Apple reports 11% gain in iPhone sales, 24% hike in Services during fiscal Q1 2022

Apple got fiscal 2022 off to a great start as the tech giant reported its earnings for the fiscal first quarter of 2022. Apple set a record during the three months from October through December by reporting revenue of $123.9 billion which easily topped Wall Street estimates of $118.66 billion, and was 11% higher than the top line of $111.4 billion recorded during the same period last year.

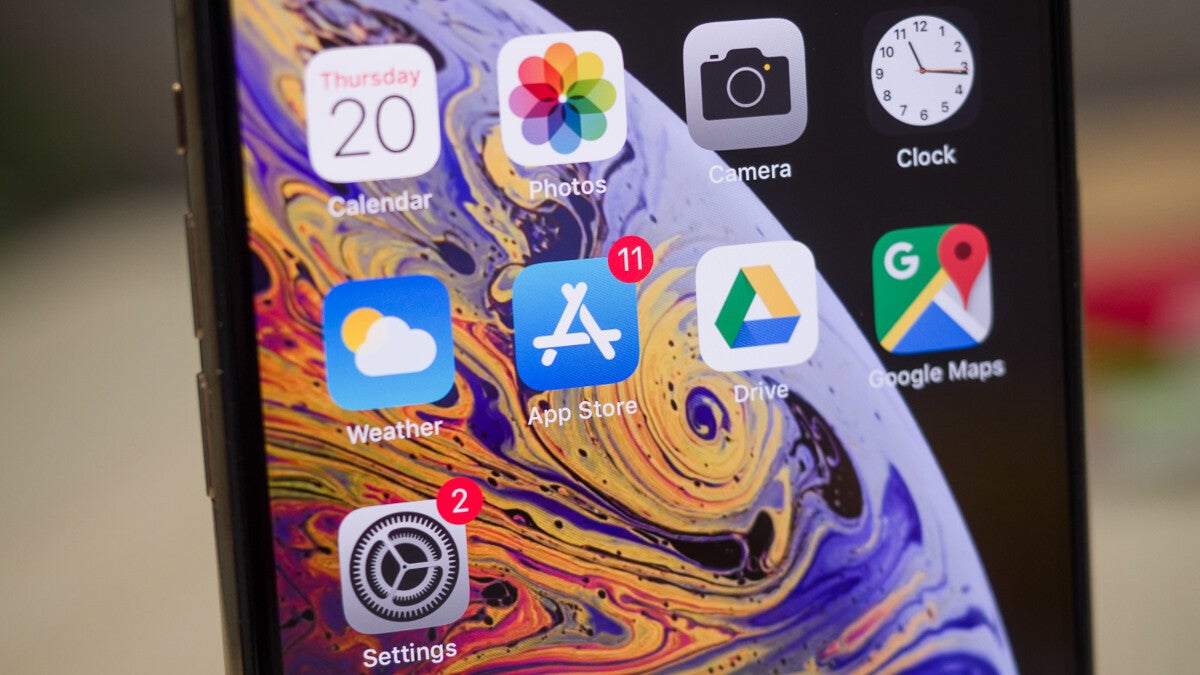

Apple iPhone sales rose 11% on an annual basis during the first fiscal quarter of 2022

Let's go right to the device that everyone wants to know about, the iPhone. The surging smartphone took in $76.63 billion which surpassed Wall Street's guess of $68.34 billion. During the same quarter last year, Apple reported $65.60 billion in handset sales giving the company a 9% increase year-over-year.

The iPhone 13 Pro series offers 120Hz ProMotion displays, upgraded cameras, much-improved battery life, and more. This is the second generation of iPhone models that support 5G connectivity.

The iPhone continued to have a strong quarter to kick off fiscal 2022

Even though the pandemic continues, fewer people are being told to work from home and schools are open. As a result, iPad revenue declined 14.10% in the quarter to $7.25 billion from $8.44 billion during the first fiscal quarter of 2021. Wall Street expected Apple to report $8.18 billion in tablet revenue so this was one area that was a failure for Apple in Wall Street's eyes.

Wearables, Home and Accessories, the business segment that includes the Apple Watch and the AirPods, took in $14.70 billion in the quarter vs. $12.97 billion last year. That works out to an increase of 13.34% year-over-year. Later this year, we could see Apple introduce three new timepieces including a rugged model and add a sequel to the AirPods Pro.

What was Apple's strongest business segment last quarter?

Apple's Services unit, which includes a wide variety of offerings including the App Store, Apple Pay, Apple Music, Apple TV+, Apple Care+, Apple News, and more, saw revenue rise from $15.75 billion last year to $19.52 billion this year. That figure topped Wall Street forecasts of $18.61 billion. For the year, Services gross rose a tremendous 24% which shows how Apple expects to continue making money even when iPhone sales turn south permanently, something that might not happen for years and years to come.

Sales rose in all segments except for Japan. In the U.S., Apple took in $51.50 billion vs. $46.31 billion last year. In Greater China, revenue was $25.78 billion ($21.31 billion in 2021) and rose in Europe to $29.75 billion vs. $27.31 billion during the fiscal first quarter of 2021.

Apple's total net income for the fiscal first quarter of 2022 rose 20.41% on an annual basis to $34.63 billion or $2.11 per share. Last year's figures were $28.76 billion and $1.70 a share, respectively.

CEO Tim Cook says that the chip and supply chain shortages for the upcoming March quarter will be less than what Apple experienced during the December quarter. Cook stated, "This quarter’s record results were made possible by our most innovative lineup of products and services ever. We are gratified to see the response from customers around the world at a time when staying connected has never been more important."

He added, "We are doing all we can to help build a better world — making progress toward our goal of becoming carbon neutral across our supply chain and products by 2030, and pushing forward with our work in education and racial equity and justice."

On Wall Street, Apple concluded the regular trading session by declining 47 cents or .29% to $159.22. After the earnings report was released, the stock soared $7.89 or 4.96% to $167.11.

Luca Maestri, Apple's CFO, said, "The very strong customer response to our recent launch of new products and services drove double-digit growth in revenue and earnings, and helped set an all-time high for our installed base of active devices. These record operating results allowed us to return nearly $27 billion to

our shareholders during the quarter, as we maintain our target of reaching a net cash neutral position over time."

our shareholders during the quarter, as we maintain our target of reaching a net cash neutral position over time."

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: