Trump's tax plan could save Apple big bucks if it repatriates overseas cash holdings

On the campaign trail, Donald Trump attacked Apple for a number of different reasons. Early in the year, he tried to start a boycott of the company because of its refusal to unlock an iPhone that belonged to a deceased terrorist. He also complained that Apple was manufacturing its products using overseas labor. He called for a 35% import tax on products made by U.S. companies in other countries.

"The Trump Plan will lower the business tax rate from 35 percent to 15 percent, and eliminate the corporate alternative minimum tax. This rate is available to all businesses, both small and large, that want to retain the profits within the business. It will provide a deemed repatriation of corporate profits held offshore at a one-time tax rate of 10 percent."-Trump's Tax Plan

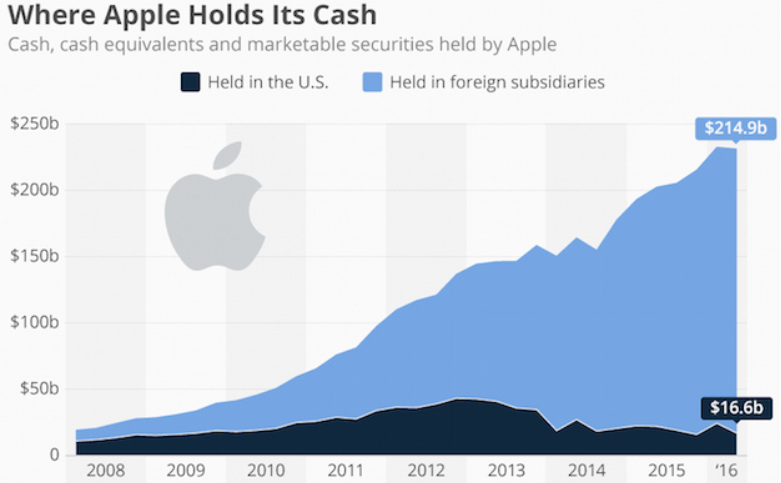

We don't know how much money Apple would choose to bring back home if this Tax holiday becomes law. But considering that it would be a one-time break, we wouldn't be surprised if the tech titan wired at least half of its overseas cash holdings back home.

The vast majority of Apple's cash is held overseas

source: TrumpTaxPlan via BGR

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: