Carrier coverage claims: What does covering “X-percentage” of Americans really mean?

When it comes to wireless service, there is a difference between coverage, and well, coverage. If there is any perceived weak point in the US wireless infrastructure, it could be argued that it is actual physical coverage, the ability to pick-up a carrier signal anywhere, anytime.

The physical footprint is the next coverage battleground

Given the incumbent nature of AT&T’s and Verizon’s networks, going back to the original A-Side and B-Side 800MHz systems that were first built decades ago, it is easy to accept claims of having 97% or 99% of Americans covered by their networks. After all, some of that infrastructure pre-dates the first Motorola prototypes of the 1970s.

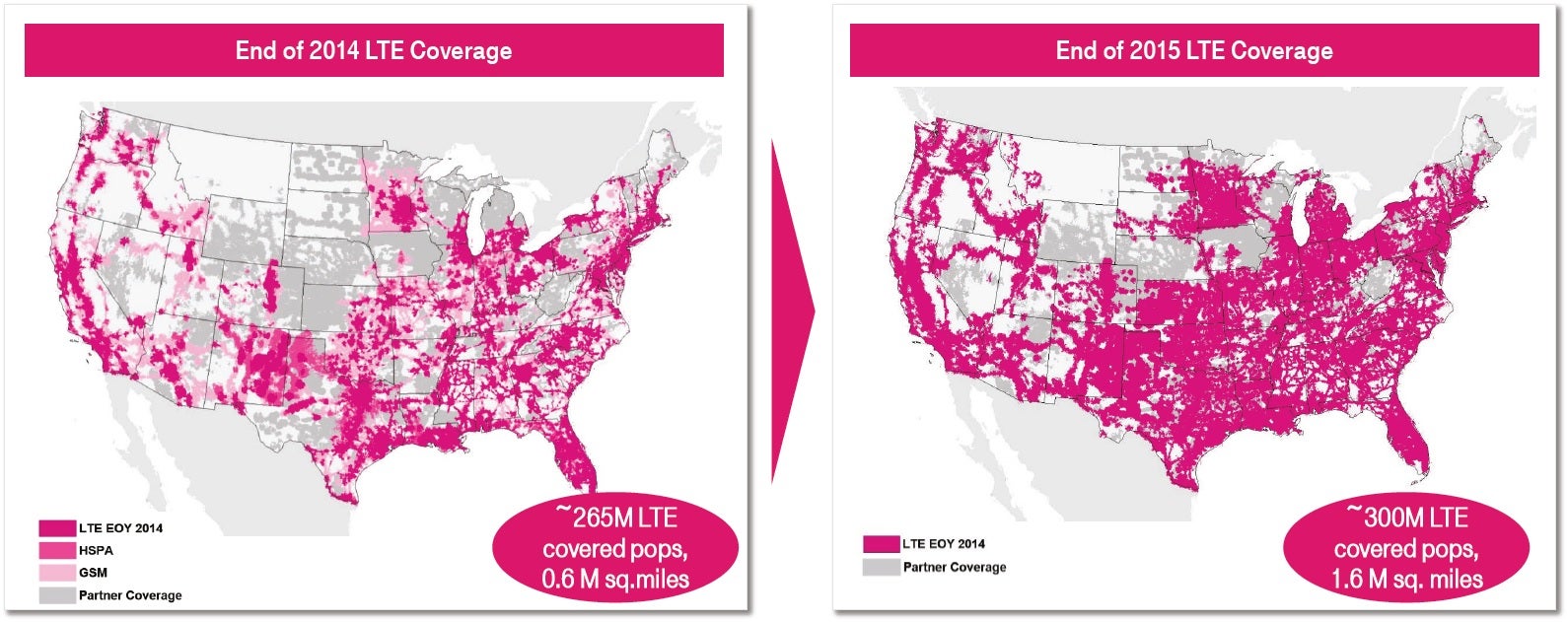

What about T-Mobile and Sprint? Everyone knows that these two carriers have younger and physically smaller networks. Yet T-Mobile, the United States’ third or fourth largest of big four carriers (depending on how you count), claims an overall network reach that covers 96% of the population. What gives? Well, T-Mobile is talking about its entire network, so that includes its LTE service all the way down to more rural areas that might still register as GPRS on a mobile device. T-Mobile is not lying about its statistic, but the reality is that percentages are rapidly becoming more meaningless in terms of wireless coverage in the United States. T-Mobile is also aggressively converting its legacy systems to LTE, and it has done a remarkable job in just two years. The conversion of its 700MHz licenses will give T-Mobile a substantially more robust physical footprint.

Project: Make your own carrier

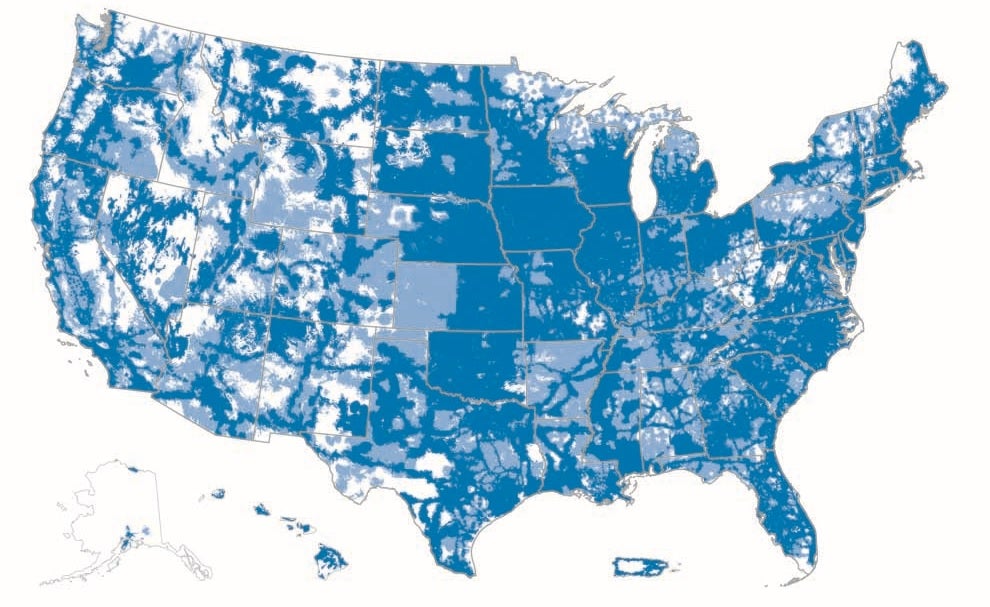

Our service covers 50% of Americans! Sounds good until you see the map right? (image from Business Insider)

It will take time to reduce the gaps

Confronting that reality, it is easy to see why the future will be less about who is covered, but rather where they are covered. This is where AT&T and Verizon currently have the advantage. The original 800MHz network licenses are still in use to this day, and have comparable coverage and building penetration propagation as the 700MHz block that was auctioned off in 2008.

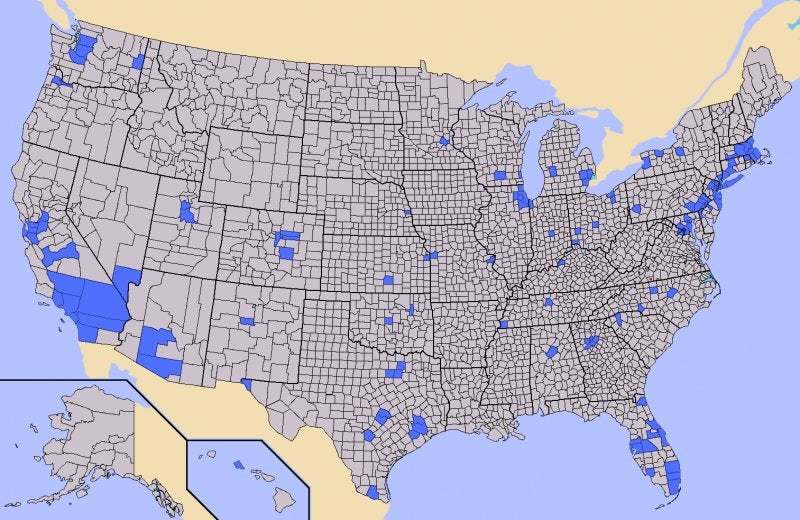

T-Mobile’s and Sprint’s networks (including their respective predecessors) are anchored on what is called PCS spectrum, 1900MHz, auctioned in the mid-1990s, and rapidly built out in population centers and along transportation routes. That explains why the two carriers’ coverage maps look so similar at first glance, and trace the interstate routes all over the country. Underpinning that coverage, things have changed a little, both carriers have since acquired lower band spectrum through acquisitions and trades, but on the whole, the PCS spectrum of both carriers, and the AWS spectrum (1700MHz) that T-Mobile also uses, is less efficient at penetrating buildings or offering uniform coverage over a particular geographic area.

Even with the spectrum auction next year, it will be several years before any of the winning providers are able to build out commercial service. The same holds true for the recently completed AWS-3 auction. Existing license holders have to vacate the spectrum.

Now (left) and "soon" (right). T-Mobile's current LTE service already covers about 85% of the population. Look at the required build out to begin closing on that final 15%.

The maps will still look largely the same – for now

Even as more and more spectrum is allocated to mobile providers to enable connectivity on an even more massive scale, it is a safe bet that large swaths of a carrier’s coverage map will remain largely unchanged, at least for the foreseeable future.

references: Business Insider and Deutsche Telekom (PDF)

Follow us on Google News

Things that are NOT allowed:

To help keep our community safe and free from spam, we apply temporary limits to newly created accounts: