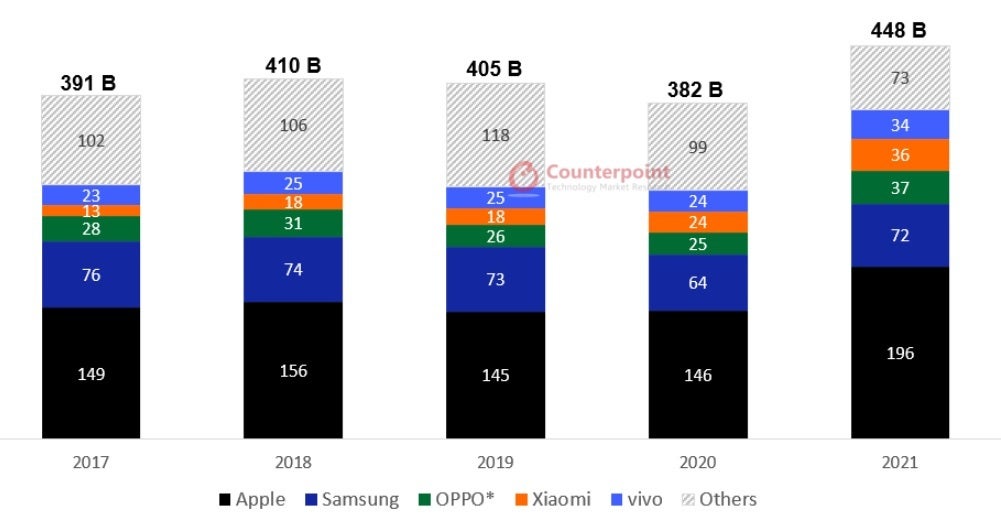

These five phone manufacturers made up 85% of smartphone revenue last year

Despite supply chain shortages, the pandemic, and other issues that could have held back the smartphone industry in 2021, the global smartphone business generated $448 billion in revenue last year for a hike of 7% on an annual basis. The previous year, the top line collected by the industry amounted to $382 billion. Fourth-quarter 2021 revenue was up 20% from the third quarter's top line.

Apple collected the most revenue in the smartphone industry last year

The data came from Counterpoint Research and reveals that Apple collected the most revenue in the global smartphone sector last year with a total of $196 billion. For the company, that was a 35% year-over-year gain. Thanks to strong demand for 5G models, the Average Selling Price (ASP) of the iPhone rose 14% last year to $825 as the device gained market share in India, Thailand, Vietnam, and Brazil.

The top 5 smartphone brands globally were responsible for 85% of industry revenue last year

Samsung was a distant second with $72 billion in smartphone revenue which was an 11% increase from the previous year's top line. The company saw its global market share increase in mid-range and premium phones thanks to the release of the Galaxy S21 line and demand for 5G handsets. Samsung shipped three times the number of foldable devices last year than it did in 2020, and its ASP rose 5% to $263.

With a little more than half the smartphone revenue attributed to Samsung last year, Oppo (which included OnePlus sales since the third quarter of 2021) finished third ringing up $37 billion in smartphone sales, a 47% annual increase. Xiaomi and Vivo were fourth and fifth tallying $36 billion and $34 billion in smartphone revenue respectively. On a percentage basis, their gains amounted to 49% for Xiaomi and 43% for Vivo.

Xiaomi saw strength in its mid to high-end models including the Mi 11x series. The company's top market is India which is the world's second-largest smartphone market. Considering Xiaomi's value for money approach, this is not surprising considering that India is a developing country.

Oppo's ASP rose 15% last year, and shipments rose in the $400-$599 and $600-$799 price segments thanks to the Reno 6 series, the Find X3, and OnePlus 9 series. 5G phones made up over 50% of its smartphones delivered last year compared with 28% the previous year. OnePlus revenue was up 33% in 2021 thanks to the OnePlus Nord line and the OnePlus 9.

Vivo's ASP rose 19% last year and its smartphone shipments were helped by demand for the flagship X60 and S series. The company also performed well in China. Vivo also had a balanced portfolio that covered all price ranges from low-end to flagship.

The top five smartphone manufacturers, Apple, Samsung, Oppo, Xiaomi, and Vivo were responsible for 85% of the global smartphone revenue collected in 2021. Counterpoint cited the pandemic for increasing the demand for mid-range and flagship smartphones as consumers purchased higher-priced handsets to help them work from home, help their kids learn from home, and for entertainment purposes.

40% of phones shipped last year were 5G compatible

While mid-range and flagship phones did well last year, budget handsets also saw their prices rise thanks to supply chain shortages and other issues. As the migration of 5G continues, more 5G compatible phones were shipped last year. Counterpoint says that 40% of phones shipped globally last year had support for 5G compared with the 18% of smartphones that were delivered in 2020.

Record fourth-quarter revenue was achieved last year by Apple, realme, and Motorola. The latter is gaining plenty of attention with a new flagship model, the Frontier, rumored to be released later this year carrying a 200MP camera sensor. The manufacturer has been trending upward and just unveiled a new flagship phone this past week.

For all of 2021, the average selling price of a smartphone was $322 as higher-priced 5G units took sales away from lower-priced 4G LTE models. The success of the high-priced iPhone 13 models also contributed to higher smartphone price tags on average.

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: