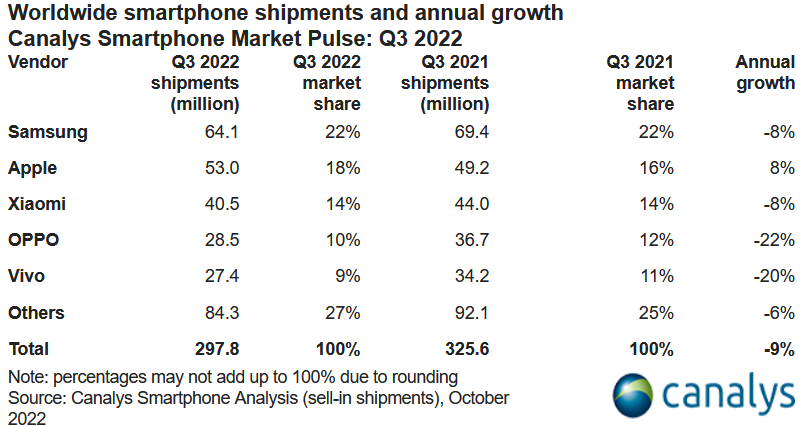

The global smartphone industry had a rather poor third quarter according to the latest report from analytical firm Canalys. The firm says that weak demand for handsets resulted in a 9% year-over-year decline in Q3 smartphone shipments. Led by the iPhone 13 and iPhone 14 series, Apple was the only manufacturer to report year-over-year growth during the quarter.

Apple is the only manufacturer in the top five to report growth in shipments during Q3

Despite delivering 8% fewer smartphones during the quarter, Samsung remained on top after delivering 64.1 million connected handsets during the period from July through September. The company's share of the market remained flat at 22%. Apple was next as it shipped 53 million iPhone models in the quarter, up 8% from the same time period last year. Apple now owns 18% of the global smartphone market.

Samsung was still the top shipper of smartphones worldwide during Q3

In third-place was Xiaomi, which like Samsung, suffered an 8% decline in shipments during the third quarter. The company shipped 40.5 million units giving it a 14% slice of the global smartphone pie. Oppo finished fourth but had the largest decline in shipments on an annual basis at 22%. After the decline, Oppo shipped 28.5 million phones during the quarter giving it a 10% market share.

Rounding out the top five was Vivo. During the third quarter, the manufacturer shipped 27.4 million phones, 20% fewer than the amount it shipped last year. That leaves Vivo with a 9% share of the market. Overall, the industry shipped 297.8 million smartphones during the third quarter, down 9% from the 325.6 million shipped during the third quarter of 2021.

Canalys Research Analyst Runar Bjørhovde says that the only sector of the market showing growth was the high-end. He adds, "Apple reached its highest Q3 market share yet, driven by both the iPhone 13 and newly launched iPhone 14 series. The popularity of the iPhone 14 Pro and Pro Max, in particular, will contribute to a higher ASP (Average Selling Price) and stable revenue for Apple."

Turning to Android, Bjørhovde says, "On the Android side, Samsung refreshed its foldable portfolio and increased its marketing initiatives significantly to generate interest and demand for its new flagships. Mid-to-low-end demand has been hit making it challenging for vendors to navigate in a competitive segment. Xiaomi managed to leverage its global scale with a refreshed product line to offset declines in its home market. Oppo and Vivo are still significantly impacted by the drop in the China market but have both shown small signs of recovery."

The outlook for the current quarter is the gloomiest in a decade

Canalys Analyst Toby Zhu is concerned that "global disruptions" are going to make the current fourth quarter the "gloomiest" in over a decade. With the upcoming winter in mind, manufacturers are cutting their production targets and those that survive the quarter in good shape, Zhu notes, will be those brands in a good position for the long term.

Canalys Analyst Sanyam Chaurasia took a look at the global aspects of the smartphone industry. "Europe and Asia Pacific outperformed the rest of the world in Q3," the analyst wrote. "Europe avoided a significant drop helped by a spike in shipments to Russia. Here, Chinese vendors leveraged short-term opportunities to stock up the channel in a market that has been undersupplied during previous quarters."

Chaurasia continued by noting that "APAC (Asia Pacific) had a huge variation between different markets, but sequentially improving demand in India, Indonesia and the Philippines helped the region stabilize its performance. Carrier-dominated markets such as North America and Latin America presented increasingly cautious sentiments on managing inventory before heading into big holiday seasons, contrasting a much more optimistic view in Q3 last year."

While the report is gloomy, it appears that Apple might be the only manufacturer in the top five that can still grow shipments despite the global economic and political factors that are keeping deliveries of smartphones down. But that could all change next year thanks to Apple. An expected redesign for the iPhone 15, the unveiling of the iPhone 15 Ultra to replace the Pro Max series, and the use of USB-C instead of the proprietary Lightning port could be quite a shot in the arm not just for Apple, but for the entire industry.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: